Should you be investing in property in Jammu and Kashmir or for that matter Ladakh, now that the state of (J&K) has ceased to exist and converted into two Union Territories (UTs)?

With Parliament abrogating the state's special status provided under Article 370, the UTs of Jammu and Kashmir, and Ladakh will now be headed by Lieutenant Governors GC Murmu and RK Mathur, respectively.

Experts say that while it may in the long term surely open up potential opportunities for the development-led economic growth in the union territories of J&K and Ladakh, expecting a surge in investments or a windfall in residential, commercial and retail segments, is expecting too much.

Investors, even locals would be cautious before investing money in these markets. Having said that, once the dust settles, the impact would first be felt on the hospitality and tourism segments followed by retail and entertainment, not to mention healthcare and education, they say.

Home Minister Amit Shah on August 5 had proposed the scrapping of Article 370, that accords special status to Jammu and Kashmir. The Centre had informed Parliament that the state of Jammu and Kashmir (J&K) would be bifurcated into two Union Territories (UTs) - Jammu and Kashmir would become a Union Territory (UT) with a legislature while Ladakh will be a different UT without a legislature.

Article 35A states that only permanent residents can acquire land in the state has also been revoked.

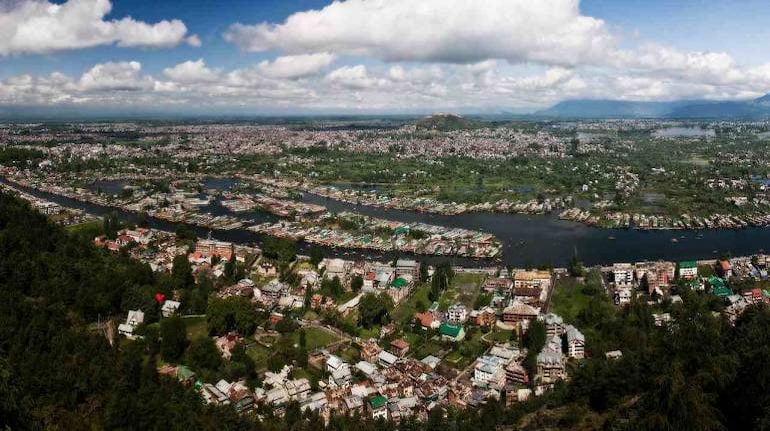

The government's recent decision to revoke Article 370 and Article 35(A) is expected to have a positive impact on Jammu & Kashmir’s overall real estate market. Property prices in Srinagar, for instance, still hover between Rs 2,200 to 4,000 per sq ft – significantly low for tier 2 and 3 cities in the country.

While locals will finally see an increase in the value of their properties, the other exciting prospect is the opening up of opportunities for Indians from outside J&K to finally invest in immovable property, said Anuj Puri, Chairman - ANAROCK Property Consultants.

That said, it is still too early to gauge the real impact of this move on Kashmir's real estate market. As of now, it is still a highly sensitive region and security concerns may keep property buyers at bay, he said.

Meanwhile, Ladakh - a major tourist hotspot which attracts scores of tourists all year round – will very likely see an uptick in hospitality sector activity over the coming months, he said.

Niranjan Hiranandani, senior vice president, Assocham and National President- NAREDCO, is of the opinion that there are a host of potential opportunities for the development-led economic growth in the union territories of J&K and Ladakh. This incredible move will translate into revocation of the ban on real estate development by the people outside the state. This will provide an impetus to the growing economic growth of the largest democracy and fetch better employment opportunities contributing to the nation’s projected GDP growth.”

Article 35A gives the J&K government the right to decide who qualifies as a ‘permanent resident’. The permanent resident is subject to some special rights. Only permanent residents can acquire land, settle, and get government jobs, scholarships in the state.

The state's Constitution, at the time of its adoption in 1956, defined a permanent resident as someone who was a state subject on May 14, 1954, or who has been a resident for 10 years and has lawfully acquired immovable property. The article is also known as the Permanent Residents Law also deprives the state's female residents of property rights if/when they marry an 'outsider'. The provision also extends to children born of any such women.

All this would have to go with the scrapping of Article 370 and Article 35 A and technically even non-residents may be allowed to invest in immovable property within the union territories.

While this may certainly allow outsiders to invest in property in the two union territories, it would certainly not lead to a rush to buy residential, especially second homes and commercial properties. It may certainly be a positive for the hospitality and the tourism sectors. Overall the impact would not be immediate, says a real estate expert who did not wish to be quoted.

The model that is likely to be followed is similar to that of Puducherry. Similar rules would apply to these newly created union territories once these changes are ratified, says another real estate expert who did not wish to be quoted.

Buying property in states such as Himachal Pradesh, Uttarakhand and even North East also comes with restrictions.

"Having said that, investors would be extremely cautious before investing in these border areas. All said and done these are problematic geographies. Even with the scrapping of Article 370, the region would continue to remain politically rife for some time. Unless and until the socio-political situation stabilizes, investors would not jump at the opportunity. But gradually one may see investments coming into organized infrastructure development such as hospitals, schools, colleges, hospitals, hospitality, tourism sectors and eventually retail and entertainment. Food processing industries could also receive a boost, there could be some opportunities in the anvil for e-commerce players but for all that purchasing power has to improve, all these have to be integrated," the expert said.

Anckur Srivasttava of GenReal Advisers said that down the line, there could be investments focused on improving the tourism and hospitality segments, there could be a focus on entertainment and retail, something that the youth of these areas require.

As for residential and commercial markets, these areas never ever had a mature real estate market – the market was always constrained, there were artificial barriers to buying and selling a property. All this may take a while to change, he added.

According to news reports, the central government is also set to notify implementation of the Real Estate (Regulation and Development) Act in the newly constituted Union territories of Jammu & Kashmir and Ladakh.

Since Jammu & Kashmir will now, for all practical and legal purposes, be viewed like any other state/UT in India, all rules and regulations of the Central government will apply there as well. As for RERA regulations, the region will have to formulate its own policies, which may not be similar to other hill states that have their own respective laws.

RERA will make a difference here only when real estate activity picks up and people come forward to deal in property. Like in all other states, here too RERA must give an equal footing to both buyers and builders and prevent unregulated real estate activity, said Puri.

If rules are in place from the very beginning, there will be little scope for manipulations later on. Moreover, transparent transactions will help build confidence of investors and buyers, he added.

The Maharashtra government had announced earlier that it was planning to buy two land parcels, one each in Jammu and Kashmir and Ladakh, before October 31, the day central laws are scheduled to come into force in the state, for construction of resorts.

"Maharashtra government has earmarked an amount of Rs 2 crore for the purpose," Maharashtra Tourism Minister Jaykumar Rawal had told Moneycontrol.

Karnataka government too had proposed a luxury hotel in the Valley.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.