The tax-saving season is in full swing, and two major financial services industries are locked in a slugfest to attract the attention of last-minute tax-saving investment seekers.

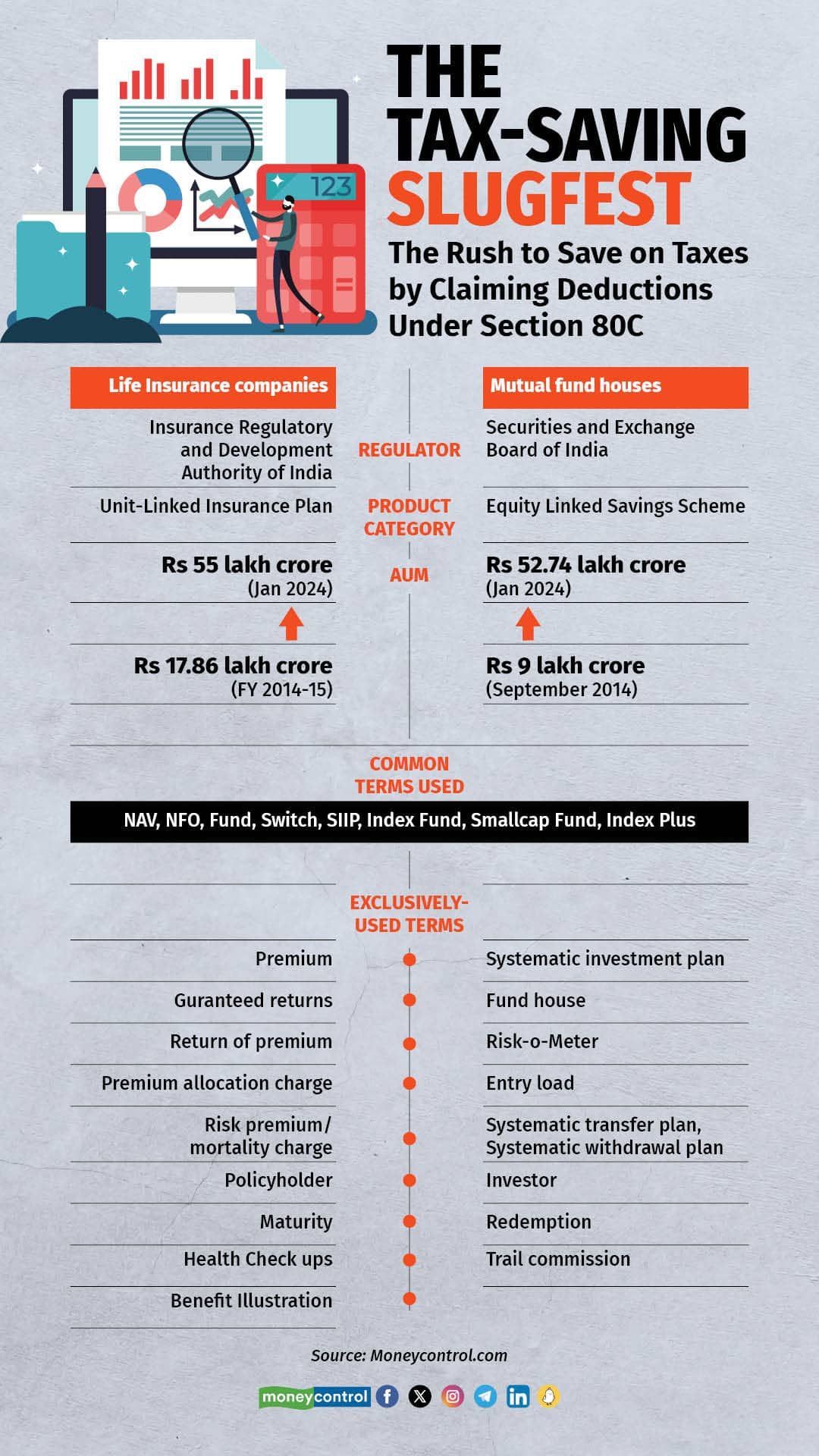

Both life insurance companies and mutual fund houses have products that are eligible for deductions under Section 80C, helping taxpayers reduce their tax outgo by up to Rs 46,800.

However, commissions, withdrawal conditions, and lock-in periods are vastly different. As with any sale, the one offering the highest margins is usually pitched at a higher decibel. Of late, several insurers have been rolling out new fund offers (NFOs) and using terms that are usually associated with mutual funds.

