India will continue to be a massive investment theme for the new funds as it is a major growth hotspot, said Sandeep Patil, Partner, head of Asia, QED Investors, on the recent announcement of its $925-million fund-raise.

His comments come at a time when the macro sentiments in the US and Europe continue to remain low amidst a funding winter and economic uncertainties.

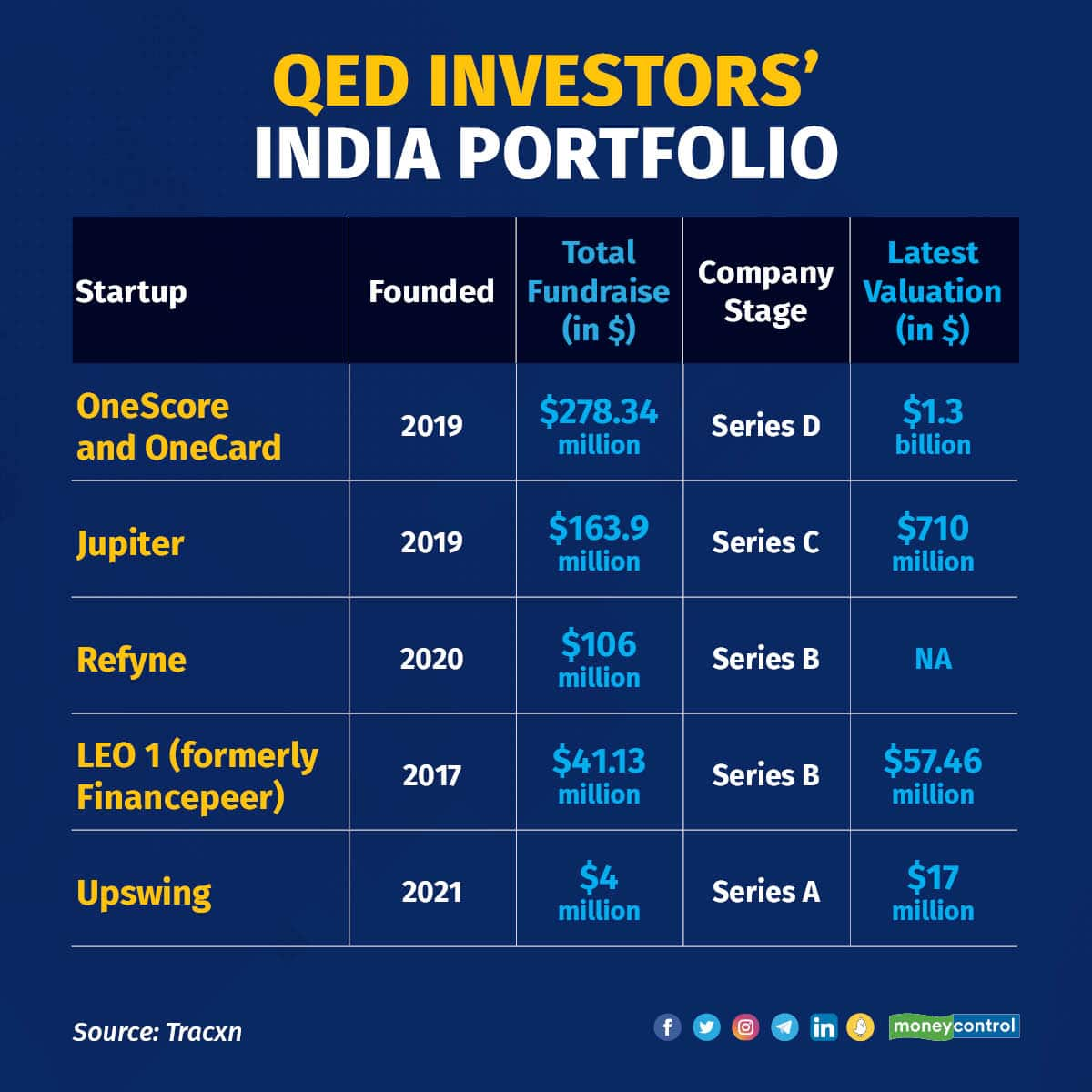

QED Investor is a global fintech-focussed venture capital firm whose India portfolio includes OneCard (FPL Technologies), Jupiter, Upswing, Refyne and Financepeer. Globally, some of its bets are ClearScore, Creditas, Credit Karma, Current, Flywire, Kavak and Klarna.

