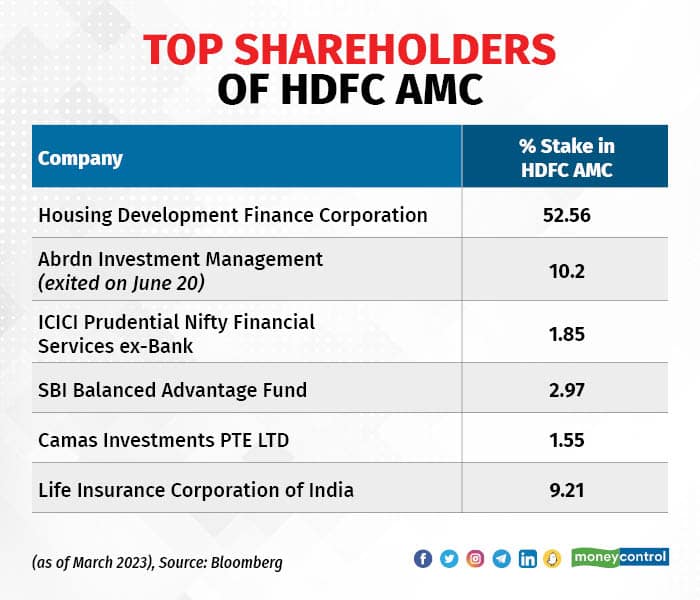

With UK-based Abrdn Investment offloading its entire 10.2 percent stake in HDFC AMC, one of the biggest shareholders of this fund house has turned out to be its rival – SBI MF.

HDFC AMC climbed over 11 percent on June 20 – its biggest ever single-day jump – after Abrdn, formerly known as Standard Life, sold 2.18 crore shares via open market transactions at an average price of Rs 1,873 per share. The entire stake sale was worth Rs 4,079.07 crore.

SBI Mutual Fund, Zulia Investments, Smallcap World Fund, and Societe Generale bought 99.1 lakh equity shares or 4.64 percent stake in the asset management company at the same average price.

As of the quarter ended March 2023, SBI Balanced Advantage Fund held 2.97 percent stake in HDFC AMC. This has increased after the Abrdn block deal.

It is now the third biggest shareholder in HDFC AMC after HDFC and LIC.

SBI MF has been snapping up HDFC AMC shares in recent times.

Earlier on March 20, 2023, SBI Mutual Fund bought 47.33 lakh shares of HDFC AMC for Rs 757 crore through an open market transaction.

The shares were acquired at an average price of Rs 1,600 apiece.

Also Read: FTSE ups weights of HDFC AMC, Shriram Finance, Timken. Check inflows expected

Analysts say the exit of a large investor like Abrdn has removed the share supply overhang from HDFC AMC, and it can do well in the near term.

Abrdn’s exit will also increase HDFC AMC’s free float market capitalisation, and it can make it back to the MSCI index if it rallies another 10 percent from here.

HDFC AMC was a part of the MSCI index but was excluded in May 2022 after it slipped from Rs 3,200 levels in September 2021 to Rs 2,000 in April 2022.

"The stock's free-float market cap failed to meet the MSCI threshold, about $1.3 billion then, following which it was excluded," Abhilash Pagaria, head of Nuvama Alternative & Quantitative Research, said.

Since Abrdn was a strategic partner, MSCI considered its holding in non-free float market cap. "With Abrdn offloading stake, this will now get added to the free float. Had the stake sale not happened, the stock would have had to rally over 25 percent for the MSCI August review," he explained.

Company Metrics

HDFC AMC has reported revenue growth of 4.3 percent CAGR over FY19-23, while its operating profits/Profit After Tax has seen growth of 10.2 percent/ 14.6 percent CAGR, respectively, over the same period.

The company has reported an AUM of 4.3 lakh crore – a growth of 7 percent in FY23 over FY22. It has a customer base of 6.6 million unique individuals with 11.4 million live accounts.

