The S&P Power Index made an all-time high of 3235.42 points on October 1 which is a 104 percent jump from its 52- week low. During the past one month, the market cap of S&P Power index has increased by about 6.42 percent of which 3.66 percent growth came in the last one week. Markey cap has witnessed an appreciation of 76.5 percent during the last one year.

After witnessing a big run-up in the traditional favourites like IT, BFSI, etc, investors are now looking for good stocks that are available at cheaper valuations and this is one of the main reasons for the renewed interest in the power sector stocks which are now rallying.

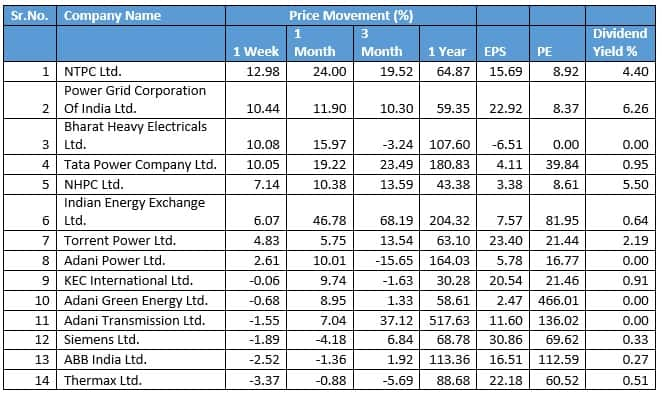

The past week has seen that the state-run utility companies have caught investor’s fancy. Public sector companies like NTPC (+12.98 percent), Power Grid (+10.44 percent) and BHEL (+10.08 percent) have risen by more than 10 percent during the past week. Among the private players, Tata Power has been the most consistent performer and has risen by about 20 percent in past one month and 180 percent over the past one year. Adani Power is the other private player which has risen 10 percent in past one month and 164 percent during the year.

Arun Malhotra, Founding Partner & Portfolio Manager, Capgrow Capital Advisors, observes that “some of the PSU stocks have become relatively cheap and in some cases, the cash flow yields are very attractive at more than 10 percent.”

Anuj Upadhyay, Institutional Analyst at HDFC Securities, echoes similar views. “Inexpensive valuations in an otherwise expensive market are driving the rally,” he noted.

Vinod Nair, Head of Research at Geojit Financial Services said: “The ongoing rally is a reflection of the revival in the economic activity, capex on renewable energy and benefit from power sector reform.” According to him, the major beneficiaries are the companies, which are focusing on renewable energy as their future growth.

S&P Power Index companies’ price movement

The opening of the economy and increased manufacturing activity post-COVID has fuelled the demand for power in India in the recent past. This coupled with increased fuel prices augers well for the sector as such.

India’s appetite for power/electricity will be driven further by growth in industrial activity, growing population especially in urban and semi-urban areas, rural electrification, increasing per-capita power consumption, big-ticket projects across the value chain and the government's aim of one nation-one grid-one frequency.

The recent power sector reforms announced by the government will play a pivotal role in shaping the future of the sector in the coming years and how the power companies will perform going forward. Some people are comparing these reforms to the reforms of the 1990s when the Indian economy was first opened up for FDI.

According to Arun Malhotra, Founding Partner & Portfolio Manager, Capgrow Capital Advisors, “The recent electricity reforms set out by the GOI have unleashed positivity in the entire sector. They will address the sub-optimal performance, particularly of state distribution companies, and take steps to reduce T&D losses.”

“The GOI intent is quite clear to improve efficiency and bring in new investments and the dramatic rise in stock prices is a reflection of this sentiment,” Malhotra added.

According to Anuj Upadhyay, falling receivables of gencos, improved collection efficiency, implementation of pre-paid meters and Direct Benefit Transfer (DBT) scheme just like in LPG, will benefit the working capital of gencos in a big way and will bring down their requirement of working capital loans.

A peek at some of the major players in India’s power sector:NTPC has 17% of total installed capacity in India with 23% generation share. It has been a significant underperformer in the power space led by a shift of value towards the renewable space. It is focused on transitioning to renewables and plans to spearhead new technologies such as green hydrogen. It is undertaking a pilot project at Vindhyanchal for green hydrogen, with potential cost of <USD3/Kg.

