A suggestion from Chief Economic Advisor Anantha Nageswaran’s Economic Survey 2023-24 pitching for more foreign direct investment (FDI) from China has sparked a debate, even as the Indian government has taken some steps on this front.

According to a senior government official, Indian authorities have initiated talks on easing restrictions on a case-to-case basis on FDI from China, which is currently subject to increased scrutiny – a step taken by New Delhi after the 2020 border clashes between the two nations.

“Discussions have started at the level of bureaucrats to identify sectors where more FDI from China could help boost India’s exports. But they are at a preliminary stage,” this official said.

Though the talks at the government level are nascent, the Economic Survey makes a clear case to increase investments from Beijing to improve India’s linkages to global supply chains.

The survey points out India’s ballooning trade gap with China and prescribes a shift to capital from the neighbouring nation to lower this import dependency.

India’s trade gap with China widened to $85 billion in the previous fiscal from $83.2 billion in 2022-23.

However, experts warn that replacing imports from China with capital, albeit partially, may not be a simple task.

According to Ajay Srivastava, Founder, Global Trade Research Initiative (GTRI), plans to bolster the country’s manufacturing sector and boost exports to the US and Europe by promoting FDI from China is not in the interest of India in the long term.

“China is already the largest import supplier for India in each of the eight industrial product categories. Allowing Chinese firms to ‘Make in India’ risks overwhelming domestic industries, potentially leading to the closure of many Indian businesses. This could transform India from a manufacturing hub into merely a trading nation, dependent on Chinese firms for critical supplies and economic growth,” Srivastava said.

Nageswaran in his survey cites the experience of East Asian economies while prescribing for more FDI from China. This could boost Indian exports to the US, he added.

“Choosing FDI as a strategy to benefit from the China plus one approach appears more advantageous than relying on trade. This is because China is India's top import partner, and the trade deficit with China has been growing,” Nageswaran said.

Srivastava, however, said the idea that Chinese companies could invest in India and then help boost the country’s exports to Western markets might be beneficial only in the short term since it risks undermining New Delhi’s long-term economic security and strategic autonomy.

“Dependence on Chinese firms for key manufacturing capabilities could expose India to supply chain vulnerabilities and geopolitical risks,” the GTRI founder said.

The timing of the conversation around more investments from China is significant given that there are two developments that could be behind this suggestion – India’s falling FDI and rising imports.

The FDI factor

The latest data from the Department for Promotion of Industry and Internal Trade (DPIIT) revealed that India’s net FDI inflows contracted 3.5 percent year-on-year in FY24 to $44.42 billion, the lowest in five years.

The last time India’s net FDI inflows came in lower than the previous fiscal was in FY19 at $44.37 billion.

At a time when the country has opened up most sectors under the FDI route, Indian authorities are clearly looking to boost inflows through innovative means.

The Budget for 2024-25 unveiled on July 23 revealed India’s strategy to focus on boosting overseas investments as it laid out plans to simplify norms around FDI and reduced the corporate tax on foreign companies to 35 percent from 40 percent.

This comes at a time when the government is targeting FDI inflows of close to $100 billion over the next five years and aiming to further liberalise the policy pertaining to this route.

Deficit dilemma

India’s deficit with China has only been widening as cited above.

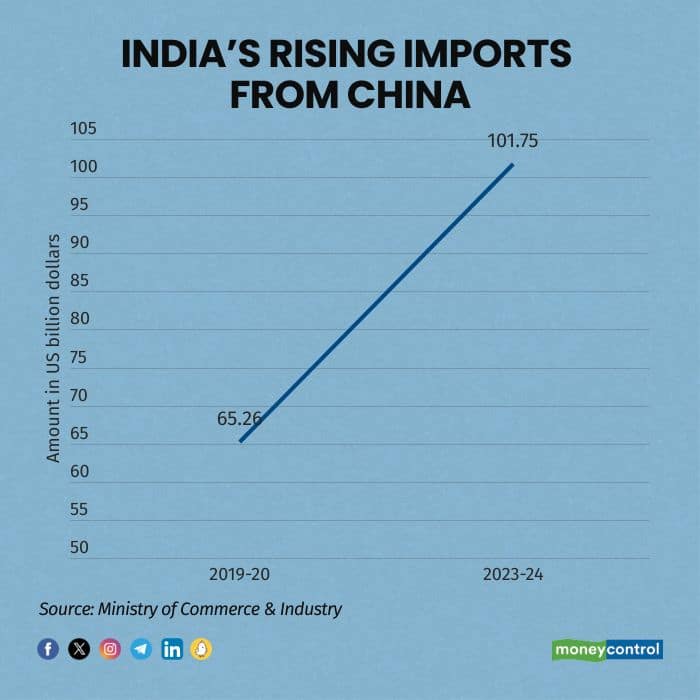

India's exports to China in 2023-24 came in at $16.65 billion, while imports were at a whopping $101.75 billion.

