Online-education provider Byju’s is seeking to restructure its $1.2 billion loan as it struggles with steep losses and cost reduction targets, according to people familiar with the information.

India's most valuable startup, valued at $22 billion, has appointed an adviser to discuss tweaks in covenants of the term loan B with creditors, the people said, asking not to be named as the information is not public. Discussions on more lenient terms, including lower coupon and more time to repay, are continuing and no final decision has been reached, one of the people said, without providing further details.

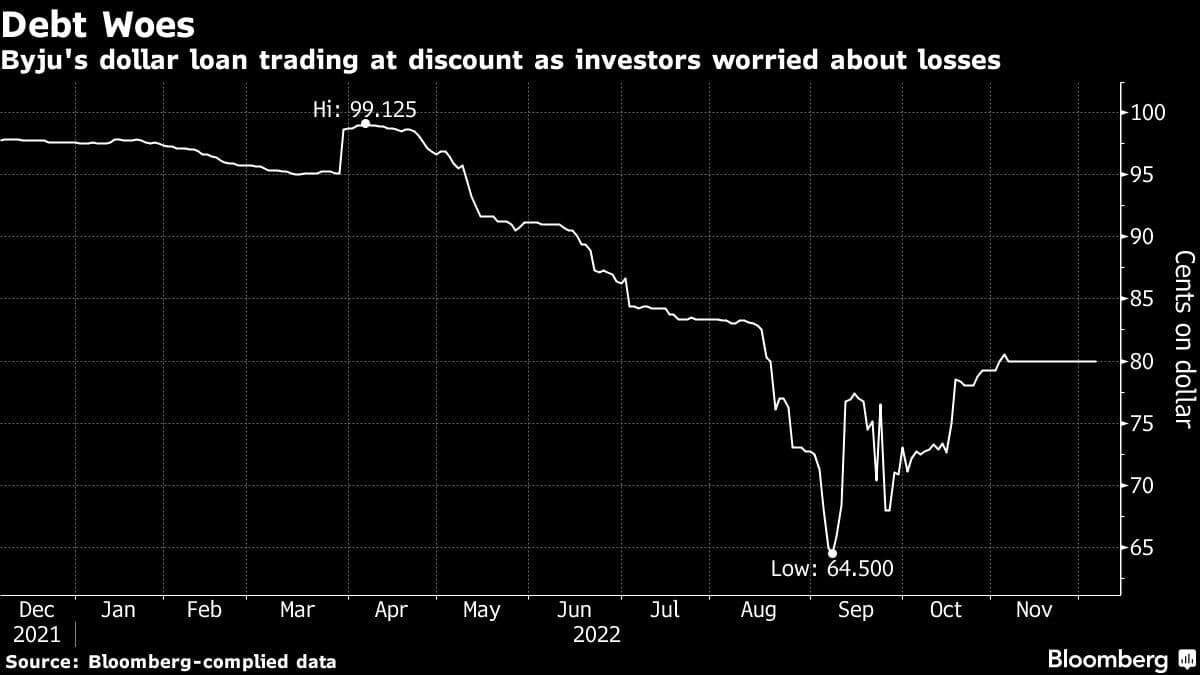

Byju’s is among the crop of startups that thrived on India’s growing mobile connections and overseas investments until its blistering growth trajectory was cut short by excessive cash burn. Creditors are getting concerned about the company’s ability to repay and many have sold down the loans, they said.

The three-month Libor has surged more than 21 times this year, making the loan costlier for the Bengaluru-headquartered firm. The margin on the loan was raised by an additional 50 basis points this year after its parent company, Think & Learn Pvt., failed to get rated, the people said.

The loan, priced at 550 points over Libor in November last year, is one of the largest unrated term loan B offerings ever from a new-age economy company worldwide and received strong demand from investors including sovereign wealth funds, Madhur Agarwal, managing director at JPMorgan Chase & Co., one of the deal’s bookrunners, said then.

The loan is trading at 80 cents on the dollar on Wednesday after touching a record low of 64.5 cents in September, according to data compiled by Bloomberg.

A representative for Byju’s declined to comment on whether it’s in talks with lenders over the loan terms.

The closely-held startup with 150 million users has been battling multiple headwinds, including a truncated fund raising, regulatory pressure and a much-delayed filing of audited financial statements that disclosed a 13-fold jump in losses for the year ended March 2021 — the latest period for which its financial accounts are available.

In October, Byju’s said it would shed 2,500 workers — about 5 percent of its total workforce — and lower its marketing and sales costs, as it races to become profitable by March. The company, founded by Byju Raveendran, is also in talks with advisers for a $1 billion initial public offering of its tutoring business Aakash Educational Services, to bolster its balance sheet, Bloomberg News reported last month citing people familiar with the process.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.