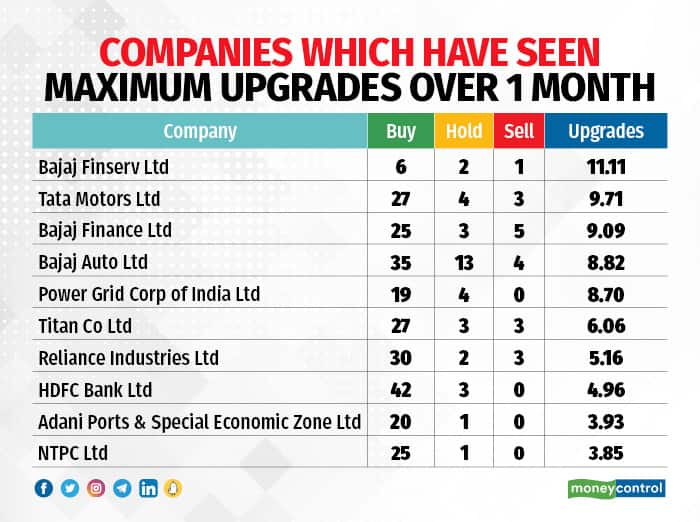

Bajaj Finserv, Tata Motors and Bajaj Finance got the maximum upgrades by brokerages over the past month, while HDFC Bank received the highest number of buy ratings at 42, up from 38 last month.

Strong earnings growth has driven the momentum in the BFSI (banking, financial services, and insurance) and auto sectors in the third quarter of FY23, analysts said.

In a recent earnings review report by Motilal Oswal, automobiles, public sector banks, and non-banking financial companies recorded an FY24E earnings upgrade of 7 percent.

“The 3QFY23 corporate earnings so far have been in line with the performance of heavyweights driving the aggregate. However, the growth has been led by just BFSI and autos while metals, oil & gas and cement have recorded a YoY earnings decline for the quarter,” the brokerage noted.

For Tata Motors, analysts at Motilal Oswal said all three businesses of the company are in recovery mode. While the India commercial vehicle business will see a cyclical recovery, the India passenger vehicle segment is in a structural recovery mode, the brokerage said.

JLR (Jaguar Land Rover) is also witnessing a cyclical recovery, supported by a favourable product mix, however supply-side issues will defer the recovery process, it added.

Global brokerage CLSA gave Tata Motors an upgrade after its JLR division reported higher wholesale volumes in the October-December quarter amid gradual improvement in chip supplies.

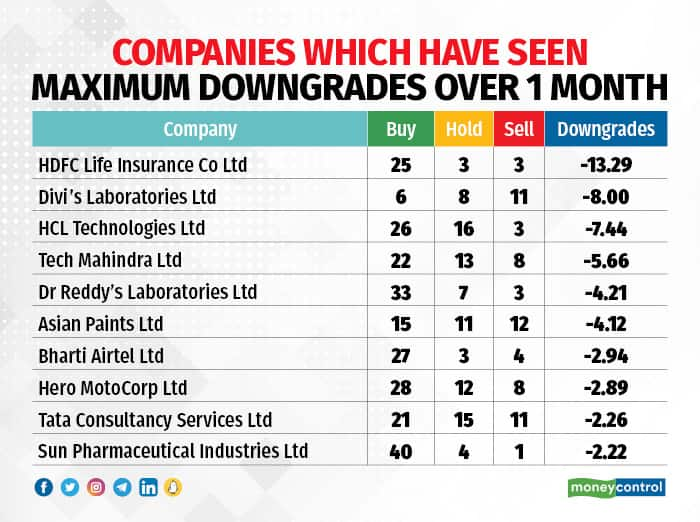

HDFC Life Insurance Company got the maximum downgrades over the past one month, followed by Divi’s Laboratories and HCL Technologies.

The HDFC Life downgrades seem to stem from the impact of the Union Budget 2023, in which finance minister Nirmala Sitharaman proposed to limit income tax exemption from proceeds of high-value insurance policies.

“HDFC Life will be the most impacted, given a higher share of single-premium product (Sanchay Fixed Maturity Plan), which constitutes around 20-25 percent of NPA (non-participating insurance plan) APE (annualised premium equivalent),” said Phillip Capital.

