Anubhav SahuMoneycontrol Research

The IPO of Prataap Snacks introduces us to a debate on pricing in the investment circle. While the company could possibly be an investment proxy for the snacks consumption demand in the hinterland, a pertinent question is on whether the pricing is justified. If not, are there investment alternatives in the same space that makes a better sense both in terms of valuation and strategy?

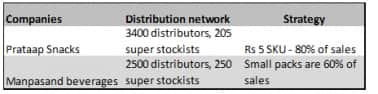

Distribution and value leverage

Prataap Snacks’ above-industry sales growth has been a product of distribution strategy and value proposition. While executing its distribution strategy, company tapped unorganized grocery stores from Tier 2 cities and towns and focused on smaller SKU (stock-keeping unit) products (Rs 5) for a wider acceptability.

It’s comparable in the snacks and beverage segment. Manpasand Beverages benefited from the volume uptick in lower value products (60 percent of the sales from Rs 5, Rs 10 and Rs 15 SKUs). In terms of distribution, Manpasand already has a tie-up with IRCTC for direct selling to vendors. Besides, the company recently inked a deal with Parle products to leverage their distribution network (5.5 million outlets). It not only helps to cultivate a Pan-India presence quickly but also establish product positioning in early days.

Prataap Snacks, while being a formidable player in rural areas and small towns, has a relatively limited presence in the tier 1 cities, for which it may have to look for new channels of distribution.

Growing competition

The snacks and beverage segment is witnessing intense competition. Existing FMCG players like Dabur, ITC continue to bring products in non-carbonated beverages range. Manpasand Beverages is also expanding its product offerings.

In the snacks segment, the RP Goenka group recently bought a controlling stake in packaged foods company Apricot Foods (E-Vita brand). Interestingly, this company produces snacks priced at Rs 5 per pack with an annual turnover of Rs 200 crore.

DFM Foods has also launched low priced SKUs recently. Thus, while competition is increasing, proven market strategies for market share expansion is also getting replicated.

Higher brand promotion costs

Brand recall could be one of the differentiating factors in this space. Various companies in this segment, preempting the requirements, have roped in celebrities and kept a substantial budget for selling and marketing expenditure. While this is necessary, striking a balance with other cost overheads is important.

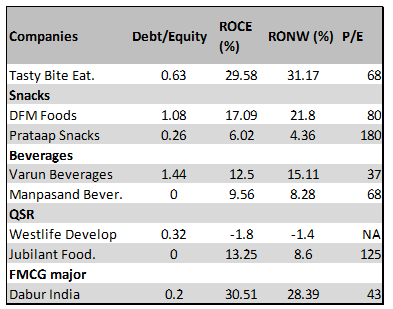

While peer names like DFM Foods and Manpasand Beverages have maintained a double-digit operating profit, Prataap Snacks posted mid-single-digit numbers. As a corollary to the low-cost strategy, its raw material cost-to-sales ratio at 71 percent stands out and could be vulnerable in an inflationary environment.

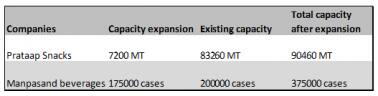

Volume growth and capacity expansion

Key players in this segment are ramping up the production capacity. Prataap Snacks would utilize a part of its IPO proceeds for the 50 percent expansion of the potato chips plant. Manpasand is doubling its production capacity with three new units at Vadodara, Varanasi and Sri City. DFM Foods is executing a brownfield expansion of 10,000 MT.

Valuation: How are competitors stacked up?

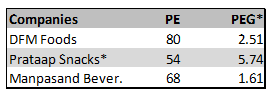

Prataap Snacks earnings multiple, implied from the IPO price band, is quite elevated. Even if we normalize the valuation multiple as per FY16 show, when the performance was not impacted by demonetization effects and higher market costs, valuation comes in at 54x 2017 earnings.

After factoring capacity expansion plans (at the same capacity utilization) and the resultant earnings growth, PEG ratios are strikingly different. Manpasand Beverages is at a more reasonable multiple. This can further improve if the company is able to improve capacity utilization (currently at 54 percent).

*Normalised PE ratio for Prataap Snacks

^Capacity expansion completed in two years and taking a 5 percent pricing effect

So, while Prataap Snacks has impeccably executed the strategy to win market share in the hinterland, the coming days would be quite competitive, more so as it moves up the value chain of both products and the market.

Given the distribution and capacity expansion plans, its peers like Manpasand Beverages appear much more reasonably priced. Overall in the consumption space, it makes a credible investment rationale if one looks at the alternatives that are better priced and offering higher return on equity.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.