Technology startups and information technology and IT enabled service companies have sought sops in the upcoming Union Budget to incentivise employment and funding in India’s services sector, one of the world’s largest.

The demands range from making the deferment of time of tax payment on Employee Stock Option Plans available to employees of more startups to a fixed time limit for concluding advance price agreements for IT companies.

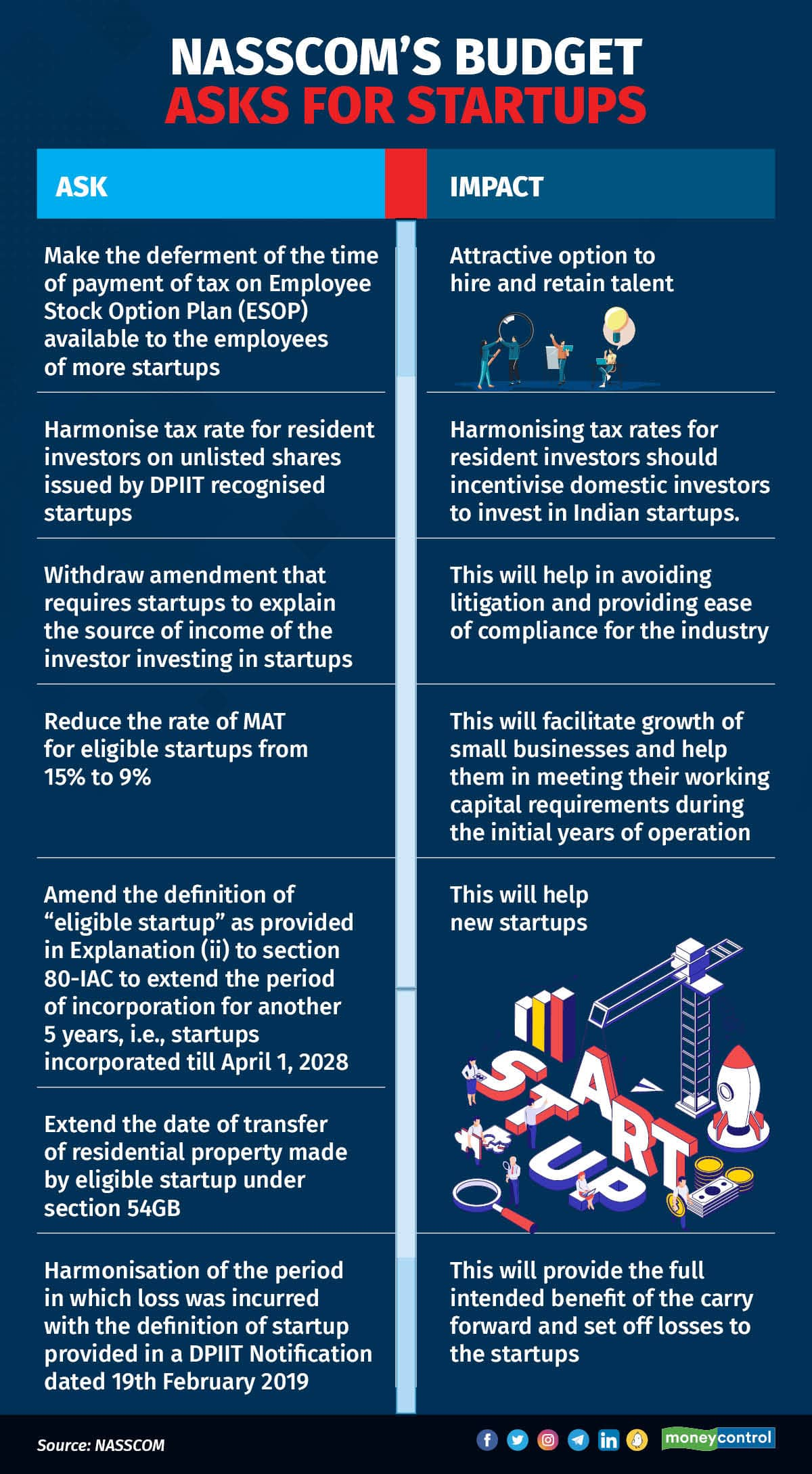

Startups want the deferment of time of payment of tax on stock options to be made available to employees of more startups. Earlier this month, the National Association of Software and Service Companies also suggested that the deferment facility should be extended to employees of startups registered with the Department for Promotion of Industry and Internal Trade. The facility is available only to startups holding an Inter-Ministerial Board Certificate. If accepted, this will open an option for startups to hire and retain talent.

Startups and Nasscom also want minimum alternative tax (MAT) for eligible startups to be reduced to 9 percent from 15 percent. Currently, MAT provisions have no threshold and all companies, notwithstanding their size, are subject to the provisions of the tax. Startups are also liable to pay MAT even if they claim exemption under section 80IAC of IT Act.

If MAT is reduced, it will help smaller businesses in meeting their daily working capital requirements, especially during the initial days.

Startups want to be able to carry forward and set off losses for 10 years from seven years currently. This would be in accordance with the change brought about in 2019, allowing a company to be considered a startup for 10 years after incorporation.

Nasscom said in a report that this extension will provide the full intended benefit of carrying forward and setting off losses for startups.

Venture capital firms are seeking equalisation of long-term capital gains tax for unlisted shares and public stock investments, a long-standing demand. If the tax is harmonised, it would incentivise local VC firms to invest in companies and widen the pool of capital for startups.

Specific demandsWithin startups, edtech companies have demanded a lower tax slab on educational products and services of 5-12 percent. Founders of edtech firms said the high tax slab acts as a barrier to democratising education. At present, educational services and products are in the 18 percent GST slab.

