Global multi-stage investment firm B Capital announced the close of its $2.1 billion growth fund (its third) on January 19. It will be deploying this across the US, Asia, southeast Asia, and India over the next 2.5-3 years. Average cheque sizes will be of around $40-50 million focussed on series B to pre-IPO rounds.

Across its various funds, the firm writes cheques ranging from $10-100 million. More than half its capital is deployed in the US.

B Capital was founded in 2015 by Facebook co-founder Eduardo Saverin and his friend from his Harvard days, Bain Capital and Boston Consulting Group (BCG) veteran Raj Ganguly. With about $6.3 billion in assets under management (AUM) today, it also counts legendary investor Howard Morgan and Goldman Sachs veteran Sheila Patel in leadership roles.

The firm believes in 'innovation beyond borders,' operates as one global team, and doesn’t have country-specific offices across its markets. It’s currently co-headquartered in Los Angeles and Singapore.

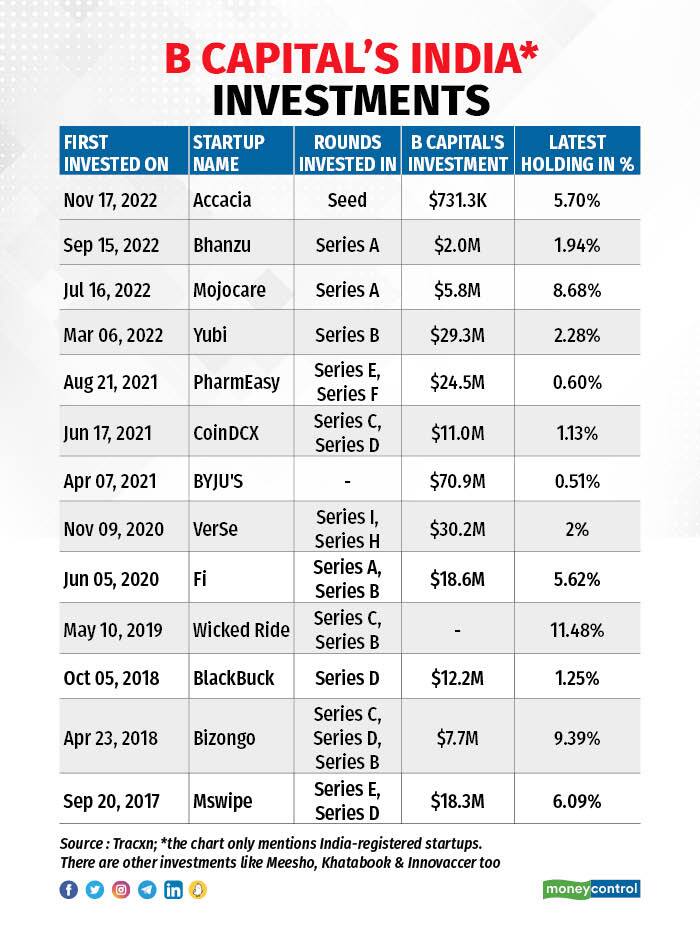

In India, some of its portfolio companies include BYJU’s, Meesho, PharmEasy, Blackbuck, DailyHunt, Khatabook, Fi, and Bizongo to name a few.

A few months back, B Capital announced its first dedicated early-stage fund (Ascent Fund II) of about $250 million focussed on Southeast Asia and India.

In an interview with Moneycontrol, Ganguly, the firm’s Co-Founder and Managing Partner, discussed the fund’s investment rationale, the India opportunity, global valuation trends, macro-economic challenges, and late-stage exit strategies.

Edited excerpts:

Given the macro-economic challenges that we are seeing, do you expect a slight shift in your investment strategy with this new growth stage fund? Will there be focus on metrics like path to profitability?

Our investment focus is going to remain largely consistent. We've always been interested in companies that are focused on both growth and profitability at the same time. Our goal has always been to operationally engage and be value-add investors. That's why we make fewer investments than many of the other venture and growth funds.

We ourselves were founders before we became investors, we have an entire team within B Capital that looks at this, and thanks to our partnership with BCG, we have access to its resources and network.

