Among the big news last week was IT major Wipro’s announcement of a Rs 12,000 crore share buyback on April 27, 2023. But that wasn’t the only buyback that was announced. The board of directors of the textile company Welspun India, too, approved their Rs 195 crore share buyback.

While Wipro is offering to buy back close to 26.97 crore shares at a price of Rs 445 per, Welspun India is planning to buy back 1.63 crore shares at a price of Rs 120 per share. That is, the two companies are offering to buy back their shares at prices that are 19 and 40 percent higher, respectively, than what they are trading at.

Wipro and Welspun India are yet to announce the buyback period and other details relating to their offers.

So what is a share buyback and what does it mean for a company’s shareholders?

What it isA share buyback, as the name suggests, is when a company buys back or repurchases its shares from its shareholders. This is done at a premium — at a price higher than the stock’s current market price. A buyback gives a cash-rich company a way to return surplus cash to its shareholders, including the promoters.

As a buyback leads to a reduction in the number of outstanding shares, it bumps up a company’s financial ratios, such as earnings per share (EPS) and return on equity (ROE). Buybacks can also result in a company’s stock price moving up.

Srikanth Bhagavat, Managing Director and Principal Advisor, Hexagon Wealth, says that by buying back its shares at a premium, a company is signaling to investors its confidence in its business and valuations.

With the Indian IT sector facing headwinds in the form of a global economic slowdown (that’s impacting IT spends), Wipro’s share buyback could work as a confidence booster for the company’s investors. The Wipro stock has lost 28 percent in the last one year.

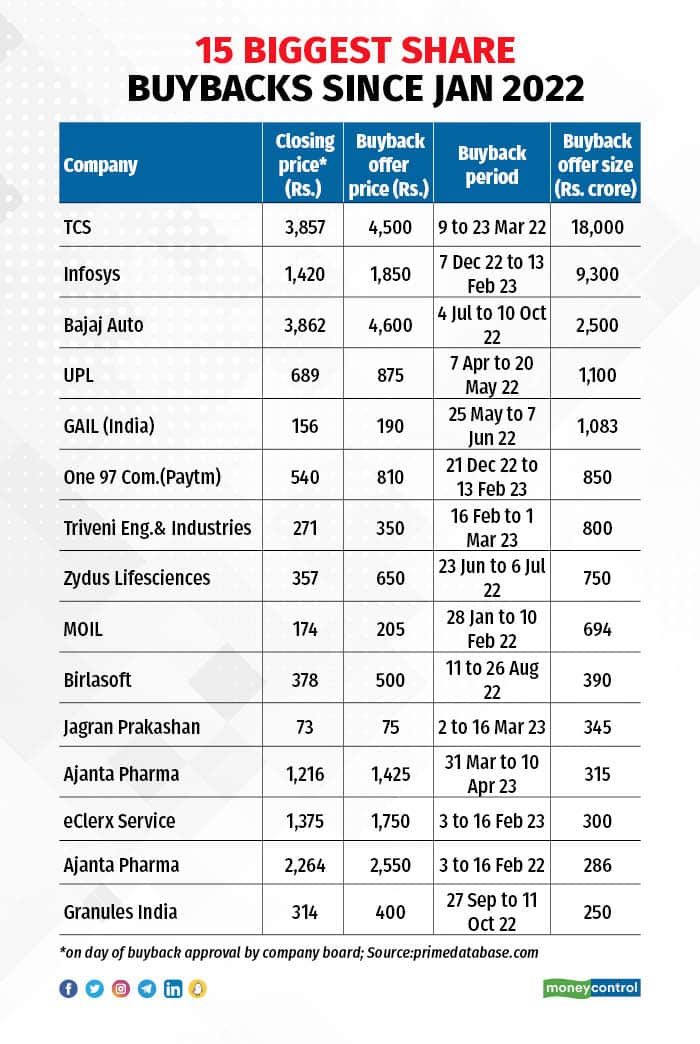

Then, take for example, One 97 Communications, the parent company of PayTM which came out with a buyback in December 2022. This helped boost the fintech company’s fledgling stock price. The company bought back 1.56 crore shares for Rs 850 crore between December 21, 2022, and February 13, 2023. The PayTM stock, which is still well under its IPO price of Rs 2,150 in November 2021, went up by as much as 26 percent during the share buyback period.

