Nifty was inching closer to the much-awaited 20,000 mark, but Infosys spoiled the party. The disappointing June quarter results posted by the IT behemoth, which has a 6.9 percent weightage on the Nifty 50, dragged the index down on July 21.

At 12:30 pm, Infosys was quoting at Rs 1,331 on the NSE, lower by 8 percent from its previous close. The stock tumbled below the crucial 200-day moving average.

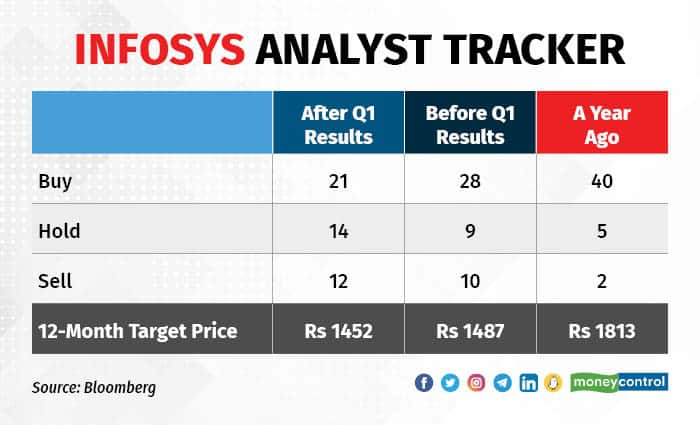

Infosys' Q1 report card not only wiped out all the gains made by the stock in a month but also made analysts wary of its future prospects. As the management cut revenue growth guidance from 4-7 percent to 1-3.5 percent, 'Buy' calls from analysts on the stock tumbled from 28 to 21 overnight.

The 12-month consensus target on the stock, as per Bloomberg, is now 2 percent lower than what it was a day back. If we look at the number of downgrades over the past year, the picture is even gloomier.

In fact, the 12-month target for the stock was Rs 1,813 a year back. Currently, it is Rs 1,313, which shows how analysts were way off with their estimates, not having anticipated the kind of slowdown witnessed in discretionary IT spending.

Also Read: Infosys nosedives 10% on sharp guidance cut

Of the recent lot, Macquarie and Nomura have downgraded their ratings on the stock.

Macquarie downgraded the stock to 'underperform' as it was disappointed by the IT behemoth's deal wins in Q1. The brokerage does not see the $2 billion AI deal as a 'mega deal' as it is just an estimate by the management.

On the other hand, Nomura has downgraded Infosys to 'reduce' along with a cut in target price to Rs 1,210, which is another 9 percent downside from here. The broking firm has also reduced FY24-25 EPS (earnings per share) estimates for Infosys by 3-4 percent to factor in the weak Q1 earnings.

According to Bloomberg, Infosys' EPS for Q1 FY24 came in at Rs 14.37 versus estimates of Rs 15. For the forthcoming quarters, EPS is estimated at Rs 15.5, Rs 15.7 and Rs 16.3. For FY24, the EPS estimate of Rs 61.6, has been revised to 3.2 percent down in a day.

Management commentaryInfosys top boss Salil Parekh said that in the near term they see clients stopping or slowing down transformation programs and discretionary works — particularly in financial services in mortgages, asset management, investment banking and payments, and in telecom. “We also see some impact in the hi-tech industry and in parts of retail,” he said.

Also Read: Delays in decision-making, clients cutting back on spends: Why Infosys sees a bleak year ahead

In the meeting with analysts, Chief Financial Officer Nilanjan Roy said the decline in guidance, among other reasons was due to lower-than-expected volumes and lower mega deals in discretionary areas.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.