In the quarter ending June, venture capital investments in startups in India took a sharp dive of 25 percent from a year ago.

The amount slid to USD 275 million in 78 deals from last year’s USD 309 million in 104 investments, according to a report by research firm Venture Intelligence.

June quarter was the lowest quarter for VC investments in India in the last three years.

Blaming the challenges in Consumer Internet and Mobile sector for the dip, Arun Natarajan, Founder and CEO of Venture Intelligence said, “While the challenges in consumer internet and mobile sector had become quite apparent last year, they are beginning to reflect quite starkly in terms of VC investment figures during 2017.”

However, he seemed hopeful that in future themes like Health-tech and 'deep-tech' could emerge stronger on the radars of investors.

Shared office space provider Awfis got the largest VC investment in the quarter with Sequoia Capital’s USD 20 million commitment.

However IT and IT-enabled services companies bagged the biggest share of the investments with nearly 70 percent of the chunk going their way.

E-commerce search software company Unbxd with USD 12.5 million, insurance marketplace Coverfox with USD 11 million and logistics tech company Fortigo with USD 10 million were other startups that received large investments.

Sequoia Capital, Lightspeed Venture and Accel India were the most active VC firms with four investments each in the June quarter.

Continuing their previous record, Bengaluru-based startups bagged a greater number of deals than their counterparts in Delhi and Mumbai.

The IT capital of India topped the chart with 26 investments, followed by Delhi-NCR with 22 and Mumbai with 14 investments in this quarter.

However, the numbers are far below from the respective quarter a year ago.

Private Equity investments climb

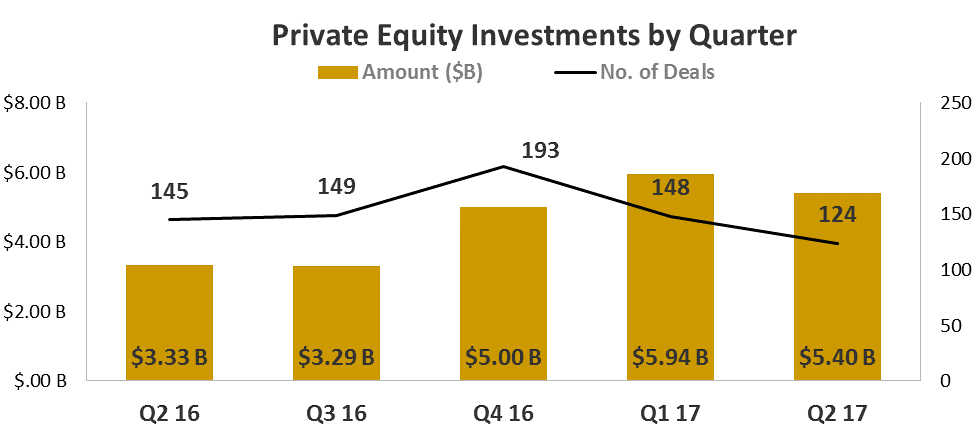

Hitting USD 5 billion mark for the third straight quarter, private equity investments rose by 62 percent annually in the quarter ending June.

Led by Softbank’s mega investment of USD 1.4 billion in Paytm, this quarter saw 124 deals worth USD 5.4 billion.

However, this was still lower than the PE investments of 5.9 billion in the March quarter.

Even for PE investments, the IT and ITeS companies accounted for nearly half of the pie attracting almost $2.6 billion across 68 transactions.

They were followed by banking and financial Services companies which bagged USD 689 million across 12 PE investments.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.