It's been over a year since the Tata group took control of Air India. The group has since announced the merger of AirAsia India with Air India Express (which is in progress), and also the merger of Vistara with Air India, which will lead to Singapore Airlines having a 25.1 percent stake in Air India. Even as the operational details were being worked out, the airline announced a mega order of 470 aircraft, in addition to inductions announced earlier. Air India has also bumped up capacity on metro routes.

This could put pressure on the unhindered run of IndiGo, an airline that was built meticulously and strengthened since the fall of Jet Airways. As Air India scales up, a combined Tata entity will be able to take on IndiGo in most routes, if not all. While IndiGo has resorted to adding capacity to dominate the market, most of these airports have limited slots and the same strategy may not work any more.

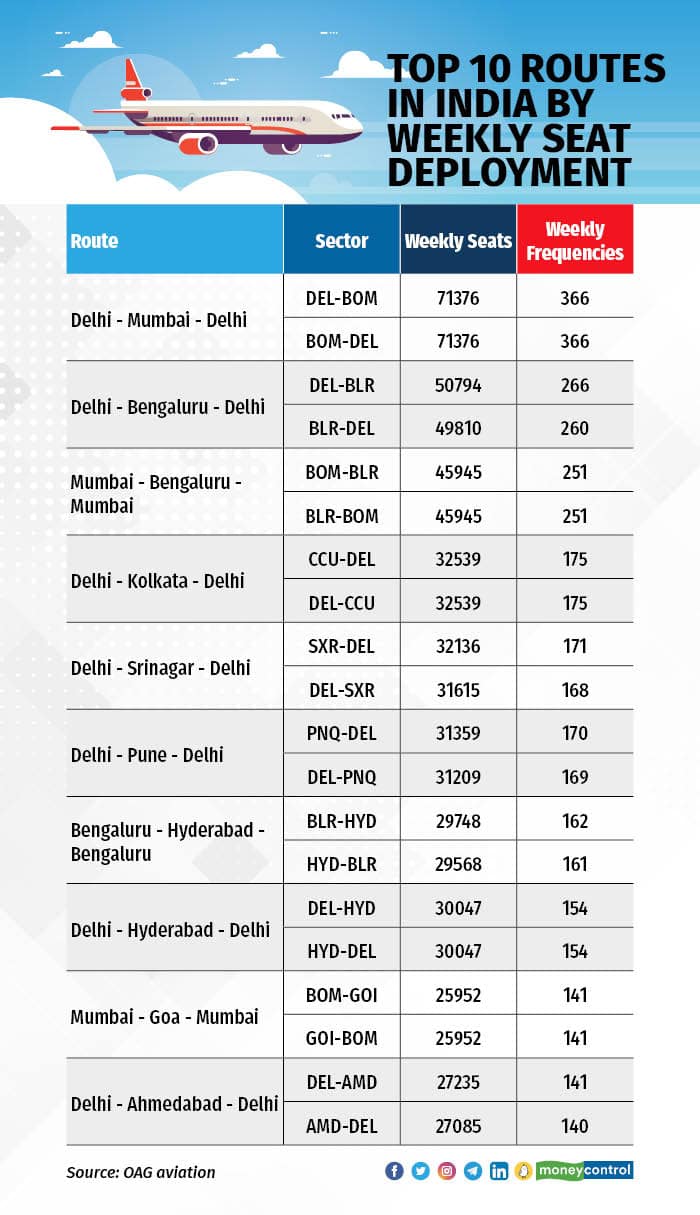

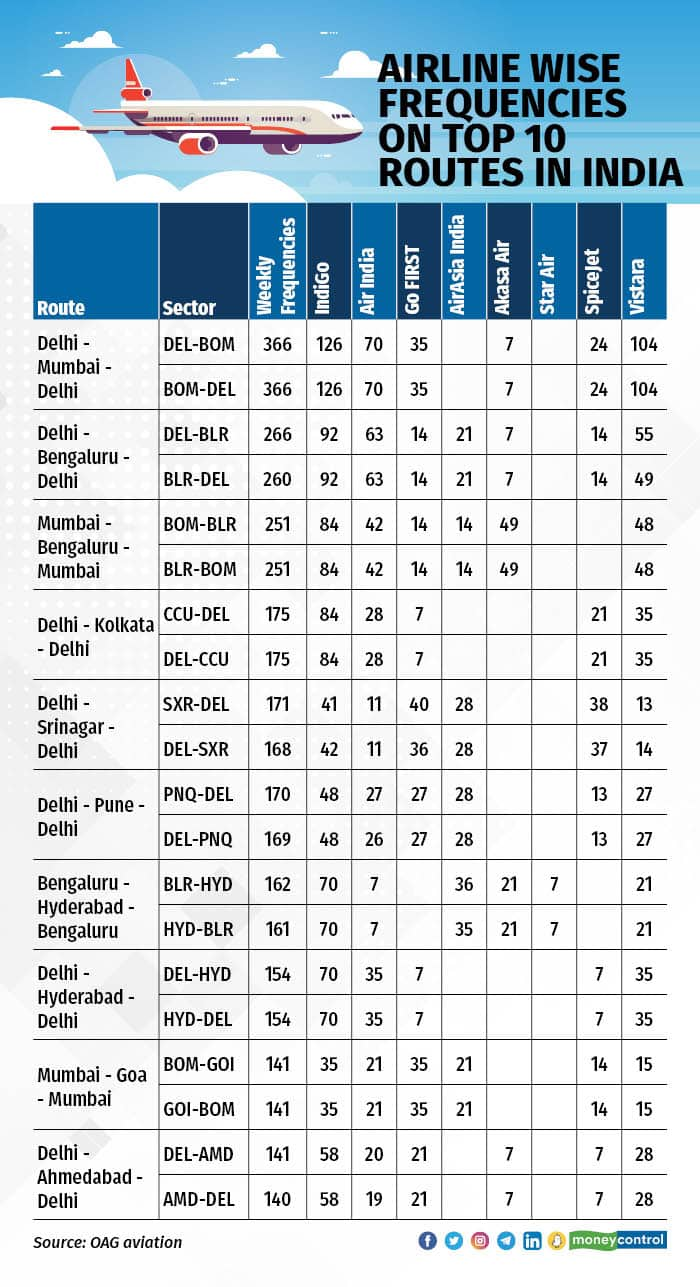

With 80 percent of the traffic coming from the top 20 airports of the country, it is worth looking at the top 10 routes and how they stand in terms of capacity, total seats, and which airlines dominate which of these routes. Data shared by OAG Aviation, an intelligence and analytics firm, exclusively for this article shows that individually, neither Air India nor Vistara matches the frequency of IndiGo on the top 10 routes in the country, but the picture changes when the frequencies of both the airlines are clubbed.

The sectors

The topmost sector in the country has always been Delhi-Mumbai / Mumbai-Delhi. In the coming week, there are 366 flights with 71,376 seats on offer each way. IndiGo has 126 of these flights, all of which are operated with the A321neo. This is followed by Vistara with 104 flights and Air India with 70 flights. With 174 weekly flights, Vistara and Air India have a significant lead over IndiGo, of about seven more flights per day on this route alone.

At 50,794 seats, the Delhi-Bengaluru sector comes in next, where again the combined power of the Tata group trumps IndiGo. Bengaluru-Delhi comes in at number three, where IndiGo has a weekly frequency of 84, whereas the Tata airlines have a collective frequency of 139. It is also the only metro route where Akasa Air has a sizable presence.

In the top three sectors IndiGo has about 35 percent of the flights, while Tata has 50 percent. In an environment where market share has often followed capacity and frequency share, IndiGo, which has over half the market, does not have even half the capacity on the top three routes / sectors.