For example, LIC has launched its Index Plus plan recently. In 2020, it had introduced its Ulip SIIP (Systematic Investment Insurance Plan). Tata AIA Life Insurance is soon coming up with a Rising India NFO, while PNB MetLife’s NFO of its Smallcap Fund is currently open for subscription. Several other life insurers, too, have announced small-cap fund NFOs in the last one year.

In the past, new insurance product launches were promoted by life insurers. In 2023-24, fund investment options — one among five-six others — are the focus of promotions.

To be sure, there are no regulations that bar them from using terms such as funds, net asset value (NAV), new fund offer (NFO), index funds, small-cap funds, and so on. However, in the case of some Ulips, the advertisements do not prominently highlight the fact that these are insurance products.

The regulators for insurance (Insurance Regulatory and Development Authority of India or IRDAI), mutual funds (Securities and Exchange Board of India or SEBI), and bank fixed deposits (Reserve Bank of India or RBI) are all different. The total assets managed by both are similar. The life insurance assets under management (AUM) stood at Rs 55 lakh crore in January 2024 against Rs 17.86 lakh crore in 2014-15, while the AUM of mutual funds surged to Rs 52.74 lakh crore as of January 29, 2024, from Rs 9 lakh crore as of September 2014.

Also read: Cash levels at smallcap funds steady though some limit inflows in rising markets

The similar terms in use present a dilemma for an investor, who may not always be sure if she is investing in a Ulip, a mutual fund, or a fixed deposit.

But if you are looking to invest in tax-saving investments and are in a hurry to do so, here are ways to ensure that the product you are buying is the one you intended.

Also read: Tax-saving: Five tips to get the best from your ELSS Mutual Fund

Minimum investment period

Ulips come with a lock-in or minimum holding period of five years, while in the case of mutual funds there is no such restriction unless you are investing in an ELSS with a three-year lock-in. One can invest as a lumpsum, via monthly installments called systematic investment plans (SIP) and even pause the investments if need be.

Medical check-up

Since insurance products have a portion of the money being invested in insuring the risk linked to an individual’s life, there would be a pre-medical check up to invest in the product.

There could be a health questionnaire as part of the proposal form of life insurance. No such health check-up is mandated for mutual funds.

Currently, there are no mutual fund products offering a free life insurance cover as well. So, if you are being asked to go through a health check-up, it is cue that you are buying an insurance policy, not mutual fund.

Recurring investments

Under insurance, one needs to invest once every year to keep the investment active. But under equity linked savings schemes, you need to invest only once if you aren’t taking the SIP option, where investments are to be made every month. Check with the advisor about what happens if you do not pay the next installment and you will know whether she is referring to life insurance or mutual fund.

Also read: Four last minute tax-planning mistakes that can cost you heavily

Minimum investment period

Ulips come with a lock-in or minimum holding period of five years, while in the case of mutual funds, there is no such restriction unless you are investing in an ELSS with a three-year lock-in. One can invest in a lumpsum or via monthly instalments called systematic investment plans (SIPs) or even pause the investments if need be.

Benefit illustration

Under Ulips, the customer needs to be led through a benefit illustration, which is a table illustrating the investment in the product and its projected returns on either 4 percent or 8 percent per annum basis.

Post-sale call

In the case of life insurance purchases, insurers follow up with a phone call to verify whether you have understood the policy details. It is a call to check whether you have been mis-sold a product[ so pay attention while you answer it.

Taxation

The maturity amount received under Ulips is tax-free, provided the annual premium paid does not exceed Rs 2.5 lakh per annum and 10 percent of the sum assured. However, under mutual funds, gains exceeding Rs 1 lakh per year are taxed at 10 percent as long-term capital gains.

So, if the salesperson claims tax-free returns, understand that you are being sold insurance Ulips.

What if you made a mistake?

It is easy to get confused and invest in a product you didn’t intend to invest in.

If you have mistakenly purchased an insurance product, then a free look period of 15-30 days is available, during which time you can cancel the policy. You will be eligible for a premium refund minus the proportionate risk premium (for the life cover). If you have been a victim of mis-selling, then you can complain to the bank or insurance company, and your premium will be returned. If the bank doesn’t resolve your query in 30 days, you can write to the banking ombudsman and the insurer with proof of calls, text messages, or documents related to mis-selling.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.