Madhuchanda DeyMoneycontrol Research

One doesn’t often come across a company which is reasonably valued, yet has a consistent track record of growth, profitability, dividend payment, and low debt. Mumbai-based Jenburkt Pharma, promoted by Mumbai-based Bhuta family is one such small cap (Market cap Rs 251 crore) pharmaceutical company listed only on the Bombay Stock Exchange.

The company

Founded in 1985, Jenburkt manufactures and markets pharmaceutical formulations in India and internationally. It offers prescription medicines in various therapeutic areas, such as anthelmintic, anti-arthritic, antibiotics, antidiabetic, anti-hypertensive, anti-inflammatory analgesic, anti-malarial, anti-osteoporotic, anti-ulcerants, dermatological, gastrointestinal, haematinics, neuropathy, and protein preparation, as well as anti-cough, cold, and allergy.

The Indian market opportunity

The Indian pharmaceutical market size is expected to grow manifold by 2025, driven by increasing consumer spending, rapid urbanisation, and raising healthcare insurance, among others.

The Indian government has taken many steps to lower healthcare expenses for patients. Paving the way for more generic drugs in the market has been one of the major initiatives. In addition, the thrust on rural health programmes, lifesaving drugs and preventive vaccines also augurs well for the pharmaceutical companies.

Jenburkt – a committed player in India

Jenburkt Pharma has 575 plus strong pan-India sales force across India and promotes all its 85 brands across 75,000 doctors and 50,000 chemists regularly. The company has more than 1000 stockists and 25 super stockists. Jenburkt also caters to large government, semi-government institutions, missionary hospitals, public sector enterprises, etc.

While exports constitute a small portion of sales, Jenburkt’s products are being exported to 15 countries globally.

Impact of price control and government regulations

For Jenburk, the products in price control contribute a very small amount to the total revenue. However, in 2016, government banned 344 fixed dose combinations (FDCs) and the company's seven products were affected by the said notifications which in terms of value and volume did not have a substantial impact on the sales and profitability.

However, severe restrictions on sale of branded generics in case government mandates physicians to prescribe only generic drugs and not the branded medicines will impact a company like Jenburkt significantly.

Strong R&D

The company has a state-of-the-art manufacturing plant at Sihor-Gujarat, which is approved as per W.H.O (world health organisation) guidelines with current G.M.P (good manufacturing practices) requirements, apart from approvals from various countries. In addition, Jenburkt has a Research & Development unit duly approved by the Ministry of Science & Technology, Government of India. Hence, the company has strong manufacturing facilities to cater both domestic and international market.

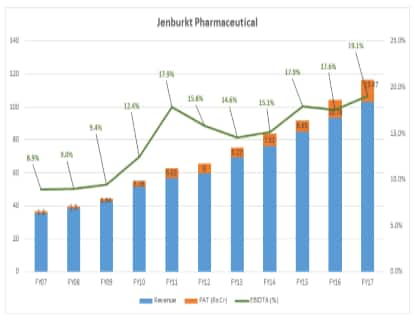

Excellent track record

In the past ten years, sales have growth 11.3 percent CAGR (compounded annual growth rate), operating profit has grown by 20 percent and after-tax profit by 27 percent over this period.

Strong balance sheet

The company has a very lean balance sheet with negligible debt on its books. Jenburkt also has a consistent track record of dividend payment.

Buyback and promoters not participating.

Jenburkt Pharmaceuticals has announced the buyback (ongoing from December 6-19) of little over two lakh eight thousand equity shares from all the existing shareholders through the tender offer process at a price of Rs 576 (current price Rs 541). The decision of the promoters to not participate in the buyback is a positive signal and would raise promoters’ stake from 45.02 percent to 47.13 percent of the paid-up equity share capital of the company.

Valuation

Going forward, better growth in domestic sales would also depend on the ability of the company to align its product portfolio towards chronic therapies for diseases that are on the rise. While the Q1 FY18 performance was disappointing (more due to the GST led disruption), performance has improved sharply in the quarter gone by. We derive valuation comfort given the steady track record of profitability and superior return ratios.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.