Last month, an analyst at a top venture fund brought a potential deal to his seniors. The analyst was excited. The consumer brand was young, growing fast, and its founder oozed charisma—confident, compelling and courageous.

But a partner at the fund who heard the analyst’s pitch was not impressed. The analyst had been taken in by the founder’s charm and vision and hadn’t seen the underlying numbers.

The fledgling company had projected revenue for a decade based on little more than optimism and extreme best-case assumptions. The company’s customer acquisition cost was triple what it stated and in the partner’s estimation, it was nowhere close to fundable.

“It was an eye-opener. Then I went back and saw historical data on companies and sectors performed during and after a boom market. It chilled me to my bones. It is easy to get carried away by the euphoria during this boom, but also dangerous,” said the analyst, requesting anonymity.

Meet the analysts

In the venture capital (VC) industry, general partners (GPs) tend to hog the limelight—privately and publicly, intentionally and unintentionally. They are subjects of profiles, recipients of awards, lightning rods for critique, and among the most spoken-about people in the start-up industry.

Analysts are the exact opposite. An analyst at a venture fund is the lowest ranking member of the investment team. It is not even a permanent role. At most firms, analysts enroll in a two-year program after which they generally pursue an MBA degree.

Unlike other investment members, analysts don’t have access to a firm’s internal finances. They are not privy to details about a VC firm’s own investors—Limited Partners (LPs)—and generally don’t get a share of the firm’s profits or ‘carry’.

Yet, the venture ecosystem cannot do without them.

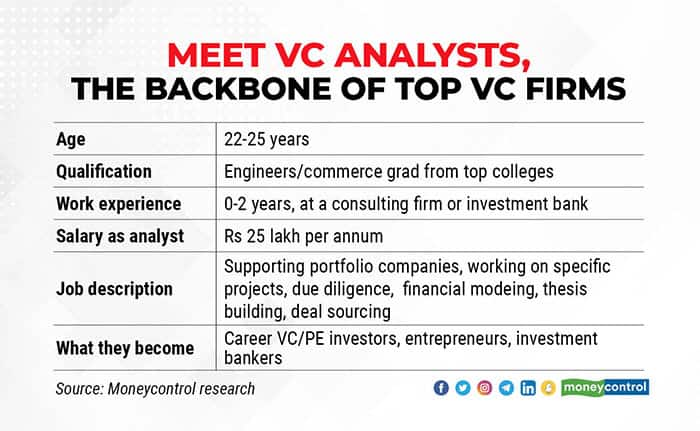

These 22 to 25-year-old men and women scout deals. They develop networks. They have their ears to the ground and help portfolio companies in gritty day-to-day work. They also play Man Fridays to their respective firms with aplomb.

Many analysts have gone on to become among the most influential people in the start-up scene (see graphic- Analysts who made it big). VC firms pride themselves on their analyst programs and a VC analyst stint generally opens up doors to a lucrative career nearly anywhere-—global consultancies, investment banks, technology start-ups or private equity firms.

The role of an analyst also lays bare the quirks of the VC industry. A partner is responsible for the firm’s investments, exits, future and relationships. The role of an analyst is ... similar.

Partners source deals. So do analysts. Partners help portfolio firms. So do analysts. Few professions have the junior most and senior most people doing largely the same thing, only with varying levels of accountability.

These quirks have been exposed even more in the last one year, when the Covid-19 pandemic changed life as we knew it. Analysts new to the industry have been working from home, trying to source deals while sitting in their shorts in the middle of the night, cold calling founders, other investors and investment bankers.

And in the last six months, analysts have also been mystified by the startup funding frenzy gripping India. They have had to do deals at a time when the market seems to be fundamentally shifting beneath their feet, and at a time when internet entrepreneurs have higher expectations than ever before.

This is their story.

Ishwar Prasad, an analyst with A91 Partners, has spoken to 150-200 founders in the last two years. He throws the figure casually, as we discuss a myriad of other things. But the number sticks because it defines what a venture capitalist, particularly an analyst needs to have- hustle.

At Matrix Partners, one of India’s biggest VC firms, analysts are encouraged to meet 15-20 founders every week. And the senior investor overseeing them—directors or managing directors—checks with them on how many people they met and which of these are worth exploring further.

The role is similar at most large VC firms, where analysts are expected to both source deals and do backend work, build financial models, help portfolio companies with specific projects, and assist in due diligence.

Young investors engage in this hustle in different ways. Some take red-eye flights. Some try very hard to see every hot deal in the market, by stretching their networks as far and wide as they can. Some post motivational thoughts on LinkedIn and Twitter, meant to portray them as young thought leaders.

The common thread in all of them? They are extremely ambitious.