The firm closed its Fund VIII of $650 million for early-stage investing, and the Growth II fund of $275 million for early growth-stage investing, which will be for Series B to pre-IPO rounds.

These global funds will invest across the US, the UK, Europe, Latin America, India, Southeast Asia and Africa, but India remains a bright spot.

In its previous Fund VI and Fund VII too, India was a significant theme, Patil told Moneycontrol.

“India has been a massive investment theme for Fund VI and VII. It is a big part of the story. So, I don't see India being anything but a big investment theme for Fund VIII,” he said.

“From a macro perspective, India is a growth hotspot, given the headline GDP growth rate, and it’s the fastest-growing large economy in the world. That fact is not just well known now. It is well-embraced, well-regarded and getting set in the investor psyche.”

The other factors driving the bullishness on India opportunity is the emerging affluence and the growing middle class. Patil expects good returns on fintech investments to come from the next 50-150 million of the population and not from the top 30-40 million alone.

“This is where we think the best investment returns will come from, be it lending to those customers, banking for those customers, insurance and payments for those customers,” he said.

He said the country’s distinguished payments and digital infrastructure with innovations like UPI and Account Aggregator took a decade of work to develop, and other countries are getting on to it now. India’s infrastructure is far more superior. Further, finding the right trained talent in technology is also a big benefit of investing in India.

Overall, in terms of cheque size through these two funds, in the early stage, the average cheque size will be between $3 and $20 million, and in the growth stage, it will be around $20-50 million.

But given the current macro uncertainties, Patil highlighted that even in the Series A rounds, cheque sizes have started to get compressed from $15-17 million to $12 million and now down to $7-9 million.

Among the segments within fintech that QED will be looking at include startups that are building full-stack offerings that will take care of user experience, product marketing and taking it all the way to how balance sheet is done.

Embedded finance, which includes any startup looking at fintech as a major monetization angle integrated into products, be it for working capital loans or point of sale financing, is another area. Other prominent themes of interest for the fund are consumer lending, SME lending and insurance.

In fact, in India, Patil said that consumer lending will be an important theme. “I think India is a massive consumer story that will play out over the next 15-20 years. So it makes sense to continue to invest behind it,” he explained.

Despite the global headwinds and negative consumer sentiments in the US and Europe, Patil said this is the best time to invest in fintech, as risk models and underwriting methods are automatically getting trained for downturn scenarios. The businesses, which will eventually emerge, are going to be robust. Limited partners (LPs) are also finding better picks at advantageous valuations, and would get a seat at the table to steer these companies.

All eyes on lendingIn India, of late, existing fintechs wanting to diversify into digital lending has been a growing theme. This includes QED Investors’ portfolio bet Jupiter, apart from Jar, PhonePe etc.

Patil said the trend is hardly surprising. “In banking, all roads will first lead you to lending and then to insurance. Profit pools for banks anywhere in the world, 60-70 percent of it will be in lending and another 20 percent in insurance and then everything else. It’s no surprise that these fintechs are looking at lending for monetisation. But lending is easier said than done. It’s easy to lend but you need to get your money back, with interest,” he said.

Though bullish on lending, QED has consciously stayed away from the ‘buy now, pay later (BNPL)’ theme in India. He called it a consumer behaviour-focused product, and that building resilience and long-term profitability through it can be done with the right innovations but it will be challenging.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.