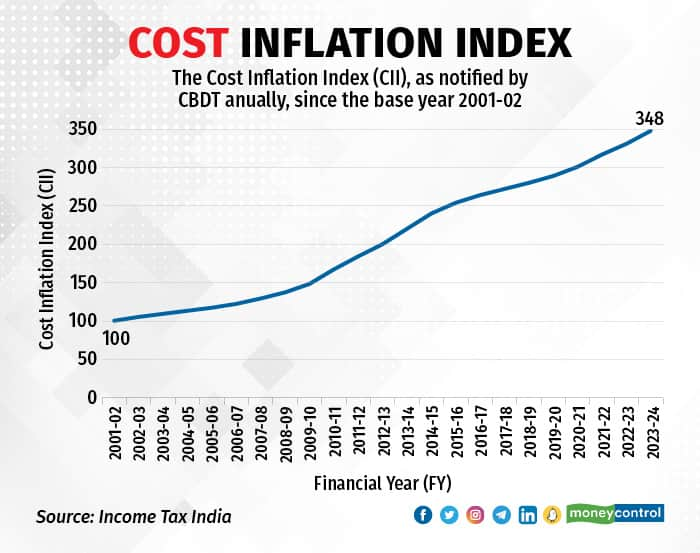

The Central Board of Direct Taxes (CBDT) has said that the Cost Inflation Index (CII) value for FY 2023-24 has grown to 348 from 331 a year back. It may look isolated and irrelevant, but it is one of the most important numbers out there that help you save tax on long-term capital gains (LTCG) from different assets like equity (shares and mutual funds), real estate and gold.

Until the previous fiscal year, the CII played a significant role in helping debt-mutual fund investors save on taxes. However, the Finance Act, 2023 has eliminated one of the most highly valued benefits for debt fund investors - the indexation benefit.

Previously, investors in debt funds could avail themselves of this benefit on their LTCG tax if they remained invested for a minimum of three years. However, it is still very relevant, so let’s read further

Also read | Not just debt funds, even gold and international funds lose their capital gains and indexation benefits

What does CII denote?CII values reflect the average change in the prices of goods and assets year-on-year due to inflation or deflation, as the case may be.

If we take into consideration the CII value for FY24 i.e., 348, and the value for FY 2022-23 i.e., 331, it means there is an average increase of 5.14% in the prices of consumer goods and assets compared to the previous year.

Remember this is not a flat increase in the price of all the products you consume or assets you have. In fact, this is an average increase, which means the prices of a few products may have increased more than others. There may also be instances where the prices of a few products have actually decreased.

On April 12, the government released its annual cost inflation index number. For those who wish to save on long-term capital gains tax levied on equity, real estate and gold, the index is important.What is the purpose of the CII values?

On April 12, the government released its annual cost inflation index number. For those who wish to save on long-term capital gains tax levied on equity, real estate and gold, the index is important.What is the purpose of the CII values?When you sell a capital market asset or even property, you have to pay capital gains tax. This is the tax on the difference between sale price and the cost price. Typically, if you hold an asset for a very long time, the asset’s value (and therefore, its sale price) goes up significantly. The higher the difference (between the sale and cost price), the higher is your tax liability.

However, due to inflation, the value of money goes down over time, and you have to spend more to purchase the same thing. In simple words, something that you would have purchased worth, say, Rs 100, many years ago, would automatically be worth much more today. Logically speaking, this inflationary price rise is not really the gain you make; your gains is the market price rise and on which you need to pay the tax.

To give relief to taxpayers, the government passes on this benefit of inflation to you, through the CII. The CII, therefore, artificially increases your cost price so that the difference between the sale and cost prices narrows down.

This, in turn, brings your tax liability (capital gains tax) down. That is why the CII is important in tax planning.

In other words, CII values are used to arrive at the inflation-adjusted cost of acquisition of assets. It is applicable for assets and investments like real estate, gold and so on while calculating long-term capital gains (LTCG) from such assets.

With the help of CII values, you can figure out the actual gains net of inflation made on transfer of assets such as equity, real estate and gold.

Indexed cost of acquisitionWhile calculating LTCG tax liability, income tax allows an assessee to take into consideration the indexed cost of acquisition. Indexation helps you adjust the investment amount against the CII value of the relevant financial years of purchase and sale.

For instance, any gains arising out of property transfer will attract capital gains tax. If the seller held the property for less than two years before transfer, then the gains from the transfer are considered short-term capital gains (STCG).

Such gains get added to the seller’s other income(s) and taxed as per the income tax slab applicable to him or her. If the seller held the property for more than two years at the time of transfer, then the gains are considered LTCG, which is taxed at 20% with indexation. To calculate LTCG from the property, the seller has to calculate the indexed cost of acquisition.

Also read | Sold a property and faced capital gains? Look at REC Capital Gains Tax Exemption Bonds – Series XVI

With the help of CII values, you can figure out the actual gains net of inflation made on transfer of assets such as equity, real estate and gold.Cost computation

With the help of CII values, you can figure out the actual gains net of inflation made on transfer of assets such as equity, real estate and gold.Cost computation Indexed cost of acquisition is computed by multiplying the cost of acquisition with CII value of the year of transfer of capital asset and divided by CII of the year of acquisition.

Say, you bought a house in 2010-11 for Rs 50 lakh and sold it for Rs 1 crore in 2020-21. To calculate the indexed costs of acquisition, find out the CII values on www.incometaxindia.gov.in for 2010-11 and 2020-21.

Also read | How taxation on housing transactions changed under the Modi government

In the example, CII is 167 and 301 for the years of purchase and sale, respectively. So, the indexed cost of acquisition would be 90,11,976 [50,00,000 x (301/167)]. Accordingly, your LTCG would be ₹9,88,023 (1,00,00,000 - 90,11,976). This is the amount on which LTCG tax will apply.

If you want to save the LTCG from tax, you have the option to either reinvest the gains in a residential property or 54EC bonds.

While the CII numbers released by the income tax department for FY 2023-24 or AY 2024-25 are currently provisional figures, the final number may vary from it. Therefore, it is advisable to use this number to estimate your gains, but wait for the final number before paying taxes on those gains to the department.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.