When we set up Moneycontrol Research earlier this year, our aim was to help our readers understand the macro and micro environments in which they were investing, and to use that knowledge to profit.

We have also been making stock recommendations over the last six months that factor in changes in policy, market trends, and, of course, company fundamentals.

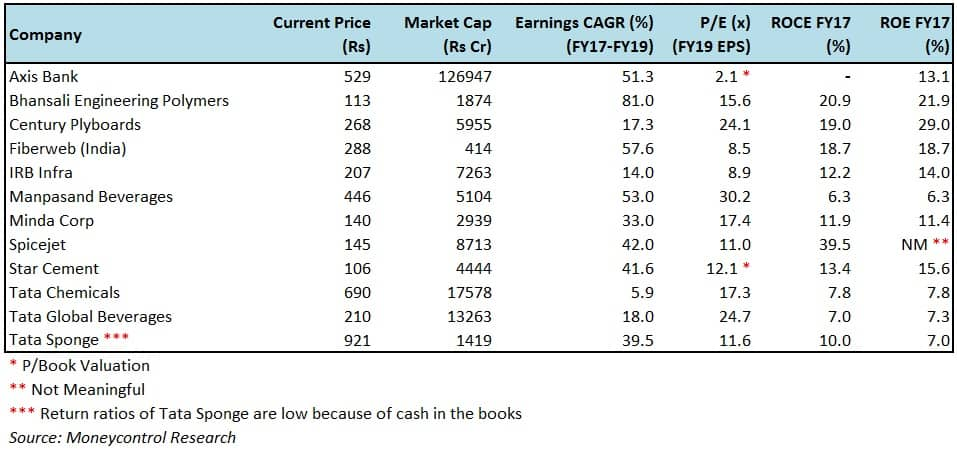

Below is our latest offering: 12 conviction picks that could fetch you strong returns if held from this Diwali to the next, along with the rationale for our choices. The list is in alphabetical order.

Watch | Samvat 2074 : The Story Behind Muhurat TradingMay your investments on the auspicious occasion yield you handsome profits!

Axis BankAfter a difficult FY18, Axis Bank should see many of the headwinds like incremental slippage and provisions waning in FY19, which should support earnings. Alongside an enviable retail franchise, it is also building a retail focused less risky asset book. While incrementally, the bank would on-board much less risk (at the cost of margins), we see Axis as a formidable player in the incremental market share game. Read more

Bhansali Engineering PolymersBhansali Engineering polymers, one of the two main manufacturers of ABS (acrylonitrile butadiene styrene) plastics in India, is building a fourfold increase in manufacturing capacity (by FY22). This should help in capturing the import-dependent domestic market (industry domestic capacity 60 percent of demand), improve capacity utilization (85 percent in Q1 2018 vs 64 percent in Q1 2017) and point towards better end-market demand from consumer durable goods as well. In the near-term, prospects of lower raw material costs (styrene) aids margins. Read more

Century PlyboardsWithin the organised plywood market, Century enjoys 26 percent market share having strong brand recall and presence in all key segments like laminates, plywood and others. The company is executing a new facility to manufacture 198,000 cubic metres medium-density fibreboards annually, which is expected to get operational in H2FY18. This is expected to drive earnings growth and improve margins and return ratios.

Fiberweb (India)The company manufactures synthetic fabric used for industrial, agriculture, and hygiene purposes. Earnings are likely to be driven by an increase in export orders, completion of polypropylene spun-bound nonwoven fabric capacity expansion, conclusion of melt-blown non-woven fabric (a unique product offering with no competitors in India) manufacturing facility set-up, and a gradual shift towards margin-accretive value-added products. Read more

IRB Infrastructure is a good play on the road construction sector with the government aiming to spend close to Rs 7-8 lakh crore over the next 5-6 years compared to the current run rate of about Rs 18,000-20,000 crore annually. Moreover, with the GST-related logistic issues easing, IRB’s BOT (build own transfer) road assets should post good traffic growth. Benefits of lower debt and interest led by launch of InvITs and strong revenue visibility of construction business, backed by a Rs 9,000-crore order book (3x revenue) should help in decent earnings growth. Read more

Manpasand BeveragesManpasand Beverages should witness a steep growth in earnings on the back of doubling of its production capacity by Q1 2019. A capacity expansion plan, in sync with enhanced distribution reach (tie-up with Parle Products - 5.5 million outlets) and new product offerings (health drink), all improve earnings visibility, in our view. Read more

Minda Corp is a well-diversified auto-component manufacturer catering to passenger vehicles, and three-wheeler, two-wheeler and commercial vehicles. With marquee clients in its kitty, no client concentration, focus on R&D to develop technologically advanced products, and a turnaround at joint venture Minda Furukawa, the company beckons investor attention. Read more

SpiceJetSpiceJet, once on the brink of bankruptcy, has navigated well in the skies over the last few quarters. We believe SpiceJet has now got all the right ingredients that are required to fly higher. With the right management at the helm, huge capacity expansion plans, foray into ancillary services, focus on cost optimization and comfortable valuations, we advise investors to board the flight for a safe journey. Read more

Star CementStar Cement, belonging to the house of Century Plyboard, is the largest player in the north-eastern market, a region catered to by very few mainstream players. The company has the highest profitability in the industry due to subsidy in excise, freight, etc. The government’s agenda to develop infrastructure in this area would sustain demand. The improvement in performance was visible in Q1 FY18 earnings and the valuation looks reasonable in the context of superior earnings quality.

Tata ChemicalsWith rapid restructuring under the new management, Tata Chemicals seems to be falling back on track. The proposed sale of the low-margin Haldia plant, increased focus on consumer and salt businesses, with improved volumes post-GST roll-out, neutralization of impact of demonetization-related destocking and firming-up of the soda ash prices are a few reasons why we find the stock attractive. Read more

Tata Global BeverageWe are positive about the company’s restructuring initiatives having the potential to unlock value for the shareholders, in addition to its attractive valuations. While on the one hand, the company is exiting operations (Russia and China business) which are not value-accretive, on the other hand it is focusing on building core brands and premiumisation.

Initiatives towards non-black tea in international market and the launch of premium mineral water in the United States should aid margins. Read more

Tata SpongeTata Sponge, which supplies sponge iron to steel manufacturers, could be a good investment candidate with the company now aiming at forward integration by building a 1.5 million tonne of steel capacity utilising cash on the books (Rs 570 crore). This could create more value. In addition, Tata Sponge enjoys cost advantage because of captive power, railway infrastructure and access to group mines. Read more

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.