Quick question: Say you have a Rs five-lakh health insurance cover. You want to bump it up to Rs 10 lakh. How do you do that? You could try buying another health cover. Or, you could simply buy a top-up cover.

Exorbitant hospital bills for the novel Coronavirus Disease (COVID-19) treatment in many cases have pushed many to buy or increase their health insurance covers. Insurers and aggregators say they have seen an increase in demand for high-value covers and even top-up plans, thanks to growing awareness.

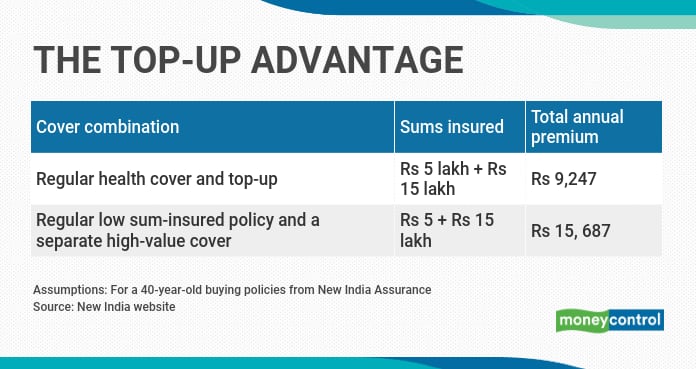

Let’s say you, a 40-year-old, have New India Assurance’ regular cover of Rs 5 lakh in place, which comes with an annual premium of Rs 5,747. Given the exorbitant COVID-19 treatment bills, you feel this cover is not adequate and want to enhance your sum insured to Rs 20 lakh.

Now, if you were to buy another full-fledged health cover of Rs 15 lakh, you will be charged an additional premium of Rs 9,940. Your total premium payable, therefore, would be Rs 15,687.

How can you increase your health cover at a cheaper cost? Here’s where a top–up cover helps. A top-up policy, as the name suggests, is an add-on to your regular cover. It gets triggered only after the base cover is exhausted.

In the above example, if you were to buy a top-up, which would cost Rs 3,500, your total outgo will be limited to Rs 9,247, but the overall sum insured would still be Rs 20 lakh. Since it gets triggered only after this base cover is exhausted, premiums are far cheaper.

Top-ups work better with a base cover

But top-up covers work best if you have a base insurance policy. This is how a top-up policy works: If you have a base policy of Rs 5 lakh and your hospitalisation bill amounts to Rs 7 lakh, the top-up will get activated to fund the additional Rs 2 lakh. Having a base policy in place is not a prerequisite for buying a top-up; it can be purchased independently too. So, in this example, you would have had to pay Rs 5 lakh out of your pocket, with the top-up taking care of the balance Rs 2 lakh. The threshold – Rs 5 lakh in this case – is termed as the deductible limit.

Should you buy a top-up policy?

Although you don’t need to buy a base cover to be able to buy a top-up cover, having a base cover helps, as it reimburses your medical costs below the top-up’s deductible cover. To be sure, the single, large cover will be feature-rich and you must carry out a cost-benefit analysis before taking a call. But a top-up cover helps mainly in two cases: 1) enhancing your health insurance cover in a cheaper way; and 2) helping senior citizens, who wouldn’t otherwise be able to afford a base health cover due to high premiums for that age-group, to cover serious ailments that can trigger large claims.

Still, must not rush to buy a top-up policy. Here’s why.

Opt for a super top-up, instead.

Ensure that you do not focus only the top-up sum insured while buying the policy. Go through the terms and conditions to ascertain whether it is a simple top-up or a super top-up. A plain vanilla top-up comes into play only if a single claim exceeds the deductible limit. However, a super top-up is far more useful as it takes aggregate claims made during the year into account.

For example, let’s say you have a base cover of Rs 5 lakh and have to be hospitalised twice during the same policy year. The first time, say, your hospital bill comes to Rs 2 lakh. And then, the second time, the bill comes to Rs 4 lakh.

Your base cover will pay Rs 2 lakh in the first instance. After this, your cover drops to Rs 3 lakh. For your second claim, it therefore pays you Rs 3 lakh. In this scenario, a plain-vanilla top-up will not get triggered as neither of the claims have, individually, breached the deductible limit (Rs 5 lakh). Therefore, when you settle your hospital bills the second time, you will have to fund Rs 1 lakh from your pocket.

A super top-up, on the other hand, will consider the aggregate of these two claims during the policy year. So, your base policy will approve the first claim of Rs 2 lakh as also partly settle the second claim to the extent of Rs 3 lakh. The super top-up will pay Rs 1 lakh – the amount exceeding the deductible limit in the second claim.

If you have purchased a regular top-up policy earlier, ask your insurance company if you can migrate to its super-top up plan, if it offers one.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.