There was a period in 2020-2021 when valuations were going up quickly and it became about growth at all costs, it became all about speed.

But we've always taken our time, we've always tried to deploy our funds over 2.5-3 years. And we have a big team. Our goal is to be helpful and add value to founders and companies so they have a path to profitability. We're really excited about the current environment where both growth and profitability are being prioritised.

Startup valuations have been crashing globally. So do you expect a further correction in valuations before it gets better, or have we bottomed out already?

They've definitely gone down by 15-25 percent, and there's a chance they may drop by another 5-15 percent. But our goal is to invest in great businesses throughout the cycle. So we're not going to wait for the bottom. There are many great companies right now that are going to go seek financing. This fund gives us the ability to back great founders, and we've always believed that these kinds of difficult times shape some of the most resilient companies. Because if you can build a company during volatile times like this, that really means that you built a product and a technology that customers are willing to pay for, because it’s mission-critical for them. That's the kind of business we want to invest in.

You have been bullish on cross-border enterprise SaaS in India, which has been a success for you. But SaaS valuations have dropped quite a bit and investors are expecting further corrections. Is that something you also see happening?

What we've seen is that some of the companies that raised capital in 2022 were those that had to go to market as they weren't well funded. They were some of the lower-profitability SaaS business models. There we've seen valuation declines of up to 40-50 percent. But the best-in-class companies that are highly profitable, growing really well, that we believe are mission-critical technologies, have had a smaller decrease in valuation. And that's really where our investment focus is — in market-leading companies. A majority of these didn't need to raise capital in 2022. Some of the companies that raised finance in 2022 have taken a hit.

You have to break up SaaS by sub-sector, see which has lower profitability. We've found cybersecurity and data infrastructure companies to be very resilient.

Beyond SaaS, what are the sectors you are bullish on, globally?

I'm excited about three areas. One is cybersecurity. Across the board, cybersecurity has been very resilient. We’ve invested in a number of cybersecurity companies from Israel, and we're seeing SaaS cybersecurity companies coming out of India.

Secondly, we're bullish on areas of market dislocation, where we feel that fundamentally the businesses are very strong. They're top-of-the-market, best-in-class businesses, but because the whole market has gone down, they've been brought down too. An example of this is biotech and healthcare, where we've seen up to a 70 percent decline in valuation in some of these companies.

The third are businesses that have a great product and technology, but the companies need a little help as they go to market and commercialise. We have one of the best business networks globally, and we're able to match corporates and startups in a very powerful way. These are the areas we're really bullish on.

What’s your reading of the India market at present in terms of growth stage opportunities? Some of your existing bets like PharmEasy, BYJU’s, Meesho, and CoinDCX faced some trouble last year. Do you see enough strong bets in the growth stages for investing? Which sectors are they coming from?

Companies in India at the growth stage are unique. In fact, I think the Indian tech market has held up fairly well and been somewhat more resilient than people expected. I think we saw growth companies across the US and Asia feel the impact of the liquidity crunch.

We think that India is becoming an innovation economy. The great thing about being an innovation economy is that you can grow even when the overall market is flat, because when you grow through innovation, you're actually building new businesses and new markets.

Look at a company like Icertis, which is one of our early bets in cross-border enterprise SaaS. They've built the entire contract management software market. When they started, people said contract management software is only a billion Dollar market. And from the beginning they said that it wasn’t a billion Dollar market, it was a new market, so no one knew how large it was going to be. I think we all now agree that contract management software is going to be a $20-30-plus billion Dollar market, and they're clearly one of the market leaders in that.

The three themes we've invested in India include cross-border enterprise SaaS built in India for the world; e-commerce, including tools around e-commerce; and, financial inclusion. With SaaS valuations coming down, we think it's an even better time to deploy capital in the growth stages.

We will continue to invest in the rise of the Indian consumer story, though we are going to be cautious about it. We do think that with global economies like the US and Europe going into a recession in 2023, there'll be a knock-on impact on the Indian consumer.