Divi’s Lab posted its lowest operating profit margin during the December quarter. Analysts are concerned over high input cost pressures and a moderate outlook of pick-up in non-Covid opportunities.

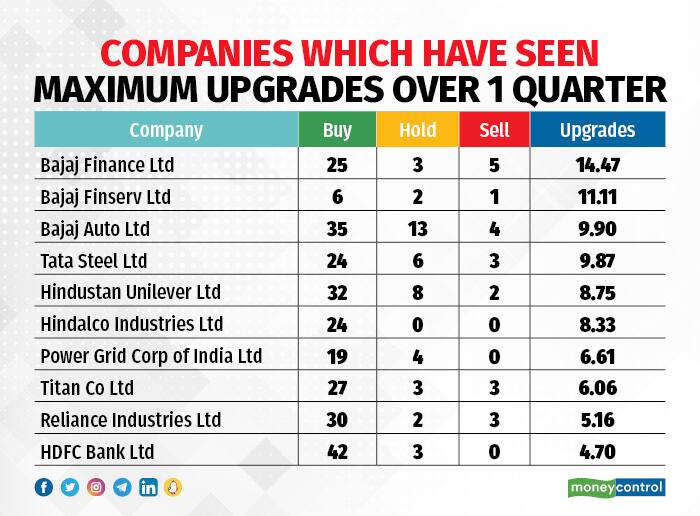

Quarterly upgrades, downgrades

Bajaj Finance, Bajaj Finserv and Bajaj Auto got the highest number of upgrades over the past quarter.

The digital transformation led by Bajaj Finance, a subsidiary of Bajaj Finserv, seems to be driving growth, with increases in client additions as well as assets under management.

According to brokerage firm IIFL, Bajaj Finance intends to build an ecosystem that will preserve the customer cohort across various businesses. With its fintech platform and health-tech platform, customers may not have to look around for products that Bajaj Finance doesn’t offer directly.

Bajaj Finance will also start its mutual fund business later this year, it said.

“Insurance businesses are firing on all cylinders. Investments in finance and health platforms would create extensions that would be value accretive over the next decade,” the brokerage said.

Among the top 10 companies with the maximum upgrades over a quarter, HDFC Bank had the highest number of ‘buy’ ratings at 42, followed by Bajaj Auto at 35.

“HDFC Bank remains one of the few banks to clock a strong deposit growth amid rising competition for deposits,” said analysts at Emkay Global Financial Services. “On the credit front, HDFC Bank remains opportunistic on the corporate side; thus, we are not too worried about the Q3 growth moderation. The bank continues to clock strong growth in the retail/SME segment which we believe should support its margins amid rising cost pressure.”

On the other hand, Bajaj Finserv had the lowest number of ‘buy’ recommendations, at six.

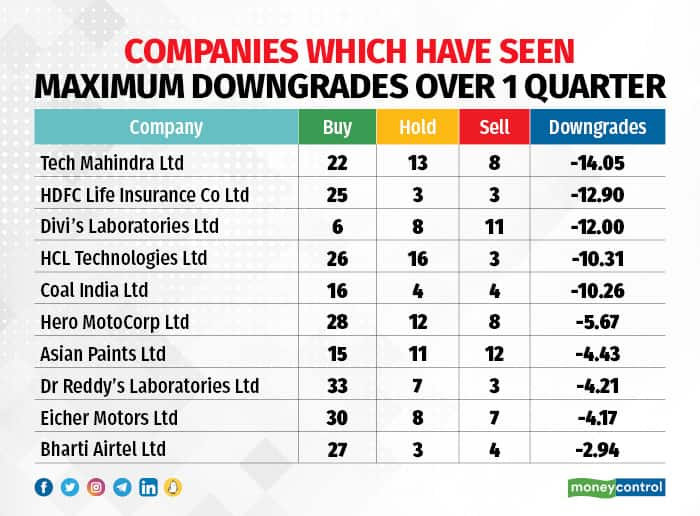

Tech Mahindra, HDFC Life and Divi’s Laboratories were among the companies with the highest number of downgrades over the past quarter.