Types of buybacksToday, a company can do a buyback using either of the following two routes — a tender offer or an open market offer. The latter route is, however, on its way out.

Under a tender offer, the company offers to buy back its shares at a specific price, as Wipro and Welspun are doing. Interested shareholders can tender their shares to the company at this price during the buyback window.

The company announces a record date to determine who is eligible for the buyback. Only those who are the company’s shareholders as on the record date are eligible for a buyback via the tender route.

The open market (stock exchange) route for buybacks works differently. Here, the company buys back its shares from the market. So, the share buyback happens at the market price (and not a pre-determined price like in a tender offer), subject to a maximum price announced by the company.

Different shareholders may land up getting different prices for the shares sold by them. For example, PayTM bought back shares in the price range of Rs 703 to Rs 480, versus the maximum buyback price of Rs 810 per share announced by the company.

In case of the Infosys buyback which opened in December 2022, the company bought back shares at an average price of Rs 1,543 compared to the maximum buyback price of Rs 1,850 per share.

More importantly, as Narendra Solanki, Head, Fundamental Research – Investment Services, Anand Rathi Shares & Stock Brokers, points out, open market offers can be prone to manipulation by a company to the detriment of shareholders. That’s why the securities market regulator SEBI has stepped in to curb this risk.

Following an amendment to SEBI’s (Buy-back of Securities) Regulations, 2018, in February 2023, the open market route is to be gradually phased out. And from April 1, 2025, buybacks via the open market route will not be allowed anymore.

Tender your shares or not?So, how does one decide whether or not to tender one’s shares during a buyback?

With a tender offer, a shareholder knows exactly what price his shares will fetch. In such cases, Vinod Jain, Founder and Principal Advisor, Jain Investment, says that if the buyback price is much higher than the market price, it definitely makes sense to tender your shares in the buyback.

He adds, “If you have a strong conviction about the company, use the buyback proceeds to buy more shares from the market (where the stock trades at a lower price). With fewer shares outstanding after the buyback, your stake in the company will be valued even higher. This can have a strong wealth creation impact in the long run.”

But Bhagavat has a different view. He feels that if the company’s fundamentals are strong and you have a positive view on the company’s future, then one must simply hold on to the shares rather than tendering them, as it is evident that the balance sheet will only be better after the buyback.

What also matters is how many shares you manage to tender successfully. A company has to reserve 15 percent of its buyback offer via the tender route for retail investors. If the shares tendered exceed the buyback size, the allocation is made on a proportionate basis.

“Generally, the acceptance ratio in buyback programs has been very low. Though there is 15 percent reservation for retail investors, the absolute amounts are too small for them to tender their shares. The management uses these buybacks to signal higher stock prices to the markets,” says Shriram Subramanian, Founder and Managing Director, InGovern.

Take, for example, air cooler manufacturer Symphony, which plans to buy back 1.43 percent of its equity shares from May 3 to May 17, 2023. Even though the buyback price of Rs 2,000 per share is at a significant premium to the current price of Rs 982, given the small size of the buyback, shareholders may have to contend with a lower acceptance ratio.

Aside from the certainty of price, the tender route is also far more favourable to investors from a tax point of view. “Shareholders do not have to pay tax on capital gains on shares sold in a tender offer. But shares sold in an open market offer are subject to capital gains tax as there is no clarity on whether these shares were bought back by the company or another buyer in the market,” says Solanki.

With regard to an open market offer, it’s hard to predict what price your shares will get sold at. So it’s best to give such a buyback a miss, according to Jain. “Anyways, the value of my existing shares in the company goes up (the same number of shares account for a higher stake) after the buyback, so I benefit even if I don’t exit.”

Finally, irrespective of the buyback route, if you think you invested in the wrong stock, then you can use this as an opportunity to exit your investment at a better price.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.