Sreeleathers, a company we initiated coverage on in the past, delivered a robust set of numbers in the quarter ended June 2017. Can this stock be a worthy value proposition at this point as well?

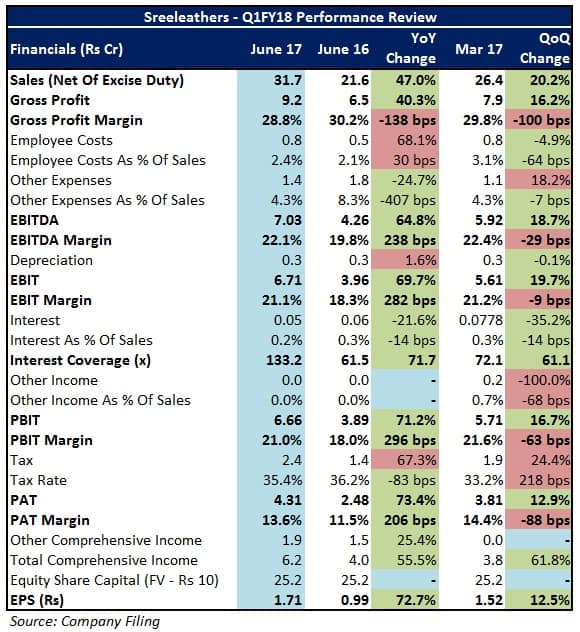

The company's key variables were impressive with a 47 percent growth in top-line and 65 percent increase in EBIDTA (earnings before interest, depreciation and tax). A 238 basis points expansion in operating profit margins propelled bottom-line profitability, too.

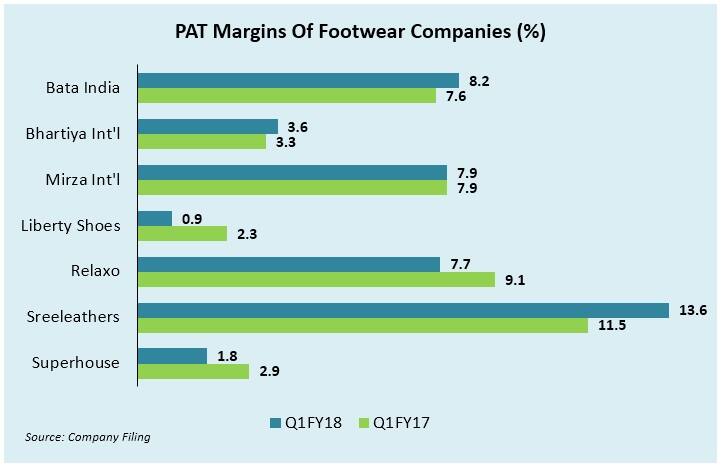

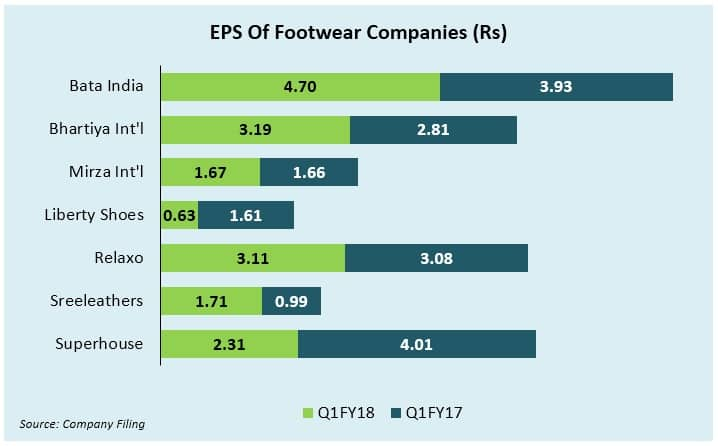

In comparison to its larger peers, Sreeleathers' recent quarterly performance was considerably better, as indicated by the charts below:-

The company hopes to cash in on the growth in India’s leather and footwear industry on the back of increasing demand, rapid urbanization, changing lifestyles, higher disposable incomes (particularly in case of the middle class population), and a 15 percent annual growth in the country’s organised space (which constitutes 30-40 percent of the overall size).

Since most of Sreeleathers’ turnover is derived through sales of products typically priced in the low to mid-range, the advent of GST will enable the company to gain market share gradually from the numerous unorganised players present in this category.

Valuation

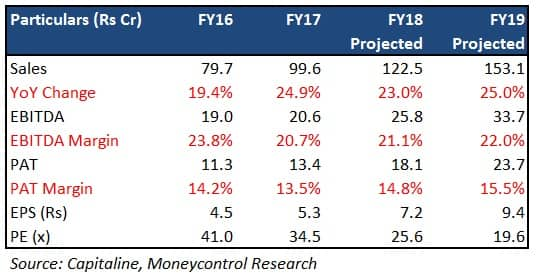

After the Q1FY18 results, no changes have been made to our earlier estimates. Given Sreeleathers’ fundamentally strong parameters and a consistent run, the company deserves to command a multiple of consumer companies. We believe that at 19.7x FY19 estimated earnings, the stock seems like an interesting pick for accumulation that investors should closely track.

Follow @krishnakarwa152For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.