Approx 3GW of renewable capacities are under construction and expected to be commissioned over the next two years. A report from Motilal Oswal suggests that even as the co. gradually scales up its renewables journey, they expect continued capitalization for its thermal projects to drive 12% growth in regulated equity over FY21–23E.

The company’s vision is to become a 130 GW company by 2032 out of which about 45% of generation will be from renewable sources. The company will not be adding any new thermal capacity and the cash flows generated through existing business will be used in the creation of renewable energy assets.

It is also looking to monetize it’s a) Renewables subsidiary and b) NVVN (power trading sub) over the next 18 months and has commenced work on the same.

The company has been able to reduce its cost of debt considerably and as per a report from ICICI Direct, the cost of debt has come down to 6.24% in FY21 from 8.07% in FY15. Furthermore, in Q1FY22 cost of debt was at 5.97%.

The above steps place the company in good stead to move forward in the coming future.

The EPC and Renewables businesses are set to gain momentum, led by a healthy project pipeline. The possible benefit from the merger of Coastal Gujarat Power Ltd (CGPL) with itself presents an upside to profitability.

As per a report from Motilal Oswal, they expect Solar EPC to give a leg up in earnings for the next two years. Recent award wins, particularly from NTPC, have seen its EPC order book inflate to ~Rs. 8,500.0 Cr thereby providing strong visibility. EBITDA from Solar EPC is expected to post a 30% CAGR to Rs. 520.0 Cr over FY21–23.

HDFC Sec expects strong performances across segments by the company. It’s strong transition into green energy, huge growth in the EPC business, higher regulated Capex, asset monetisation and merger benefits present huge opportunity for growth.

As per Power Grid, Rs 10,300 crore of upcoming opportunity is present in interstate and intrastate works. It bagged Rs 9,000 in awards in recent months, which is a positive sign.

It expects capitalisation in FY22 to be Rs 16,000-17,000 crore. It expects another Rs 5,000 crore worth of assets to be monetized over the next 12-18 months which will help its financial health.

The company has been known for its dividend payout and does expect an upward trajectory in dividends, but will look at distributing payouts that are sustainable.

As per Motilal Oswal, Power Grid has a steady business model. Continuation of the tariff structure and regulated RoE by CERC (power regulator) for FY20-24 lends visibility to PWGR’s business model. From a longer-term perspective, investment in renewable energy and growing power demand would continue to drive the need for transmission works.

Given an under-penetrated market and strong competitive positioning, the company is well-positioned to capitalize on upcoming opportunities.

Torrent Power is benefitting as a result of better demand and lower T&D losses in its distribution franchise (DF) business, which lead to a 7 percent YoY jump in EBITDA and 43 percent in PAT in Q1FY22.

Demand for its DF business has been steady and is now closer to pre-COVID levels. T&D losses at Bhiwandi fell to 11.6 percent (v/s 24.5% in 1QFY21), while for Agra it stood at 17.4 percent (v/s 22.8% in 1QFY21). With a healthy balance sheet, TPW is still well poised to capitalize on opportunities from privatization in the distribution space.

Motilal Oswal expects the company’s distribution franchise business to improve in FY22E/FY23E. This, along with continued capex in the regulated distribution business and lower interest costs, should result in 21 percent PAT CAGR over FY21-23E.

Vinod Nair is buoyant about NTPC, Power Grid and Tata Power while Anuj Upadhyay is positive about NTPC, Power Grid and Coal India.

Even though a lot of emphasis is being laid on RES, still 70 percent of India’s power generation is coal based. Indian utility companies are now resorting to domestic coal as the prices of imported coal have soared in a big way. Coal India being the largest producer stands to benefit from this increased demand in the short term.

Given these developments, the sector is expected to generate a lot of investor interest in the coming years and Electricity Amendment Bill when passed will be a huge catalyst. Well managed power companies will gain the most. Companies not directly associated with power generation and distribution like Power Finance Corp, REC Ltd and PTC India Financial Services will also stand to benefit in a big way as a result of these reforms.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.