Today is Rahul Bajaj’s last day as the Non-Executive Director and the Chairman of Bajaj Auto. He will be succeeded by Niraj Bajaj.

"Rahul Bajaj, the Non-Executive Chairman of the company, who has been at the helm of the company since 1972 and of the Bajaj Group of companies for the past five decades, has tendered his resignation considering his age," the company said.

He took over as Chief Executive Officer of Bajaj Auto in 1968 and was at the helm of Bajaj Auto for nearly 49 years.

While the company’s stock has been trading for many years, but the company went through a restructuring program in 2007-08 wherein the erstwhile Bajaj Auto was made into Bajaj Investment Holdings.

The Bajaj Group essentially created two more entities - Bajaj Investment Holdings and Bajaj Finserv - out of Bajaj Auto. Through the targeted internal shuffling, the auto business of the group was centered under Bajaj Auto while all the finance units like insurance and NBFC were put under Bajaj Finserv.

Bajaj Investment Holdings became the holding company owning shares in both Bajaj Auto and Bajaj Finserv. Rahul's elder son Rajiv runs Bajaj Auto as its MD while younger son Sanjiv runs Bajaj Finserv as its Chairman.

Bajaj Group in 2008 listed two of its companies – Bajaj Auto and Bajaj FinServ - on the stock exchanges after it was demerged from Bajaj Holdings and Investments.

Post restructuring in 2008 to date, Bajaj Auto's market-cap has increased by almost 13 times. On May 26, 2008, Bajaj Auto’s market-cap was around Rs 8,750 crore, which has risen to a whopping Rs 1,10,950 crore as on April 29, 2021.

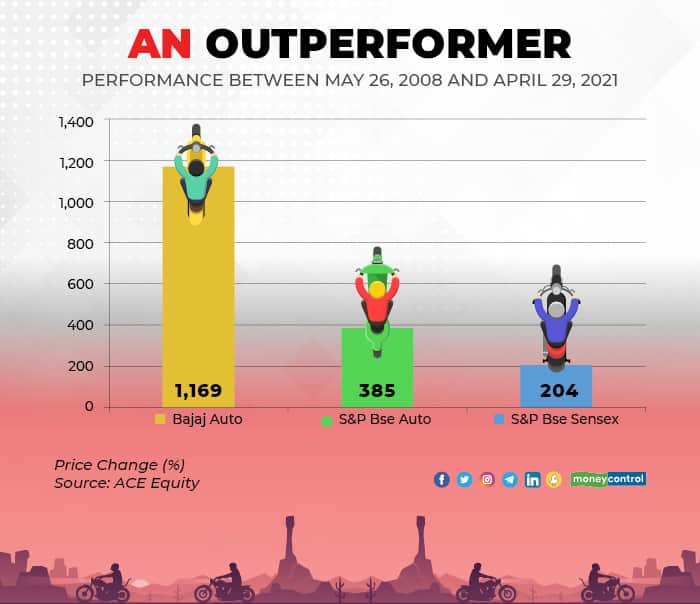

In last 13 years, Bajaj Auto's share price has outperformed the benchmark index Sensex and the BSE Auto index by a huge margin. During the May 26, 2008 to April 29, 2021 period, Bajaj Auto’s share price has surged around 1,169 percent, while Sensex and Auto index have gained 204 percent and 385 percent, respectively.

Among the peers, Bajaj Auto leads in terms of market-capitalisation. The company's current market-cap is Rs 1,10,950 crore - almost doubled its two-wheeler competitor Hero MotoCorp’s m-cap of Rs 57,169 crore, and three-times higher than TVS Motors’ m-cap of Rs 30,096.77 crore.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.