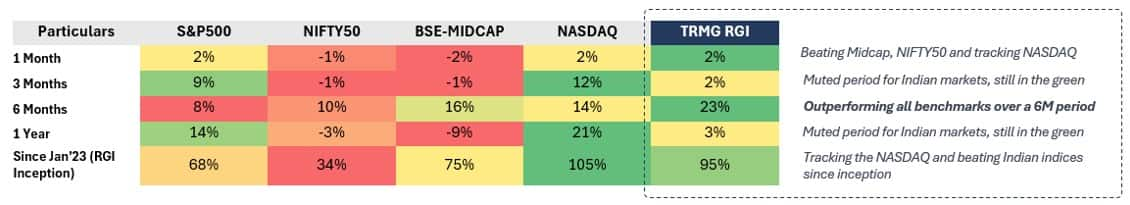

After a muted 1-year amid market correction, TRMG RGI has bounced back sharply - posting +23% in 6 months and consistently beating Indian indices and closely tracking the NASDAQ since inception (Jan-23).

After emerging from a year of recovery and rationalisation, the markets stayed selectively optimistic for India’s listed startups. The equation was clear proof before the reward and re-rating. Companies that showed evidence of progress - whether through profitability, soaring adoption metrics, synergies playing out, or strengthening category leadership- were rewarded. Those still in transition were met with patience, not premium.

Proof in action was seen in various forms in this quarter:

Proof of profitability:

The TRMG RainGauge Index is a proprietary, rules-based benchmark designed by TRMG to track India’s leading listed startups and tech-enabled companies. It is an equal weighted index of top 20 companies by Market Cap from the VC-backed listed startup universe and reflects the evolution of the ecosystem in public markets with a dynamic, transparent, and objective construction logic.

The complete report can be downloaded from: RainGauge — The Rainmaker Group

Tithi Jain contributed to this report.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.