Ruchi AgrawalMoneycontrol Research

Post the normalization of the headwinds faced by Indian agri industry during Q1 FY18, the Q2 FY18 performance showed signs of revival. We stay positive on the sector and our investment case rests on how we see the revenue cycle and the positioning of the business model.

How was the current performance?

While Q1 FY18 performance saw an overall contraction and was impacted by inventory destocking around the implementation of GST; with the normalisation post GST there was an average topline growth of 5 percent across major agri companies in Q2 FY18, along with a healthy EBITDA growth and stable margins.

Restocking post GST, a near normal monsoon and Kharif season, higher frequency of pest attacks and expansion of cotton acreages worked in favour of agro chemical companies and aided growth.

Road Ahead

Clearing up of channels -Destocking around GST and tight liquidity conditions helped to clear up inventory channels which now would support topline growth and provide demand clarity to companies.

Water levels, good Rabi expected to be better -The last leg of monsoon showers led to improved water levels in reservoirs and upgraded the soil moisture level which would benefit the upcoming Rabi season.

Chinese production ban to hurt select companies - With rising pollution concerns the Chinese government has taken strict steps leading to shutdown of many companies and production cuts at many others. This would impact companies which source material from China and might have significant impact on margins.

Chinese import restriction to benefit domestic players – With reduced imports from China, domestic producers would see demand improvement. This would also lead to increased plant utilization and better operational leverage.

Regulations on generics - Generic product companies are set to benefit from the new regulations which are in favor of the generic players. However, with increased demand for generics due to Chinese import restrictions, there has been an increase in the prices which has left little gap with branded products.

Higher incidents of pest attacks to benefit the industry as a whole - The Kharif season saw higher frequency of pest attacks across the country which would work in favor of the crop protection segments and would benefit upcoming Rabi demand for agri companies.

Investment Thesis

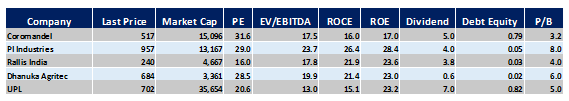

Rallis India – The agri arm of the Tata group manufactures and markets farm inputs and seeds and seems to be well positioned to capture markets on the back of reduced competition and rising product prices. Relative to peers the company is trading at attractive multiples. We believe Rallis has been one of the laggards of the Tata group and with increasing business traction it is positioned for growth.

Coromandel International – Coromandel is a manufacturer of crop protection and yield enhancement products with a major presence in southern India. With a growing share of the non-subsidy business, margin expansion in the fertilizer business, greater operating leverage and visibility of growth in crop protection business, we expect a healthy topline growth in the coming quarters.

PI Industries – PI is a globally present contract research company for manufacturing agro chemicals and has a good presence in the domestic market as well. Post a subdued Q2, we believe PI industries has a good line-up in the order book and has shown visibility of upcoming revenue inflows which would start from FY19. Moreover, its flagship brand Nominee gold (herbicide for rice) witnessed less than expected impact from the introduction of generics due to overall industry expansion and good brand recall. The company is also set to benefit from Chinese plant shutdowns and restrictions on Chinese imports.

UPL - UPL Limited provides crop protection solutions and is engaged in the business of agrochemicals, industrial chemicals, chemical intermediates and specialty chemicals. Although the management has lowered the FY18 revenue guidance, the EBITDA margin expectation remains steady. A diversified business, regulatory favour for generics, a healthy working capital cycle and interesting valuation make UPL an attractive pick.

Dhanuka Agritech - Dhanuka Agritech Limited is engaged in formulation and marketing of plant protection agro-chemicals, including insecticides, herbicides, fungicides and plant growth regulators. The branded business of Dhanuka Agritech is set to benefit from changing regulatory environment. Robust domestic presence, improved agri regulations, and growing penetration seem to benefit Dhanuka in the long term.

Overall, we stay cautiously positive on the sector like Rallis India and Coromandel Industries. We are convinced with the business model of PI, Dhanuka and UPL and suggest to buy on dips.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!