Centre's surprise move to amend the taxation on gains from debt funds has come as a jolt for mutual fund investors and the sector. While some mutual fund categories lose out, others might gain, officials and experts said.

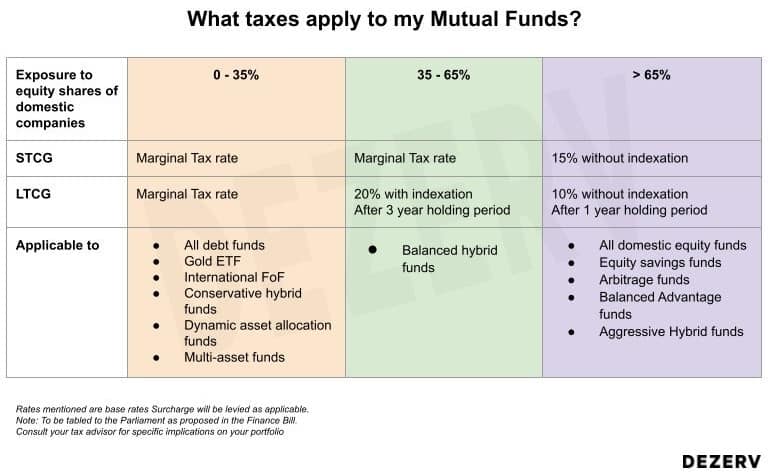

According to the amendments to the Finance Act, gains from debt mutual funds with less than 35 percent of their assets in equities will now be taxed at the marginal tax rate across tenures as opposed to the earlier benefit of long term capital gains (LTCG) with indexation for debt investments of more than three years.

Earlier, gains from investments in debt mutual funds of more than three years were subject to LTCG tax rate of 20 percent after indexation.

According to brokerage house CLSA, with this amendment and the changes brought in the budget on life savings products, there is no tax arbitrage left across debt instruments, whether they are bank deposits, debt mutual funds or life insurance savings products.

The Association of Mutual Funds in India plans to urge the finance ministry to reconsider the amendments, people aware of the matter said.

Who loses out?

According to Punit Shah, a partner at Dhruva Advisors, the amendments to treat gains on debt mutual funds as short term capital gains (STCG) will substantially diminish the attractiveness of debt mutual fund products.

Also read | Debt mutual funds may lose long-term capital gains taxation benefit

With the changes to the Finance Act, capital gains from a fund with 30 percent in equity and 70 percent in debt instruments would be taxed purely on the basis of one’s income tax slab, which is a big negative for investors.

“Entire debt mutual funds can be the immediate losers. Corporate bonds or banking PSU funds, which are popular among investors, may take a hit,” a mutual fund distributor said on condition of anonymity. “Existing investments are not losing out as these amendments will get applied after March 31. Also, gold funds, pure international funds, funds of funds – so, any product which is less than 35 percent in Indian equities is going to lose out.”

Sandeep Bagla, CEO of Trust Mutual Fund, is of the view that in the past one or two years, there have been outflows from mutual fund debt schemes in spite of the tax benefit.

Source: Dezerv

Source: Dezerv

“The only segment that saw inflows was target maturity funds, which were passively holding G-Secs, mimicking fixed deposits but with tax benefits. Incremental inflows will come into funds that are able to manage their portfolios actively and generate inflation-beating returns for investors. There is likely to be no impact in the short term but could impact the ability of mutual funds to attract debt flows in the long term,” he said.

As per CLSA, the decision is negative for mutual funds as the debt category (ex-liquid) contributes 19 percent of assets under management and 11-14 percent of revenue.

Who wins?

VK Vijayakumar, chief investment strategist at Geojit Financial Services, said that when STCGs are imposed on debt funds, taxation will be similar to taxation of bank fixed deposits. “This is a blow to the debt market,” he said.

Vijayakumar said now more money will move to bank fixed deposits, equity mutual funds, hybrid funds with more than 35 percent investment in equity, as well as sovereign gold bonds.

Also read | Finance Bill 2023: Domestic royalty tax doubled to 20%

“The proposed changes are in line with the philosophy of the new default personal income tax regime without exemptions. India’s tax policy is moving to a simple, consistent tax regime with no room for tax exemptions and arbitrage," he said.

Somnath Mukherjee, CIO at ASK Private Wealth, said removal of tax arbitrage from all categories of fixed income is good for the development of the bond markets in general, and the corporate bond markets in particular.

“It will incentivise a larger pool of retail investors to directly participate in the debt markets – both G-Secs and corporate bonds – instead of getting intermediated via wholesale platforms like mutual funds. It will also force debt MFs to work harder on generating alpha, and bring down costs of passive MFs like target maturity funds, roll-down funds and fixed monthly plans,” he said.

Balanced advantage funds, which maintain about 65 percent in equity and 35 percent in debt, will be a big beneficiary of the amendments, while conservative hybrid funds will lose out.

Also read | F&O trading: Govt's STT hike leaves traders confused

Further, Vishal Goenka, Co-founder, IndiaBonds says that the changes create a uniform level playing field between debt mutual fund and direct bond investment.

"For direct bonds no indexation is applicable for LTCG but taxed at a flat rate of 10 percent. Taxation rules across bond investments should be uniform as this simplifies the choice for investors who should focus on analysing the investment itself rather than the taxation disparity,” he said.

However, some experts said the taxation changes will not have a long-lasting impact on debt funds.

“It's possible that some people may shift out of debt mutual funds in the short term, but the realisation will come to people that there are no other credible options available. There is no policy change, which has made fixed deposits more attractive. Professional management, liquidity, and diversification still remain big positives for debt mutual funds,” said Suresh Sadagopan, managing director at Ladder7 Wealth Planners.

Investors’ risk profile to rise

Experts said the change in debt taxation would meaningfully impact allocation decisions.

“For the same expected returns, investors will have to take a higher risk going forward. Assuming an investor’s target return was 7 percent per annum post-tax over three years, that is currently achievable by investing 100 percent in a target maturity fund that invested in AAA papers. Going forward, assuming yields don’t change, the investor will have to invest over 25 percent in equities (assuming 13 percent equity return), to achieve the same target returns,” said Roopali Prabhu, chief investment officer for the private wealth group at JM Financial.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.