On financial inclusion, we believe that both consumers and small businesses don't get proper access to banking and credit in the Indian market, and that there's a role that fintech companies can play. But in markets like this, you have to be very careful about lending businesses and any business that's relying on credit, because you do see non-performing loans significantly increasing during downturns. So we stay away from lending businesses and focus much more on software companies in the fintech space.

For this fund, have you started speaking to startups? How are the conversations shaping up?

We meet thousands of companies per year across all our funds. Conversations with founders are now a lot more about efficiency, whether it's sales efficiency or capital efficiency. Investors are much more interested not just in growth, but how we are getting that growth. This is something that we've always looked for. We've always looked for companies that have really high customer loyalty, where the customer actually grows and scales with the company. That's something that's worked for us in 2015, and that worked for us in 2020 and 2021, when the market was very frothy, and that's something that we think will continue to work in 2023 and 2024.

Some of the best companies in history have been built during times like this. Look at companies like Microsoft and Alibaba. These and many others were started during difficult times. The reason they succeeded is because they built products and technology that customers were willing to pay for even during a downturn.

Currently, IT spend is being reduced by large US enterprises, and they're the customers of many of our software companies. But while spends are decreasing overall, there are areas like cybersecurity, data infrastructure, data labelling, artificial intelligence, etc., where large corporates are actually increasing spends. I think you'll see some artificial intelligence deals in 2023 at very high valuations.

What has been the impact of the funding winter on growth-stage cheque sizes?

There were rounds being raised in 2020 and 2021 that the companies frankly didn't need. We're a big believer that companies should raise at least two years’ worth of capital, because we want founders to focus on building the business and not on raising capital. But we saw businesses raising four or five years’ worth of capital. They are happy, but the problem is when you raise so much capital, it has a tendency to make founders and CEOs less capital efficient.

The overall growth stage outlook has been bleak last year, and even the LPs (limited partners) of growth stage funds were following up on their investments. What has the conversation for you been like during your fundraise last year? What are the sentiments of your LPs?

We've always really prided ourselves on having a highly engaged group of LPs. We share a large amount of data with our LPs, we're constantly in conversation with them. In fact, we view them as strategic partners and not just as LPs. That obviously starts with our relationship with BCG. They're both a strategic partner and an LP. But it really extends to all of our LPs. We have great founders and large US institutions who are our primary investors.

We're not in a quarterly business, it takes five and even 8-10 years for these companies to really grow and scale. We've discussed with a lot of our LPs that if public markets go down, then the valuation of our businesses too might go down. But ultimately, what we want everyone to focus on, including our partners, is the fundamental business performance. We took our valuations up much more slowly when public markets went up in 2020, and 2021. We didn’t take the full mark-ups and therefore we've been in a better position. But the reality is that while public markets are way down, our companies are growing 2-3X more than their public market software companies, so they deserve higher valuations.

Both in the US and India, many of the tech firms that had IPOs last year disappointed the markets. Like Coinbase, Affirm, Freshworks in the US, and Paytm, Zomato, Nykaa, etc., in India. As a growth-stage investor, has this altered your exit calculations for portfolio companies going for IPOs in the next two years? How do you view this?

Our perspective is a bit more mixed on this one. We were excited to see that there were more IPOs in the Indian tech market than before. It's not just Indian stocks that declined in value from their listing price, all tech stocks declined in value post-IPO. Things might change over time, but right now the IPO window is shut. For most of our portfolio companies an IPO isn’t an option at this point. Maybe that'll change in the second half of 2023. Maybe it’ll take longer.

We are currently working with our late-stage companies to reach profitability, so that they're not forced to do an IPO just for the financing. We have been building strategic partnerships with large corporates that are sitting on trillions of Dollars of cash. We do think that corporate M&A will pick up in 2023. We have very deep relationships with a lot of corporates, and we're seeing increased interest in M&A activity already.

We think some of our companies can be long-term, large, standalone companies, in which case there are ways for us to get liquidity through the secondary market, among others, so that we don't have to rely on the business going in for an IPO or selling out.

We are focused on using all the different tools at the right time to provide liquidity. But we're not afraid to hold an investment for 8-10-plus years if we find a company with a lot of value and growth.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.