HDFC AMC has a market share of 11.1 percent as on March 31, 2023, maintaining its position as among the top-3 mutual fund houses in India.

The domestic mutual fund industry crossed the milestone of Rs 40 lakh crore assets under management (AUM) in FY23. The AUM has nearly doubled over the past five years, mainly due to robust retail participation via systematic investment plans (SIPs).

“The mutual fund industry benefits from a range of tailwinds, such as the increasing importance of financial savings among Indian households, the under penetration of MFs, growing investor awareness and education, robust distribution platforms, and the accessibility of transactions through digitization. HDFC AMC is one of the best bets in India for capitalizing on the industry's long-term structural opportunity because of its pedigree and a well-diversified product mix,” brokerage KRChoksey said in a report.

With a 54.4 percent equity mix, the company has outpaced the industry in terms of the AUM mix.

HDFC AMC continued to focus on new product development and promotion activities to mitigate the risk of increasing competitive intensity, regain market share, and support overall AUM growth in the coming quarters, KRChoksey added.

A key contributor to the company’s growth has been its focus on digitalisation.

HDFC AMC reported that 81 percent of total investor transactions were electronic as at end-FY23 as compared to 76 percent in FY22 and 69 percent in FY20. The company’s digital transactions have logged a 28 percent CAGR since FY17.

The company management remains positive on the HDFC-HDFC Bank merger and will continue to target higher wallet share from the bank distribution channel.

Regulatory Headwinds

SEBI, in a consultation paper last month, mooted an all-inclusive total expense ratio (TER) for the industry with new AUM-based slabs to make mutual funds more transparent.

TER is the commission that a mutual fund company charges from investors. The market regulator has proposed to make TER all inclusive with taxes, transaction and brokerage costs, etc. being added to this.

Analysts say the proposed TER overhaul implies steep profit hit for AMCs.

“We estimated that if all expenses were included in TER, then the negative impact on fees could range from 13-34 bps for listed players. Even if 60 percent of expenses were passed along to distributors, our analysis showed that listed players with a large equity AUM corpus could still see a sharp dropoff in expected FY25 net profit in the range of 6-15 percent, with HDFC AMC bearing the brunt,” analysts at BOB Capital Markets said.

Also Read: Six charts that influenced SEBI’s mutual fund total expense ratio proposals

That said, players can cushion the impact if they are able to pass along the entire burden to distributors.

“We believe that given its size and branding, HDFC AMC should be able to comfortably transfer the burden. In 2019, when the TER was last revised by the regulator, the overall hit on equity AUM stood at ~25bps, of which the company only took a 2-3bps hit and the rest was passed on to distributors,” it noted.

Most analysts, in fact, expect the industry to pass on the major burden of any additional cost.

The impact, when passed through by AMCs, will largely be borne by intermediaries such as distributors, brokers and Registrar and Transfer agents (RTAs), and in some cases through better control and calibration of portfolio churn, they added.

“With the regulatory overhang addressed, a high (75-100 percent) pass-through of the impact could present upside possibilities for AMC stocks,” Abhijeet Sakhare, an analyst with Kotak Institutional Equities, said in a recent note.

Also Read: AMCs confident in passing on additional impact due to TER rule tweaks

HDFC Asset Management Company on April 25 posted a 9.3 percent rise in standalone profit after tax (PAT) at Rs 376.60 crore for the quarter ended March, compared to Rs 344.55 crore in the corresponding period of the previous fiscal.

Revenue from operations rose 5 percent to Rs 540.95 crore from Rs 516.28 crore in the quarter ended March 31, 2022.

PAT for the full fiscal 2022-23 stood at Rs 1,423.92 crore, up 2.2 percent compared to Rs 1,393.13 crore in FY22. Revenue from operations increased 2.4 percent to Rs 2,166.81 crore as against Rs 2, 115.36 crore in 2021-22.

Shares of HDFC AMC are down 6.35 percent on YTD basis, though the one-year return stands at 12 percent.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.