The National Association of Software and Service Companies (NASSCOM) has sought various tax sops in the upcoming Union Budget 2023 to further incentivise employment and funding to the world’s third-largest startup ecosystem.

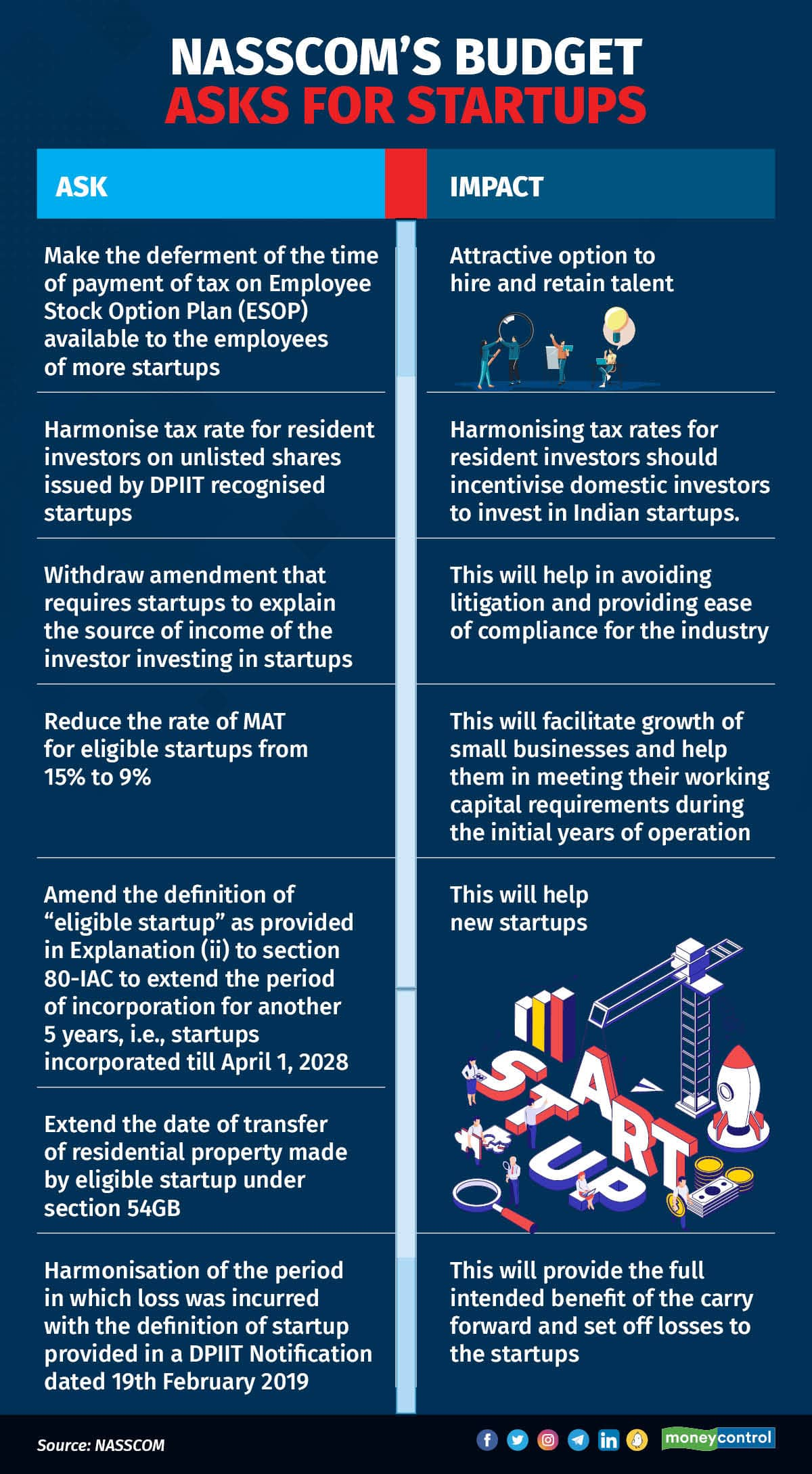

These proposals range from making the deferment of the time of payment of tax on Employee Stock Option Plans (ESOP) available to employees of more startups to a reduction in the Minimum Alternate Tax (MAT) for eligible startups.

The industry body has recommended the government make the facility of deferment of ESOP tax even to startups that do not hold an Inter-Ministerial Board Certificate (IMB certificate), subject to ‘appropriate conditions,’ but should not require each startup to seek permission for it.

