Tiger Global Management, one of the world's most aggressive technology investors, has bet big on early-stage companies in India this year, despite the fact that the New York-based hedge fund firm has been slow to deploy capital elsewhere in the world due to macroeconomic headwinds.

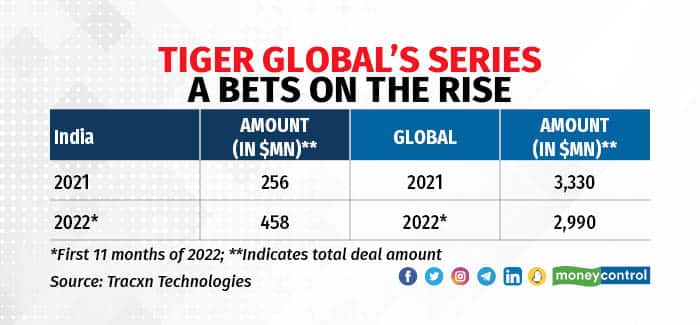

Tiger Global has participated in Series A rounds totalling $458 million in the first 11 months of 2022, an increase of 80 percent compared to the same period in the previous year, according to data from Tracxn Technologies. According to the data, Tiger Global participated in Series A rounds totalling $256 million in 2021.

Globally, the New York-based hedge fund company participated in Series A rounds totalling $2.99 billion, an 11 percent decrease from the previous year. According to the data, Tiger Global participated in Series A rounds totalling $3.33 billion in the first 11 months of 2021.

Moreover, while the overall pace of early-stage investments in India has increased this year, Series A investments have lagged. Early-stage investments increased by 30 percent in the first 11 months of 2022, compared to 2021, while Series A bets increased by only about 15 percent. Tiger Global's optimism about Series A thus defies the trend.

Tiger Global did not respond to questions sent by Moneycontrol.

In an interaction with Moneycontrol, Vikram Gupta, the founder of IvyCap Venture Advisors, which typically invests at the early stages, explained the significance and scope of Series A rounds for startups in India.

“Out of the over 60,000 registered startups, about 25,000 have got angel, seed, or pre-Series A funding. But only about 1,200 are Series A funded, and of those, 100+ have translated into unicorns. So, there’s that huge potential for building many more unicorns. But there are challenges at Series A. You need conviction, the cost is high, fund sizes are small, and fund economics don’t allow you to hire good quality resources, among others. So, there’s a lot of gap at Series A and funds are looking to disrupt that, and so are we,” Gupta had said.

To be sure, Tiger Global has been bullish on India since the beginning of the year, and many of the hedge fund company's partners have visited startup hubs like Bengaluru and Delhi this year to explore investment opportunities.

Tiger Global Management's private investment head, Scott Shleifer, visited India earlier this month to meet with founders, portfolio startups, and investors, and sounded "very bullish" on the country, Moneycontrol reported on November 23. In conversations with portfolio founders, he also said that Tiger Global sees India's private market bets as a "silver lining" at a time when some of its US bets are turning sour.

Tiger Global, while bullish, is not ready to write late-stage cheques just yet. It will continue to play in the early stages, and India is expected to be one of the largest beneficiaries of Tiger Global's new fund, according to sources close to the development. Bloomberg reported in October that the New York-based hedge fund firm was in talks to raise $6 billion for its new venture fund.

The size of the new fund was reduced from $8 billion to $6 billion, according to the report. The report also said that Tiger Global would be investing in enterprise companies through the new fund and ‘largely in India.’

Tiger Global told investors in May that more than half of the fund's investments were in Series A or Series B rounds, which are typically the first or second big financings for private tech companies, from its newest and largest venture capital fund, which had raised nearly $13 billion in March.

Tiger Global is one of India's most aggressive tech investors, having created nearly 40 unicorns out of the country's 106 to date.

Tiger Global has backed unicorns across sectors in 2022, including neo-banking platform Open, gaming platform Games 24x7, small and medium enterprises lending marketplace Oxyzo Financial Services, Web 3.0 infrastructure Polygon, and social commerce platform Dealshare.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.