Investors who had invested in gold on the back of the stupendous returns this asset had given between late 2018 and 2021 have been in for some disappointment of late.

There have been concerns regarding the recent fall in gold prices despite rising inflation. While it is true that prices have declined from the peak of $2,071 in March 2022, it is due partly to the waning of geopolitical premium as the Russia-Ukraine tensions appear to have not dragged in other economies, as had been anticipated. So should you still continue to invest in gold?

How have gold prices been affected?

Inflation has been running high lately with the US Consumer Price Inflation (CPI) surging to a 40-year high of 8.6 percent in May. It has been over 8 percent for the last three months. The sharp rise in inflation is driven by multiple factors. Earlier, the surge in COVID infections in parts of the world led to port closures and restrictions that disrupted the supply chain.

Moreover, during the pandemic, some governments handed out stimulus cheques to boost the economy. This had a trickle-down effect which increased the overall demand amid constrained supply. Further, Russia’s invasion of Ukraine led to an increase in raw material prices such as that of crude oil and agri commodities, contributing to inflation.

To combat rising inflation, the US Federal Reserve has adopted an aggressive posture and started quantitative tightening. Even with higher nominal rates, real rates in the US continue to be in the red, based on current inflation numbers. Yields on 10-year Treasury Inflation Protected Securities (TIPS), which are inflation-adjusted bonds that price in average inflation and nominal yields over the next 10 years, have turned positive for the first time in two years as investors expect inflation to ease. The positive real yields that TIPS offer now may have reduced the allure of gold, being a non-yielding asset, and thus have had a bearing on gold prices.

Despite the headwinds, prices in the dollar terms are still up 9 percent from the low of $1,677 in 2021. Gold has performed even better in the domestic currency. In rupee terms, prices are up 15 percent from the low of Rs 43,994 per 10 gm in 2021. The resilience in the prices is a result of gold’s long-term store of value characteristic that helps preserve purchasing power. The buoyant appetite for gold is also evidenced by the limited exchange-traded fund or ETF outflows in 2021 (-$9 billion) against inflows of $49 billion in 2020. Moreover, in 2022, there was a net inflow of about $16.5 billion until May.

How will inflation affect gold prices?

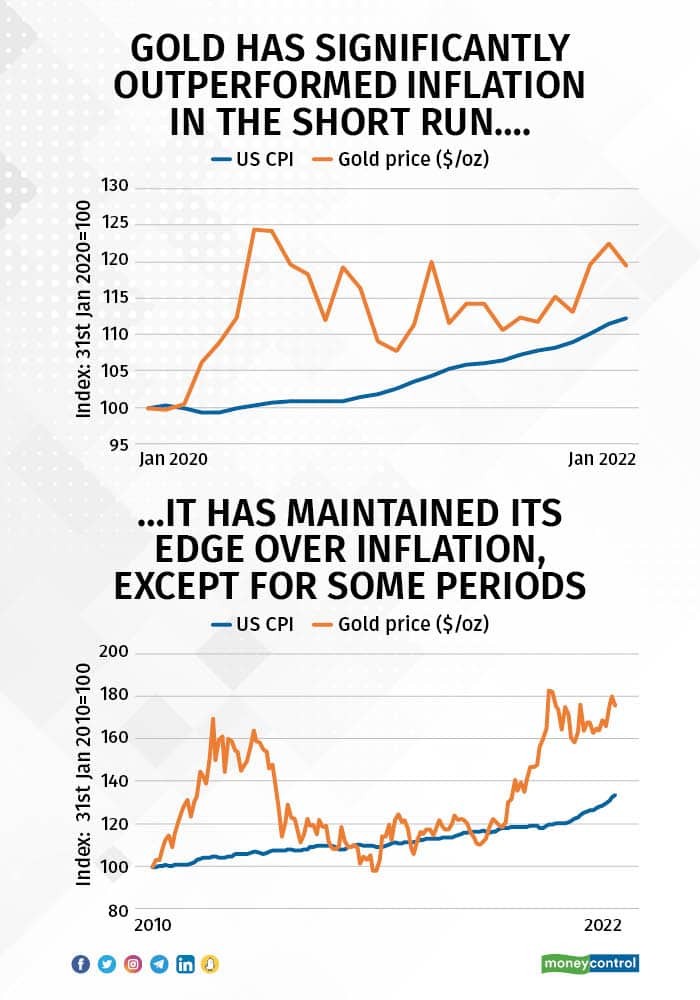

To understand gold’s relationship with inflation, let us look at the price of gold and the CPI chart indexed to 100 from January 2020 (chart1), where gold has significantly outperformed inflation. While in the long-term chart (chart 2) starting from 2010, barring some periods of underperformance when other macroeconomic factors pull the prices down, gold has maintained the uptrend and continued to beat inflation.

If we compare gold with equities and fixed deposits over a 30-year period, gold has more or less kept pace with the real consumption expenditure increases which tend to be higher than the official inflation prints. While equities will provide superior returns in the long term, gold is an excellent cushion to deal with market volatility while still maintaining purchasing power parity.

Looking ahead, given that the Fed’s power is limited to curtailing demand to curb inflation, it can’t do much to ease the supply chain pressures of the Russia-Ukraine war and China’s zero-Covid policy.

Also, with the risk of recession increasing, the Fed could be forced into a less aggressive stance. If inflation persists or becomes entrenched, we can see a repricing of inflation expectations, which could again bring down yields on the TIPS, giving gold a push. Gold, therefore, becomes an excellent allocation in the portfolio to generally help during times of stress and weather inflation along with other macroeconomic and geopolitical uncertainties.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.