The hustle that VC firms expect is harder to pursue during a pandemic, during different phases of which, you are alone, cooped up in a room, you or those around you are in distress and yet oddly enough, work is busier than ever as internet start-ups took off massively due to rising digital adoption.

Work culture

VC firms are also relatively unstructured and have less hierarchy than most organized professions- consulting, banking, IT, financial services, or others. Teams are generally small- even top firms may have a team of just 10-15 people doing investments. Everyone does a little bit of everything.

Kriti Arora joined A91 Partners- a $350 million fund run by former partners at Sequoia- as an Analyst in February 2020, weeks before the first lockdown in India. Coming from consulting giant McKinsey- the source of many VCs India and abroad- she was thrown into the deep end, having to cultivate internal and external networks largely working from home.

“VC firms, especially compared to consulting firms, are rather unstructured. It takes time to get used to that. It was a challenge. There are days with an extreme amount of work and days where there's nothing. But that's when you have to keep yourself motivated,” Arora says.

Working from home was a double-edged sword for many of these analysts. Some found freedom they had previously craved. They could work when they wanted and sleep when they wanted if they coordinated timings with their seniors. They found time to work out, to read, to chat.

But they all took time to adjust. One analyst at a top firm joked that some months she didn’t feel she deserved her salary, while other months she felt she should be earning double what she was being paid.

And by most standards, VC analysts are paid handsomely. Analysts at the top 5-6 firms earn about Rs 30 lakh a year. They are generally 22-25 years old, have an engineering or commerce degree from an elite institution and a one or two of post-degree experience, at consulting firms, investment banks or start-ups.

VC firms sometimes have a high-pressure work culture, especially for young investors. Working through the night to close a deal, taking six flights a week (pre-pandemic) and packing your calendar with overlapping events is not unheard of.

One firm is trying a different approach though. At A91, analysts say they don’t get calls from partners after 7pm- virtually unheard of at most top firms. People close to the firm also said that this is a conscious effort, where partners are trying to give analysts more leeway, not monitor their performance too closely, and let analysts take their own time to learn the ropes.

A91’s Prasad used this leeway to coordinate with his team and work from 4am to 9am- time when he felt most productive- for many months, leaving his evenings free for workouts and hobbies Such a scenario is unimaginable pre-pandemic, and still hard to find in most VC firms today. Having worked at A91 for two years, Prasad is headed to the prestigious University of Pennsylvania’s Wharton School later in the year to pursue his MBA.

Working for smaller teams such as A91, or local funds like Blume Ventures and India Quotient also means that analysts get to spend more time with partners- understanding their thinking and absorbing their experiences. At Accel each analyst is mapped to a partner, so while he/she does learn from that partner, cross-partner interactions and learnings are less likely

At large firms like Sequoia, analysts work closely more with principals and vice presidents, with partners addressing them more on internal team calls and big-picture meetings, not always one-to-one.

Serendipity

Despite the meticulously planned calendars of entrepreneurs and investors, choc-a-bloc with internal and external meetings, deal making is often serendipitous. Deals stem from distant connections, bumping into old colleagues at events, a casual tweet that results in follow ups and more.

“There is a lot of serendipity attached to offline meetings, which is sometimes missed. An unplanned catch-up after an industry event or board meeting was always interesting,” says Anubhav Goyal, an Analyst at Chiratae Ventures who was promoted to Associate earlier this year.

He has a point. The nature of early stage investing also leads to deals based on gut feelings, instincts and comfort with certain personality types.

Analysts across VC firms have no-agenda meetings with founders and even other investors, so that when these start-ups eventually raise money, these investors have a leg-up, having established a connection already.

That’s harder to do virtually, when Zoom and MS Teams calls are formal almost by design. "One has to put in some conscious effort to make sure that the first few virtual interactions with founders and industry colleagues are engaging and not just transactional. The virtual setting has however helped in faster and more frequent interactions with the portfolio teams,” Goyal said.

While deal making is the front and centre of venture capital, working with portfolio firms is also crucial for analysts, and a key part of their appraisal criteria at the end of their two year stint.

More so, deal making often has some level of luck involved. Helping portfolio companies with expansion projects, cost-cutting, introducing best practices and trying to differentiate from competitors are important. Founders are often fond of younger investors who help them fix crucial parts of their companies.

For instance, at bus commute startup Cityflo, Jerin Venad credits Anshika Sinha, Vice President at Lightbox Ventures with helping him realise that he needs a Chief of Staff(CoS). Sinha studied and analysed other startups she knew, and helped Venad realise that he was doing too many things that weren't his responsibility or strength.

The CoS is more senior, analytical and diligent than Venad, he says, and lets him focus on the big picture.

Sinha also helps compare salaries to peers when Cityflo hires for senior roles.

