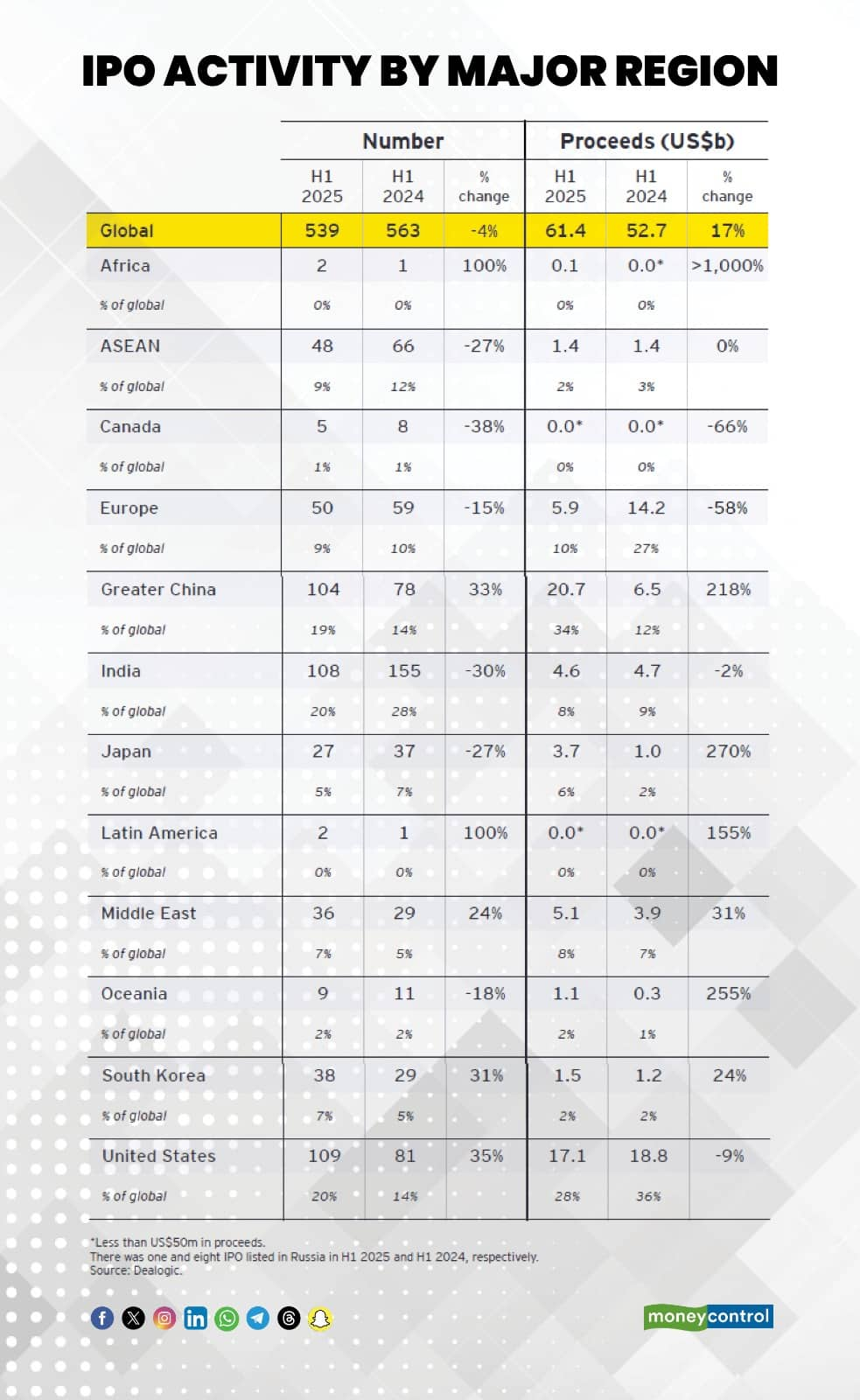

India’s IPO market ranks among the most active globally in terms of the number of listings, however, it lags behind the US and China in terms of total capital raised, according to the latest EY Global IPO Trends report. In the first half of 2025, India accounted for just 8% of global IPO proceeds, compared to 28% for the US and 34% for China.

Follow our LIVE blog for all the latest market updates

In the first six months of 2025, India saw 108 companies list, raising $4.6 billion from capital markets, which may look like a strong show but it is a 30 percent year-on-year decline in the number of IPOs. The fundraise dipped only 2 percent during the same period, suggesting that despite a slowdown in activity, the quality and size of the issues remained intact.

Also Read: Tata Capital files updated confidential DRHP for IPO, says report; Tata Investment shares rise 5%

This, as per the EY report, reflects a shift in strategy from both sides of the table. Issuers are being more selective about when and how they tap the markets, while investors are leaning toward companies with stronger fundamentals and clearer growth trajectories. In short - fewer, but better-quality issues.

This cautious tone comes amid a backdrop of heightened global uncertainty. Geopolitical tensions and choppy macroeconomic conditions have made issuers more wary, with several high-profile companies delaying their listing plans or revise valuation expectations.

Even so, the second half of the year could see a pick-up, according to EY, which said a robust pipeline is in place from sectors like technology, fintech and healthcare. Many IPO-bound companies have already received regulatory clearances and are essentially in wait mode, ready to launch as soon as market conditions turn more condusive.

Read More: BSE shares rise 3% amid buzz of SEBI allowing Jane Street to resume trading

India’s IPO market continues to trade at a relatively high price-to-earnings ratio of around 27x, similar to the levels seen in the US, reflecting investor confidence, but also creating added pressure for companies to justify valuations. A slow start to the year - driven by a mix of global volatility and domestic concerns - meant many deals were pushed forward.

Now, signs of recovery in market sentiment are starting to show, with the retail investor interest staying committed to equities, and the regulatory environment largely supportive. With macroeconomic indicators turning more favourable - especially on inflation and liquidity - EY expects a stronger second half for primary market activities.

Globally too, the IPO landscape has been a mixed bag. The US saw 109 IPOs - highest first-half count since the 2021 boom – yet raised less money overall. China, on the other hand, saw deal activity surge more than 30 percent, with proceeds rising three-fold on larger offerings and strong investor appetite.

In contrast, India’s decline in volume coupled with steady IPO proceeds signal a maturing market where investors are focusing more on quality than quantity.Whether that trend changes will depend on how the rest of 2025 plays out.

EY lays out two potential scenarios - in one, improving trade dynamics, easing monetary policy, and geopolitical de-escalation could help set the stage for a broader recovery in global IPO activity.

On the other hand, continued macro stress - be it sticky inflation, interest rate uncertainty, or geopolitical flare-ups - could keep the market in a wait-and-watch mode. If that happens, both issuers and investors are likely to stay on the sidelines, delaying listings and ensuring valuations remain in check.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.