The number of ‘hold’ ratings on Tech Mahindra’s stock increased to 13 this quarter from 10 a quarter ago.

‘Hold’ ratings on HCL Technologies increased to 16 from 12 a quarter ago.

Low discretionary tech spending coupled with macro challenges in the west may contribute to a negative outlook for tech stocks. Analysts at Credit Suisse expect India's top four Indian IT companies to witness a 10-27 percent valuation-led correction, with HCL Tech likely to be the worst hit.

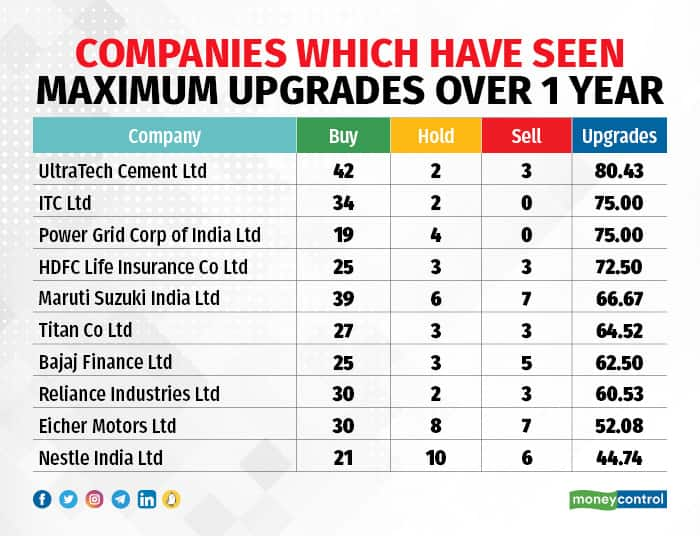

Maximum upgrades, downgrades over past year

UltraTech Cement had the maximum upgrades, with 42 ‘buy’ calls from 37 a year ago. Last year, there were seven ‘hold’ calls on the company’s stock, which have shrunk to two now.

Analysts like UltraTech’s ability to maintain its market position and cope with the industry's inherent cyclicality. Strong branding and focus on capacity building to target long-term growth opportunities have also been positives.

ITC, Power Grid Corporation of India and HDFC Life followed UltraTech in terms of the most upgrades over the past year.

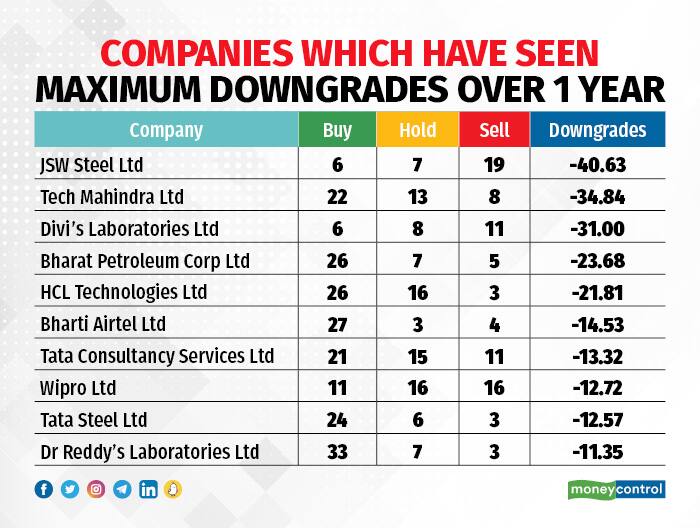

JSW Steel got the maximum downgrades. From 19 ‘buy’ recommendations a year ago, the stock slipped to six ‘buy’ calls, even as ‘sell’ ratings soared to 19 from seven a year ago. Analysts said JSW Steel’s high valuation provides limited upside potential.

“Despite margin recovery in sight, due to steep valuation, we downgrade JSTL to Sell rating with target price of Rs 688,” Centrum Broking said.

‘Buy’ calls on Tech Mahindra fell to 22 from 43 last year, and ‘sell’ ratings jumped to eight from one. Analysts said the muted business momentum in the Indian IT sector and pressure on margins led to the downgrade.

Divi’s Laboratories, Bharat Petroleum Corporation, and HCL Technologies were the other stocks with extreme downgrades over the past year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.