Similarly, Siddarth Jain, analyst at Accel helped SaaS startup Securden formulate its content marketing strategy. By speaking to others and analysing competition, he helped the company improve its search engine optimisation, improved its blogs and made its content more relevant and accessible.

The unexpected boom

Besides the pandemic, analysts have also had to reckon with the biggest and most unexpected boom in India’s internet funding history. At the end of 2019, led by Uber’s tepid IPO and WeWork’s failure to list, investors had grown wary of funding large unprofitable internet startups.

Already cautious of high-burn companies, the Covid-19 pandemic was expected to drag sentiment down further, which it did, but only temporarily. The last six to nine months have seen an unprecedented funding boom across stages, something that has rattled even experienced investors who are struggling to connect the dots.

Analysts too have been grappling with this reality. One result of the pandemic-led boom is that entrepreneurs sometimes have sky-high expectations. They want the most aggressive valuations and they negotiate only with the partners at a fund, finding analysts too junior to seriously engage with. This has been a pre-pandemic problem as well, where experienced founders especially prefer speaking to partners directly.

Founders contend that sometimes analysts ask only skin-deep questions and ask for confidential numbers-growth, user retention, revenue etc- which they may then use to evaluate competitors.

Analysts carry this reputational risk- of peskily enquiring numbers and not doing much else—to such an extent that VC firms—for whom brand and image is paramount, are trying to solve the issue.

At Accel, one of India’s largest VCs and a backer of Flipkart, Swiggy and Freshworks, analysts are discouraged from deal sourcing in their first year.

“Our first-year analysts do more diligence and help portfolio companies because we think that builds an understanding of the space. We don't want them to be mere call centers. In their second year they do deal sourcing, which is about 30-40% of their total work ” Prayank Swaroop, partner at Accel said.

“It is unfortunate that nobody cares about analysts and associates in the founder world. It is changing, but very slowly. So we are trying to train our analysts, such that the founder meets them and he is blown away” he added.

Analysts help VC firms stay nimble, be aware of new sectors and opportunities. More so during the current boom, where VC firms are trying to stay nimbler than ever, wanting to see all the best deals, and yet carefully picking a select few, trying to avoid their biases and open up their minds.

“An analyst can provide a fresh perspective. A partner’s experience is invaluable but they have strong perspectives on sectors. So I feel as an analyst I should push their thinking and help reassess status quo beliefs and assumptions with a fresh pair of eyes. The fund should not become an echo chamber,” says Prasad of A91 Partners.

But this is hard to implement. Analysts are fiercely competitive, and sometimes insecure. Some try to curry favour with partners by feeding their biases.

If a partner does not like logistics companies, neither will the analyst. If the partner feels the fintech sector overvalued, the analyst will agree. Some analysts are constantly trying to figure out what their friends at other firms are investing in.

Newer analysts sometimes have a fear-of-missing-out, especially when they see press articles about large funding rounds or hear of their peers close deals. They gradually come to terms with the ups and downs of investing.

“It's important to know that venture investing is a non-linear activity. You can do one deal a week for a few weeks and then nothing for months. And that's okay as long as you are consistent in the process of learning and meeting entrepreneurs,” says Chiratae’s Goyal.

There is even a WhatsApp group for young investors across firms- ‘Associates and Analysts’, meant to help each other out, say three members of this group. If someone is looking for research on a subject, a specific article, or even a connection somewhere, they message on this group.

Members are usually helpful, but also aware of the competitive risk. They cannot be seen giving details that even signal what deal they are working on, or what project they are working on. They balance competitive pressures but try to be as useful as they can.

The endgame

The vagaries of venture capital is not for everyone. Many of these analysts, after their two years, don’t become investors. They become bankers, entrepreneurs, management consultants. They are all generally extraordinarily successful in the traditional sense. After all, VC firms pride themselves on selecting the best of the best- whatever that means to them.

Yet most of them are grateful for the experience. Kriti Arora of A91 joined the firm knowing she doesn’t want to have an investing career. She quit to start-up in the remote working space, but her investing stint taught her about life on the other side, and she says it will help her be a better entrepreneur.

Yet most of them are grateful for the experience. Kriti Arora of A91 joined the firm knowing she doesn’t want to have an investing career. She quit to start-up in the remote working space, but her investing stint taught her about life on the other side, and she says it will help her be a better entrepreneur.

Vikram Chopra, co-founder and CEO of Cars24 agrees. “Being an analyst taught me the power of critical and objective thinking. As a founder you obviously have to love your business and are very attached to it. But it is also important to be dispassionate and look at things from afar,” says Chopra, who was an analyst at Sequoia from 2009-11.

“Does my business have a real differentiator? Is the market big enough? I shouldn’t be blinded by passion and that’s what I learnt,” he added.

During the pandemic these analysts were sometimes a little rattled, a little low and a little anxious. But they say they are better investors , and better people for it.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.