The crypto sector expects a more friendly tax regime and parity with other assets and regulations. Trading volumes on domestic crypto exchanges plummeted about 90 percent as cryptocurrency prices fell and a new taxation policy was introduced for virtual digital assets in the FY23 budget.

The government had said then that gains from crypto assets would be taxed at 30 percent, irrespective of the individual's income tax slab rate.

The agritech sector, considered a sunrise sector, wants tax sops for capital expenditure and warehousing to be excluded from GST. It hopes agri-NBFCs will get tax benefits as it will help the sector flourish and aid the government in achieving its goal of doubling farmer incomes.

Space tech startups want a larger allocation in the budget for the Indian National Space Promotion and Authorisation Centre, the government's one-stop body for dealings with private space companies. The centre was allocated Rs 33 crore last year and the sector wants up to Rs 100 crore this year.

What the IT/ITeS sector wantsIT/ITeS companies have three key recommendations that they say will aid the sector in ease of doing business. They pertain to the per diem allowance threshold, safe harbour rules, and advance pricing agreements.

Nasscom recommended that a monetary threshold should be given for per diem allowance to reduce the compliance burden. Per diem allowance is not taxable if spent in its entirety by the employee but is taxable if there is an unspent amount. The industry body has asked that supporting documentation be required only above the recommended monetary threshold.

Nasscom said safe harbour margins for companies have been notified only for those whose turnover is up to Rs 200 crore. This can be accessed only by a few companies, it said, recommending the threshold be increased to Rs 1,000 crore. Safe harbour rules are used as a dispute resolution mechanism for transfer pricing issues when there is a transfer of services between an entity and its offshore entities.

On advance pricing agreements, which are used to resolve transfer pricing issues before a transaction, it suggested that a fixed time limit be prescribed for concluding APAs as it takes at least four years.

Delays in concluding APAs create uncertainty for taxpayers and impact the ease of doing business.

It also asked the government to consider a fast-track mechanism for APA applications that would cover international transactions such as loans, corporate guarantees, and intra-group service charges for IT/ITeS companies with a cost-plus remuneration mechanism, as these transactions usually have almost standardised APA resolutions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.