NASSCOM suggested that the deferment facility should be made available to employees of DPIIT (Department for Promotion of Industry and Internal Trade)-registered startups. It also suggested that eligible ESOPs should be offered only to Indian resident taxpayers and the terms of the ESOPs should be the same for all employees to whom they are offered. NASSCOM also recommended that the government have a process designed for fast-tracking of the IMB certification.

In 2020, the government enabled deferment of the time for payment of tax on ESOPs for DPIIT-recognised startups that hold an IMB certificate. The move was aimed at addressing the onerous situation where employees of a startup became liable to pay a potentially huge tax on shares received under an ESOP, without realising any profit, NASSCOM said.

The deferment also aimed to address the issue of the startup having to deduct TDS (tax deducted at source), which usually amounted to much more than the cash salary of the employee, the industry body said. According to NASSCOM, there are currently 645 IMB-certified startups in the country, less than 0.8 percent of the over 82,000 DPIIT-recognised startups.

“ESOP is an excellent tool to attract talented and experienced candidates. Making the facility of deferring the point of taxation on sale of ESOP to a wider pool of startups shall make ESOPs an attractive option to hire and retain talent. This shall provide a boost to the startup eco-system in India,” NASSCOM said in a note, a copy of which was viewed by Moneycontrol.

NASSCOM also recommended that the government withdraw the amendment introduced in the Finance Act of 2022 that requires startups to explain the source of income of an investor, saying that it disincentivises friends/family to lend money to startups. This will help in avoiding litigation and providing ease of compliance for the industry, NASSCOM said.

Section 68 of the Income Tax Act provides that the nature and source of any sum, whether in the form of a loan or borrowing, or any other liability credited in the books of a taxpayer, shall be treated as explained only if the source of funds is also explained in the hands of the creditor or entry provider. NASSCOM said pre-seed-stage startups generally borrow funds in the form of loans from family or friends of the founders, having to disclose the source of income of the creditor disincentivises such investors.

“It is important to note that under the current provisions, revenue authorities have sufficient powers to call for information or make enquiry from any person under section 131 and 133 of the IT Act,” NASSCOM said.

“Further, there have been various judicial precedents which have provided that the revenue authorities cannot question the source of source. Therefore, shifting the onus on the taxpayer to prove source of source is not a welcome step for the industry, especially the startup community,” it added.

Minimum alternate taxThe industry body also sought reduction in the Minimum Alternate Tax for eligible startups to 9 percent from 15 percent. Currently, MAT provisions have no threshold and all companies, notwithstanding their size, are subject to the provisions of the tax. Therefore, startups are also liable to pay MAT, even if they claim exemption under section 80IAC of IT Act.

“This provision defeats the very purpose of providing tax incentives for startups under section 80IAC. In order to provide a boost to the startup ecosystem, the government should reduce the rate of MAT for eligible startups from 18 percent to 9 percent,” NASSCOM said.

“This will facilitate growth of small businesses and help them in meeting their working capital requirements during the initial years of operation,” the industry body added.

NASSCOM also suggested that the government amend the definition of “eligible startup” as provided in Explanation (ii) to section 80-IAC to extend the period of incorporation for another five years to cover startups incorporated till April 1, 2028. Explanation (ii) to section 80-IAC provides the definition of “eligible startups” for the purposes of granting tax benefits. As per the definition, eligible startups refers to a company or limited liability partnership incorporated before April 1, 2023. Accordingly, startups incorporated after April 1, 2023 will not be eligible for tax benefits under the IT Act.

Transfer of residential propertyThe industry body also recommended extending the date of transfer of residential property made by eligible startups under section 54GB, which provides for exemption from capital gain on the transfer of residential property to eligible startups and which is not applicable if the transfer of residential property is done on or after March 31, 2022.

“In order to align the benefit under section 54GB with the existing definition of eligible startup provided under section 80-IAC, we request the government to review the date of transfer of residential property made by eligible startup under section 54GB of IT Act,” NASSCOM said.

NASSCOM also recommended an amendment to allow an eligible startup to carry forward and set off losses if such losses have been incurred during the 10-year period beginning from the year in which the startup is incorporated. Current provisions allow an eligible startup to carry forward and set off losses if such loss has been incurred for seven years beginning from the year in which the startup was incorporated.

“This will provide the full intended benefit of the carry forward and set off losses to the startups,” it added.

Besides, NASSCOM also recommended equalisation of long-term capital gains (LTCG) tax for unlisted shares and public stock investments in the upcoming Budget, a long-standing demand for private equity and venture capital firms.

“The current tax provisions do not provide a level playing field to domestic investors vis-à-vis foreign investors. Harmonising tax rates for resident investors should incentivise domestic investors to invest in Indian startups,” NASSCOM said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.