State Bank of India (SBI) reported higher-than-expected loss of Rs 4,876 crore in the first quarter of FY19 on spurt in mark-to-market (MTM) losses on its investment book. The bank didn’t avail of Reserve Bank of India’s (RBI’s) dispensation with regard to spreading of MTM loss over four quarters and instead took the full hit in Q1. The bank increased loan loss provisions. Consequently, the provision cover improved to a healthy level of 69 percent. So, while the profit and loss statement bled, the balance sheet strengthened.

On asset quality front, lower slippages to non-performing assets during the quarter was comforting. The bank is grappling with asset quality issues arising out of its corporate exposure since the past many quarters. While some asset quality pain might persist for a couple of quarters, the end seems certainly near.

SBI stands out because of its sheer size and relatively better operating performance among public sector banks, which are fast losing their relevance in the financial system. We expect a faster recovery for SBI in contrast to many small-sized public lenders. While FY19 may remain a year of consolidation due to higher credit costs, we expect the reported numbers to improve significantly from FY20. With the stock trading at 1.1 times FY20e (estimated) adjusted core book value, the current valuations seem to be pricing in the concerns. Investors should use the consolidation as an opportunity to invest for the long-term in the stock.

Quarter at a glanceNet interest income (the difference between interest income and expense) spiked 24 percent YoY despite a muted growth of 5.5 percent in advances book. This was mainly on the back of an uptick in net interest margin (NIM) to 2.95 percent and significant write-back of interest income as a large account was upgraded from non-performing to standard category.

The subdued growth in core fee income at 2 percent YoY and lower trading income undermined non-interest income that dropped by 17 percent YoY.

Operating expenses increased by 20 percent YoY, pushing the cost-to-income ratio to 58 percent as compared to 54 percent in the previous year. This was mainly driven by higher staff cost as the bank provided for a wage hike and the related rise in pension and gratuity expenses. Growth in the number of employees will be restrained in the near future as new recruitments are expected to be lesser than retiring employees. However, employee costs might still be high as the bank partly provided for revised gratuity ceiling in the quarter gone by. The balance would be provided in the next two quarters.

Pre-provision operating profit (PPoP) was almost flat YoY. Although the incremental slippages were much lesser compared to the last few quarters, the bank increased loan loss provisions by 8 percent YoY. This improved the provision cover to 69 percent, significantly better than 61 percent in the previous year. This along with the spike in investment depreciation on the back of hardening bond yields resulted in the widening of loss in Q1FY19.

Capital adequacy of the bank remained comfortably above the regulatory requirement at 12.3 percent. Despite negative internal accruals, the bank’s Tier I ratio improved sequentially to 10.36 percent due to sequential de-growth in the loan book.

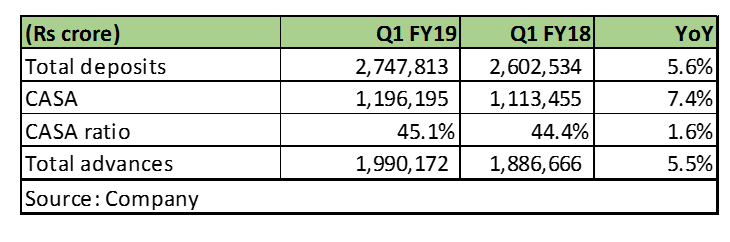

Soft growth in loan book despite the healthy growth of retail assetsThe performance on the liability front continued to be impressive. Deposits increased to Rs 2,747,831 crore, a growth of 5.5 percent YoY, in line with advances growth. However, growth in current account-savings account (CASA) was ahead of growth in term deposits, thereby improving the CASA ratio to 45.07 percent as at end June 2018. The same was reflected in the lower cost of funds for the quarter.

Advances growth was contained at 5.5 percent YoY as the domestic loan book growth at 7 percent YoY was partially negated by 4 percent de-growth in international loans. The proportion of overseas loans stood at 13.4 percent as of June-end 2018.

Cyclical weakness in the large corporate segment continued but retail assets like home, auto, and personal loans reported growth in mid to high teens, albeit on a lower base. Retail assets grew by 14 percent YoY while corporate loans growth was dragged at 5 percent YoY.

Asset quality: Respite due to lower slippagesFresh slippages reduced to Rs 9,985 crore in the quarter, which is almost 2 percent of the loan book. This along with higher recoveries and write-offs led to a 5 percent sequential decline in gross non-performing assets (GNPA).

Around 91 percent of corporate slippages was from the watch-list which is comforting.

In addition to GNPAs, the bank’s stressed asset loan pool, popularly known as watch-list, is key to its future asset quality. The watch-list encompasses all special mention accounts, with power sector loans constituting 41 percent of the list. The bank’s watch-list has declined to Rs 24,633 crore (1.2 percent of loans) as compared to Rs 28,989 crore (1.4 percent of loans) in Q4 FY18. While the watch-list puts upward pressure on GNPAs, the comforting factor is that the bulk of the bank’s power exposure is towards state-owned utilities and hence less likely to slip.

We are most enthused by SBI’s higher provision coverage ratio (PCR) of 69 percent. The bank’s total exposure to corporates undergoing resolution through National Companies Law Tribunal (NCLT) also reduced to Rs 63,038 crore from Rs 77,630 crore in Q4, due to the resolution of a couple of accounts in NCLT 1 list. PCR on the list 1 and 2 stood at 65 percent and 79 percent, respectively as at end June. While the resolution of NCLT accounts will lead to lower GNPAs and better margins, there could be possible write-back of provisions as bank’s PCR on these cases is healthy.

Also Read: SBI puts Jet Airways under watch, classifies airline as potential stress loan

Best positioned to play the asset cycleLast quarter, management articulated its strategy which it endeavours to achieve by March 2020. It aims to deliver a consolidated return on asset (RoA) of 0.9-1 percent while improving GNPA to below 6 percent and maintaining provision cover above 60 percent by March 2020. With much lower slippages expected for FY19 and FY20 at 2 percent and less than 1.3 percent, respectively resulting in the normalisation of credit cost, the target looks achievable. Capital could be a constraint in delivering the target but a successful equity raising in the near to medium term will be an added trigger.

While reported earnings were weak, we are encouraged by the improving outlook. We expect asset quality pain to persist for a couple of more quarters and credit cost to trend downwards over the next two years. Earnings will gain traction as provisioning reduces and bank levers the capital for loan book growth.

With a potential improvement in return ratios, the current valuation of 1.1 times FY20e price-to-adjusted book value looks undemanding. Moreover, SBI could benefit from the ongoing resolutions of corporate cases through NCLT with a favourable resolution acting as a positive trigger for the stock.

The bank is also looking at divesting its stake in some of the profitable subsidiaries (general insurance in near term) which will also add to its capital position buffer. Given the comfortable capital adequacy and dominant market position, the bank is best positioned among state-run banks. Investors looking to play the asset recovery and resolution cycle should buy into the stock as a long-term bet.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.