Ruchi Agrawal

Moneycontrol Research

Highlights:

- Hotel chain with a presence in low competition regions

- Strong margins and expansion

- Operational issues now fading away and key property back in operation

- Strong balance sheet leaves scope for expansion- Investments and strategic partnership might trigger a stock uptick

Sinclairs Hotels (SLH) is a growing hotel chain with stable performance and a strong balance sheet. The company operates luxury properties and enjoys a leadership position in areas of operations. SLH has generated decent returns over the years and maintained strong margins with consistent expansion which make the stock an attractive pick.

About the company

Sinclairs is a luxury hotel chain with seven properties in Port Blair, Darjeeling, Burdwan, Dooars, Siliguri, Ooty and Kalimpong with a total room capacity of 362 rooms. The company is planning an additional 114 room property in Kolkata which is slated to come in operations soon. The hotel chain is promoted by the Suchanti family (Pressman Advertising), with around 56.96 percent promoter holding.

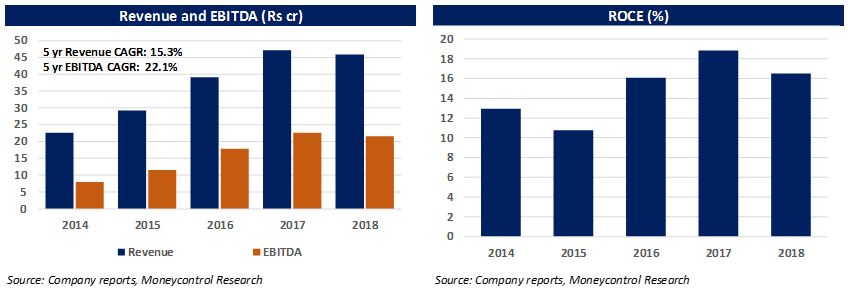

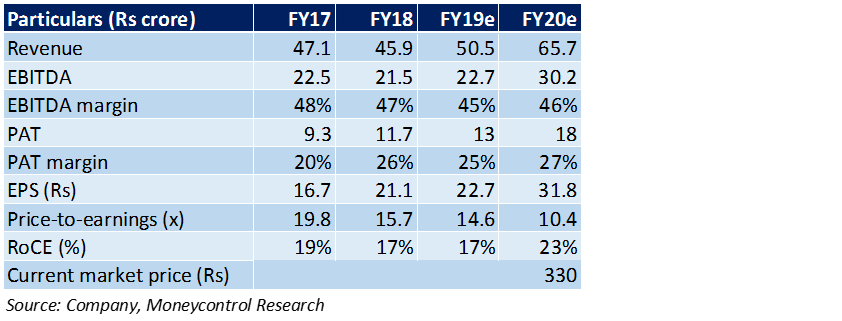

Financial performance

Barring the latest few quarters, the company has posted a strong financial performance with stable revenue and profit growth. The recent performance has majorly been impacted due to political unrest in key areas of operation and renovation of the major property in Port Blair. With unrest now over and the property back in operations, we believe the company is positioned for improvement and growth in the future.

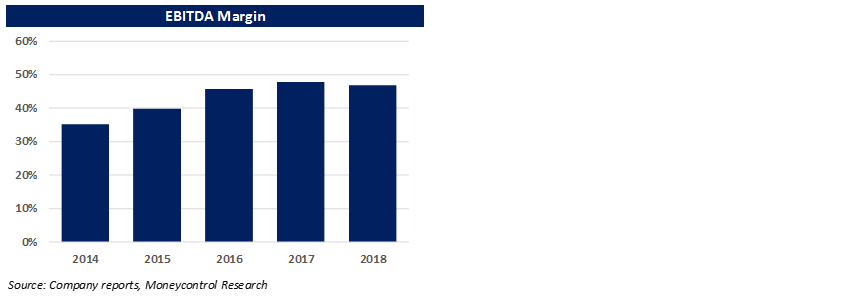

Strong margins

The company has posted strong margin profile in the last few years, higher than peers. While it indicates a strong profit generation on the sales, it also shows the strength of the brand which enables the company to command higher rates.

Uncaptured locations – the company has properties in locations which are attractive tourist spots but lack the presence of major hotel chains. This gives the company an edge and pricing power in the regions.

Strong balance sheet – With almost no debt, the balance sheet of the company remains strong. Most expansions have been funded through internal cash generation. This leaves scope for expansion both organic and inorganic.

Favourable sector dynamics – with a favourable demand-supply situation, the company is a part of the upcycle in the hospitality industry and we believe with its premium properties it is positioned to benefit from the demand growth.

Strategic investment - SLH is currently in discussions for investments, strategic partnerships and joint ventures. Any investment by a major hotel chain might bring in significant upside to the stock. The implementation of the Kolkata hotel project is based on this and commencement of operations at the property would bring in added revenues and brand visibility for the company.

Key risks

Regional sensitivity – some areas of operation are sensitive. While on the one hand, the location of properties is an asset, on the other it exposes it to various political and economic risks. The performance was impacted due to political unrest in the first half of the year. While it is over, similar risks might arise in the future.

The threat of competition – while the company currently enjoys a leadership position in most areas, the growth of large hotel chains in the areas in the future might pose competitive challenges.

Our take and valuations

We remain optimistic about the long-term prospects of Sinclairs given the past performance and fading away of the recent turmoil. We see the business as a strong and growing one, with healthy margins and generating a decent return on capital. With sector dynamics turning favourable we believe the company is well positioned to benefit from the upcycle.

Due to the political turmoil in key regions and stunted quarterly performance, the stock has corrected 42 percent from its 52 weeks high and is now trading at a 14.6x 2019e earnings. We find current valuation at a discount to peers and recommend to accumulate the stock with a long-term perspective.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!