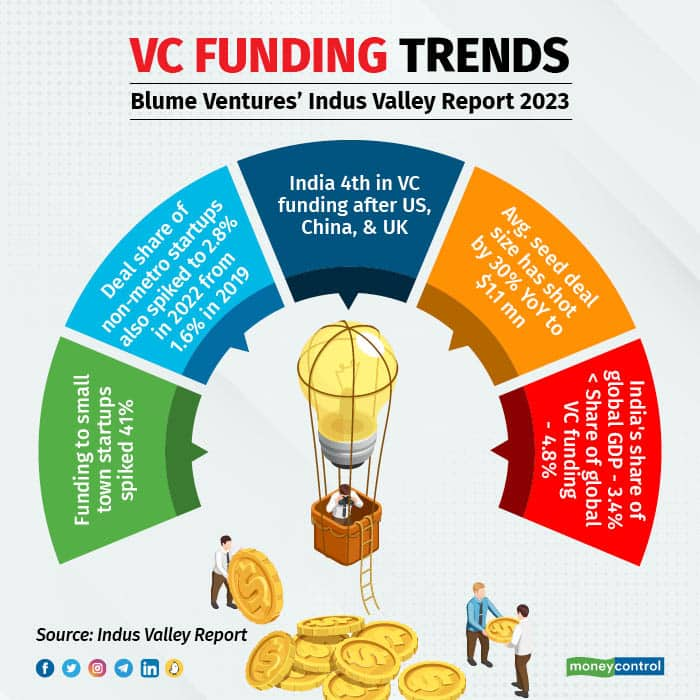

Funding for startups originating in small towns increased 41 percent year on year in 2022, while investments in hubs such as Bengaluru, Mumbai, and the national capital region (NCR) fell 48 percent during the same period, indicating that the concentration of startups has started to shift from metro cities to smaller towns.

The deal share of non-metro startups increased to 2.8 percent in 2022 from 1.6 percent in 2019, according to Blume Ventures’ Indus Valley Annual Report 2023.

In addition, the report highlighted the number of emerging local angel networks that support the trend. Several local networks, including BITS Spark, TiE Pune, AngelList, Jharkhand Ventures, Venture Catalysts, Calcutta Angels, and The Chennai Angels, assist young founders with seed funding.

India was the fourth largest destination for venture capital (VC) investments after the United States, China, and the United Kingdom, according to the report. Interestingly, while India's share of global GDP was 3.4 percent, its share of venture capital funding was 4.8 percent.

China accounts for a larger portion of the global GDP, but only 13.8% of global venture capital funding.

In the US, net mutual fund inflows in the calendar year 2021 are 3.5x of the overall venture funding deployed, as per the report. Whereas, in India, net mutual fund inflows in the same period were 65 percent of the overall venture capital (VC) funding deployed.

The funding winter has also led to investors making fewer late-stage bets. According to the data in the report, growth stage funding dropped by 55 percent in value in 2022 (investment into companies that are over 10 years old, or Series G or later rounds of institutional investments), which accounts for about 90 percent of the fall in 2022. However, seed-stage deals have dropped 25 percent in comparison.

While the number of seed funding rounds fell from 2,003 in 2022 to 1,150 in 2023, the average deal size in the segment increased by 30% year on year to $1.1 million.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.