Early stage investments in India's edtech start-ups have soared nearly 2.5 times in the first seven months of 2022, as investors continue to be bullish on the country's multi-billion dollar education market.

This trend stands in stark contrast to the funding slowdown and layoffs in ed tech unicorns such as Unacademy, Vedantu, Eruditus and Byju's group, as they focus on profitability and efficiency.

Indian ed-tech companies have raised $248 million in early-stage funding (up to series A) from private equity (PE) and venture capital (VC) investors between January-July this year, compared to $101 million during the same period last year, according to data from Tracxn Technologies. In the whole of 2021, Indian ed-tech companies had mopped up $251 million.

Globally, early-stage investments in ed-tech companies have fallen over 60 percent to $1.21 billion in 2022 so far, from $3.37 billion last year, the data showed.

The aggressive fundraising by early-stage ed-tech companies underlines the optimism of investors about India’s multi-billion dollar education market.

“The lack of conventional learning opportunities, and the challenges foregrounded by Covid in recent times, has allowed passionate entrepreneurs to come up with products and services that enable uninterrupted education, while also accelerating India's literacy graph across non-metros and rural regions,” said Mayank Kumar, co-founder and managing director of upGrad.

“Ed-tech companies are actively creating an inclusive space with a high-engagement curriculum to drive maximum career outcomes for their learners, thereby attracting early-stage investments by new and marquee players who are interested in supporting such result-oriented business models,” Kumar added.

The annual education spend in India is $135 billion, with over 150 million Indians taking high-stakes exams to get into university programs and government jobs, according to Mujtaba Wani, partner at GSV Ventures, a company that has backed ed-tech unicorns like LEAD, Vedantu, and Eruditus, among others. India offers a huge potential market for ed-tech firms and remains one of the most attractive markets for ed-tech investors,’’ Wani said.

“While making an investment, VC firms and investors cannot overlook the gestation period, which creates pressure on their revenue trajectory,” Kumar said.

"Therefore, the scale at which new businesses are operating in India is allowing such players to get results much faster on their early-stage investment than from a matured portfolio,” he added.

upGrad has made as many as 13 early-stage acquisitions this year. Kumar said that the market for ed-tech was estimated to be around $88 billion and is projected to reach $320 billion by 2029.

The data attains significance as it comes at a time when demand for ed-tech services has slowed down with the re-opening of schools and colleges, thanks to the Covid-19 situation normalising in most parts of the country. Ed-tech giants like Unacademy and Byju’s have laid off hundreds of employees amid a slump in demand for their solutions.

Moreover, late-stage funding for Indian ed-tech companies (series B onwards) has remained flat at around $1.5 billion, forcing late-stage ed-tech firms to scramble for different revenue streams to match the revenue projections they made last year to justify high valuations.

“The reason late-stage investing has slowed down is because companies were previously valued at very high multiples. So they will either need to grow into those valuations (which will take time), or be comfortable with down rounds,” said Wani.

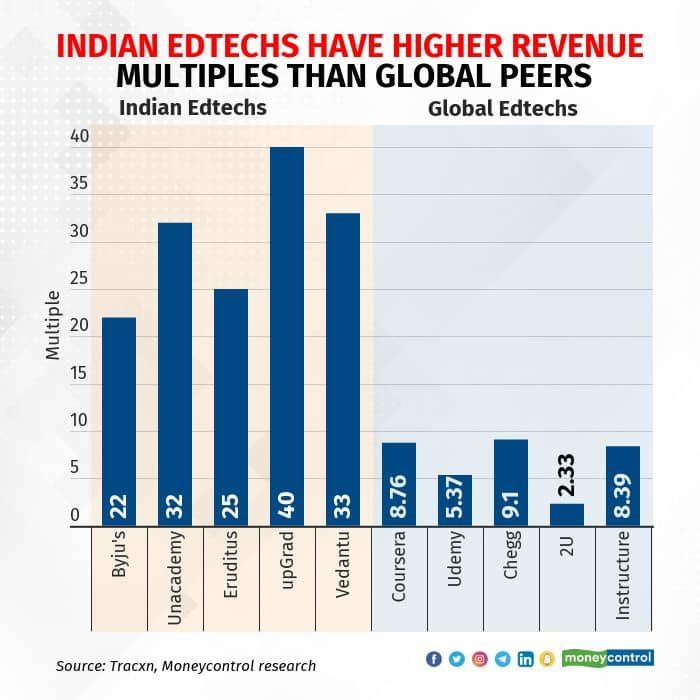

To be sure, India’s ed-tech companies, even early-stage firms, have higher revenue multiples than most global peers. For instance, ed-tech unicorns in India have revenue multiples between 22 and 40, while Chegg Inc. and 2U Inc., two of US’s largest ed-tech companies, have revenue multiples of around 9.1 and 2.33, respectively. Coursera has a revenue multiple of around 8.76.

“India’s ed-tech companies are unique in the sense that they have a much bigger serviceable market than large global companies like Udemy, Coursera, etc.,” said an investor requesting anonymity.

“Thus, a high revenue multiple is easier to sell for an Indian ed-tech company as the market is much bigger and you can project a stronger revenue. Companies like Byju’s, that have global operations, can project even stronger revenues. But what is important is actually clocking the projected revenue. If they manage to do that, they can further unlock value and raise perhaps at higher valuations,” the investor added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.