Of the twenty sectors which comprise the top 10 routes, Delhi has the maximum (7), while Bengaluru and Mumbai have three sectors each, Hyderabad has two, and Kolkata, Srinagar, Pune, Goa, and Ahmedabad have one sector each. None of the routes from Chennai has made it to the top 10 in terms of seats deployed.

On the Delhi-Hyderabad-Delhi route, IndiGo and the Tata group airlines have an equal number of flights. However, IndiGo beats the three Tata group airlines in frequency on the Bengaluru-Hyderabad-Bengaluru, Delhi-Kolkata–Delhi, and Delhi-Ahmedabad–Delhi routes.

Akasa the surprise player, GO FIRST and SpiceJet losing ground

On the Mumbai-Bengaluru-Mumbai route, at 49, Akasa Air has the second highest weekly, one more than Vistara and seven more than Air India.

SpiceJet and Go FIRST have not had the smoothest of sailings in the last few years. Even pre-pandemic, SpiceJet’s balance sheet wasn’t very strong, while Go FIRST has had issues with Pratt & Whitney engines ever since the induction of the A320neo in its fleet. Post Covid, the situation has become alarming for both carriers in terms of capacity utilisation.

SpiceJet is not present on the third busiest route in the country — Mumbai-Bengaluru-Mumbai — while both SpiceJet and Go FIRST are not present on the Bengaluru-Hyderabad-Bengaluru route. Go FIRST is holding on to its strength on the Delhi-Srinagar-Delhi and Mumbai-Goa-Mumbai routes, with its frequency evenly matched with IndiGo.

In the month of April 2023, the total number of domestic seats decreased by 4.5 percent compared to the same period in 2022. This can be attributed to capacity issues faced by Spicejet (due to financial problems) and GoFirst (grounding of A320neo aircraft).

"The decline in capacity would have been greater, but was partly offset by capacity addition by market leader IndiGo, Air India and Akasa Air. Akasa added capacity in April 2023 in key markets such as Ahmedabad and Bengaluru, where the airline has established a hub," said Mayur Patel, Head of Asia, OAG Aviation.

IndiGo will probably have to wait for the Navi Mumbai and Noida airports to open up to bump up capacity. Until then, it is deploying the A321s on metro sectors where it can effectively compete with the Tata group carriers. While AirAsia coming under the Tata group’s umbrella is not going to make a big difference until the airlines cross-sell itineraries, Vistara’s merger will have a big impact.

Will corporations, who are the biggest spenders, move to full service airlines again or will cost dictate their decisions? This, among others, will influence IndiGo’s plans for next year, when we’ll see what tricks it has up its sleeves.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.