From a toddler to a teenager to an adult, witnessing your child grow is a sight to behold. A parent’s love and care for their child knows no boundaries even as they turn independent.

While your love as a parent doesn't need to change with your child’s age, how you plan to secure their future, financially, definitely requires transformation to match their life-stage.

As your child grows, expenses related to upbringing, education, extracurricular activities, etc. also rise and your financial plan should reflect the same. This helps you keep your finances in order and also supports your child in fulfilling his/her dreams and goals.

To help you achieve the same, this Children’s Day, here is how you should undertake asset allocation based on your child’s life-stage.

Decide investment goals based on your child’s life-stage

There are two key phases of a child’s life which will require substantial funding from your side: higher studies, and beyond (this can include wedding).

As schooling is a recurring expense, you are most probably going to use your regular income to finance this part of your child’s life. This will nevertheless require adequate budgeting as schooling and extra-curricular activities are no longer small expenses, especially if you are living in metro cities.

Although the consumer price inflation is a centralised number, different items grow- or become expensive- at different rates.

Although the consumer price inflation is a centralised number, different items grow- or become expensive- at different rates.

Coming to the aspects which require significant planning, you need to start saving and investing money early enough. You also need to save money in a way that you get the funds at different times when you will have the requirements.

The first step is to recognise the specific amount that is based on the goal you need to save for. This number needs to account for the rising inflation, as the value of the Rupee now and after five years would defer significantly. Then, the next step is to identify the amount you need to invest each month or each year to reach the goal amount at your child’s particular life-stage.

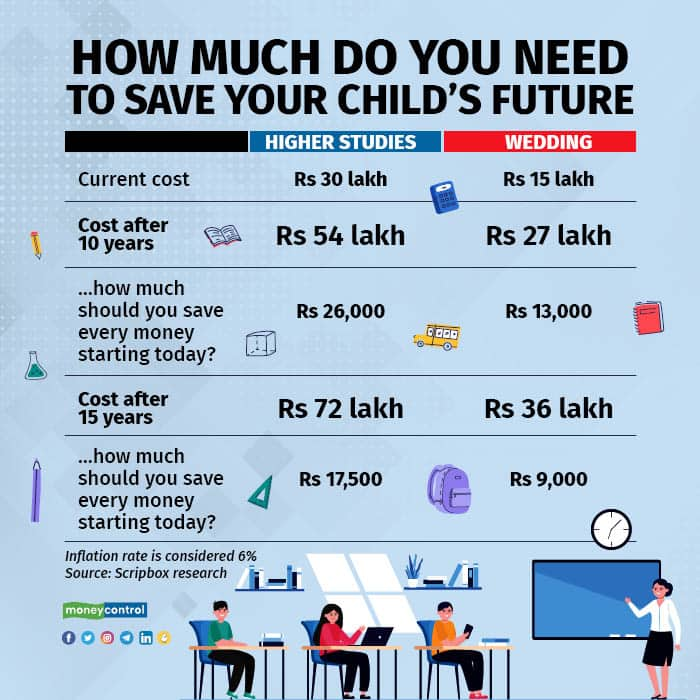

If you wish to save for your child’s higher education and wedding, here is how much you require to save based on the cost in the coming years.

The sooner you start planning, the lesser you will need to keep aside, every month

The sooner you start planning, the lesser you will need to keep aside, every month

In this same manner, based on your child’s future goals, inflation levels, and expected cost, you need to bifurcate funds. This will provide you with an estimation of your monthly and yearly investments and where you can invest.

Given education inflation is in double-digits in India (10 percent or more), the cost after 15 years would be more than double the amount now. This means planning is a necessity rather than a choice.

Also read | Should you invest in child-focussed mutual fund schemes?

Understand that the earlier you start the process, the less you’d have to invest to reach the goal amount. Also, you will be able to spread your investments across different avenues to get better growth.

How to efficiently plan asset allocation?

Asset allocation depends a lot on how much time you have before you need the money. The longer the time frame, the more growth you need to beat inflation.

For shorter durations, investing in instruments providing stable returns such as fixed-income instruments is the right way to go. While for long-term investments, you have time and should allocate more space to equity in your child’s investment portfolio.

Let’s take a reference from the above table on higher education for your child. Based on the assumed cost for higher education at Rs 30 lakh in 2022, your money needs to reach Rs 54 lakh, if you have a 10-year time horizon before you child needs the money and Rs 72 lakh if you have a 15-year time frame.

For the time frame of 10 years, you can leverage equity investments and earn higher growth compared to fixed-income instruments. Your asset allocation can be higher towards equity (diversified among mutual funds, stocks, and ETFs) with a lower allocation to fixed-income investments. The same can be applied to the investment horizon of 15 years, with an even greater allocation to equity.

However, suppose your tenure is less than five years, your asset allocation would be in fixed-income investment options like bank FD, bonds, debt funds, etc. This will mean a far higher monthly/annual contribution as you will have to give more weight to debt tools over equity for this time horizon.

Also read | The secret behind maximising SIP returns. A Moneycontrol - CRISIL study

Additionally, you should invest in a way that your funds mature gradually at different life-stages of your child.

Keep it simple

Saving and investing for the different life-stages of your child can be a challenging task. However, following some simple but key steps can help you. Start with separating funds for short- and long-term goals, and decide on appropriate asset allocation based on the time to maturity and your risk tolerance levels.

This Children’s Day, gift your children the future they deserve and will thank you for!

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.