Even as India’s total imports dropped 5.7 percent on-year in 2023-24, imports from Beijing rose during the same period by 3.3 percent.

The growth in India’s imports from China in the previous fiscal has been stupendous if one looks back as recently as 2019-20 when imports stood at $65.26 billion – accounting for a spike of nearly 56 percent.

This data point is concerning at a time when India is making efforts to move away from import dependency, especially on cheaper goods from China, in a bid to increase the competitiveness of domestic manufacturing.

Beyond FDI

Signals of India’s economic shift with regard to China are evident beyond the recent FDI suggestion.

In fact, India is said to have plans to offer short-term visas to Chinese technicians to help with the implementation of projects related to the flagship production-linked incentive (PLI) scheme. This is after New Delhi delayed clearances for entry of vendors from Beijing.

The move to expedite the process of issuing visas of not more than six months to facilitate entry of Chinese vendors was necessary to help Indian workers navigate machinery sourced from Beijing.

A second government official said the policy is to do what is beneficial for India. And, China could play a role in bolstering flagship schemes such as the PLI as well as the country’s overall export competitiveness if India opens the right doors to its East Asian neighbour.

Policy pivot?

From FDI to visas, the recent commentaries and suggestions from the Indian government seemingly point to a pivot on its China policy.

Indian authorities have been deploying more checks and balances when it comes to Beijing especially since relations between the two nations took a turn for the worse with the border standoff in the Galwan valley in 2020.

Since then, New Delhi has been very cautious about allowing Chinese investments or professionals into the country even as imports from Beijing have seen a steady rise.

In fact, in order to curb opportunistic takeovers or acquisitions of Indian companies, the Centre amended the FDI policy, specifically Press Note 3, April 2020. Under this new rule, an entity of a country sharing land border with India or where the beneficial owner of an investment in India is situated in or is a citizen of any such country, can invest only under the government route.

These amended rules under Press Note 3 that came into force on April 22, 2020, increased scrutiny over FDI, especially from China.

And then in 2020 itself, there was a ban on TikTok and dozens of Chinese-made apps citing a risk to India’s national security.

The talks of promoting Chinese FDI also signal a shift in India’s approach towards China plus one policy that looks to move supply chains away from Beijing.

GTRI’s Srivastava pointed out that India’s participation in the Indo-Pacific Economic Framework (IPEF) and the Supply Chain Resilience Initiative (SCRI) with the US and other partners explicitly aims to reduce dependency on Chinese supply chains.

“Encouraging Chinese FDI contradicts these strategic efforts to diversify and strengthen supply chains independent of China. India’s involvement in these initiatives reflects a broader geopolitical and economic strategy that prioritises resilience and reduced reliance on China, which should not be compromised for short-term investment gains,” he added.

The Economic Survey, however, seems to be suggesting a reversal in this very approach.

As the US and Europe are shifting their immediate sourcing away from China, it is more effective to have Chinese companies invest in India and then export the products to these markets rather than importing from China, adding minimal value, and then re-exporting them, the survey added.

India’s changing dynamics on China aside, the key question still is, could India reduce imports from Beijing by relying more on FDI from the same nation?

Rathin Roy, a former member of the Economic Advisory Council to the Prime Minister, thinks not. He pointed out that imports from China are preferred since their goods are cheaper and unless India comes up with a nearly impossible policy of pushing for Chinese FDI while putting price restrictions or discriminatory non-tariff barriers on imports from Beijing, this could be a misplaced conversation.

Roy said, “I don’t think we can fight an economic war with China not when it is our largest import partner. So, the idea to get more FDI from China is fine as long as we are not under the impression that if you get more FDI from China you can afford to reduce imports from them.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.