Tiger Global Management, one of the world’s most prolific tech investors, has upped its Series A bets in India this year as early-stage funding to the country’s start-up ecosystem seems to be gathering momentum, even as late-stage funding is slowing.

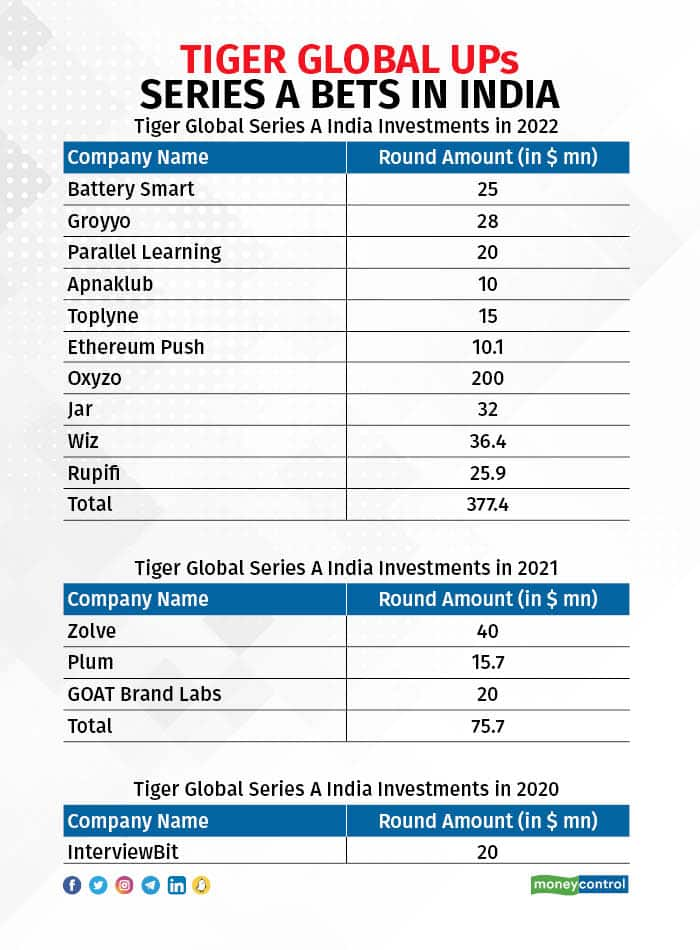

The New York-based hedge fund company has participated in Series A rounds of 10 companies totalling $377.4 million in the first six months of 2022, against three companies in rounds totalling $75.7 million in the whole of 2021, according to data by Tracxn Technologies. Tiger Global had participated in only one round of $20 million in 2020.

The average size of Series A rounds that saw Tiger Global’s participation also jumped to $40.2 million in 2022 from $25 million 2021. Tiger Global did not reply to queries sent by Moneycontrol.

Source: Tracxn Technologies

Source: Tracxn Technologies

Tiger Global joins Sequoia Capital India, another aggressive tech investor in India, to increase its early-stage bets, suggesting that appetite for early-stage investments in the country is rising after it hit a 12-month low in May. Sequoia Capital India, last week, had said that it was extending the seed-level funding range for its investments through Surge, its start-up accelerator programme to as much as $3 million.

Meanwhile, other global venture capital (VC) firms including Matrix Partners, and Accel, which invest aggressively at early stages, have also raised their largest-ever funds for Indian start-ups this year, suggesting that early-stage investments in India will continue.

“Indian founders need more capital flowing in at Series A, especially now that we have 80+ micro-VC funds developing hundreds, if not thousands, of start-ups over the next three to four years,” said Anirudh A Damani, Managing Partner, Artha Venture Fund.

“So, it is important and logical for growth-stage funds to start picking founders earlier than the much-more crowded Series B and beyond ecosystem,” Damani added.

Late-stage funding, meanwhile, is showing signs of slowdown amid a sharp correction in global financial markets, which has hit tech valuations the hardest.

“If the focus is on sustainability and the company is moving in this direction, we continue to believe there is enough money available to support it. However, there could be cases of lower valuation,” said Swati Murarka, Vice President at Athera Venture Partners.

“Second is the case of those companies which do not have a secular growth trajectory path and will have to be supported by existing investors. The hardest question is about companies which are declining. If this continues for some time, there are going to be quite a few difficult conversations which are inevitable. In our portfolio, the situation does not look scary,” Murarka added.

Tiger Global, meanwhile, in May, had told its investors that the company has increased early-stage investments globally through its newest and largest venture capital fund of nearly $13 billion, marking a shift in its strategy as the hedge fund company typically invests at later stages.

The shift comes a month after Tiger Global had reported a sharp fall in the total value of its public stock positions to $26 billion at the end of March quarter from over $46 billion in the previous quarter.

Tiger Global had also told its investors that more than half of the fund’s investments were in Series A or Series B rounds, typically the first or second big financings for private tech companies. The company also marked its first seed-level bet in India when it led a Rs 20-crore round in software-as-a-service (SaaS) platform Shoplo.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!