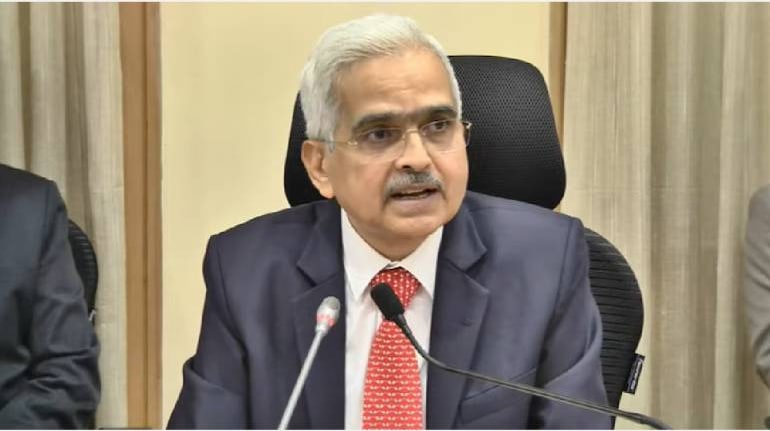

The much-awaited guidelines on digital lending are likely to be issued by the Reserve Bank of India (RBI) in the next two months, Governor Shaktikanta Das said while addressing the press after the Monetary Policy announcement on April 8.

"We have received a lot of comments on the recommendations by the Working Group on digital lending. I believe the examination of those comments has been completed. We will hold internal deliberations now and finalise the guidelines in the next one to two months," he said.

Deputy Governor M Rajeshwar Rao said that over 650 comments were received in response to the report by the working group on digital lending and a response has been framed on the basis of those, which will be put up for further discussions.

The governor also said that the regulator continues to receive multiple complaints from customers falling prey to frauds by digital lending apps and platforms.

"We receive many complaints on frauds in digital lending, sometimes even through social media, and we investigate those matters immediately," he said.

The RBI had constituted the working group on January 13, 2021, after several instances of dubious Chinese apps giving credit at high interest rates and using high-handed recovery methods pushed customers to suicide in 2020.

While this has been a concern for the RBI for over a year, the working group which was led by RBI Executive Director Jayant Kumar Dash submitted its report only last November.

The working group has made recommendations on three fronts – legal and regulatory, technology, and financial consumer protection. The recommendations aim at ensuring that customers borrow from only verified and authentic mediums and the fintechs that fall under the purview of these norms include credit and buy-now-pay-later (BNPL) players.

While these norms may try to eliminate any fake platforms and apps, they will be applicable on various BNPL players, including Capital Float, Slice, ZestMoney, Paytm, BharatPe and Uni.

Deputy Governor Rao also commented on the issue of loopholes in the KYC process, which led to fraudsters seeking loans using PAN cards of other customers, like in the case of Indiabulls Dhani.

"We are looking into it and based on the outcome of our investigation, appropriate action could be initiated. There are certain operational issues with KYC which we are looking at internally," he said.

Deputy Governor Rao added that the RBI will deliberate on what amendments are required to KYC norms to make them simpler and yet address the issues.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.