There is a misconception that one must start with substantial capital to create substantial wealth. This is a myth that can discourage one from making the most efficient choices when it comes to investing.

Instead of focusing on investing lumpsums in bank deposits or being misguided into buying high-premium traditional life insurance plans, the focus should be on the three aspects that are critical for efficient long-term investing: starting early, being disciplined, and regularly increasing your annual investments by small proportions in line with any increase in income.

Approached in this manner, creating long-term wealth does not require relying on a large-sized capital investment, nor do you need to chase the highest return investment alternatives. What you need is time and discipline.

Numbers do not lie

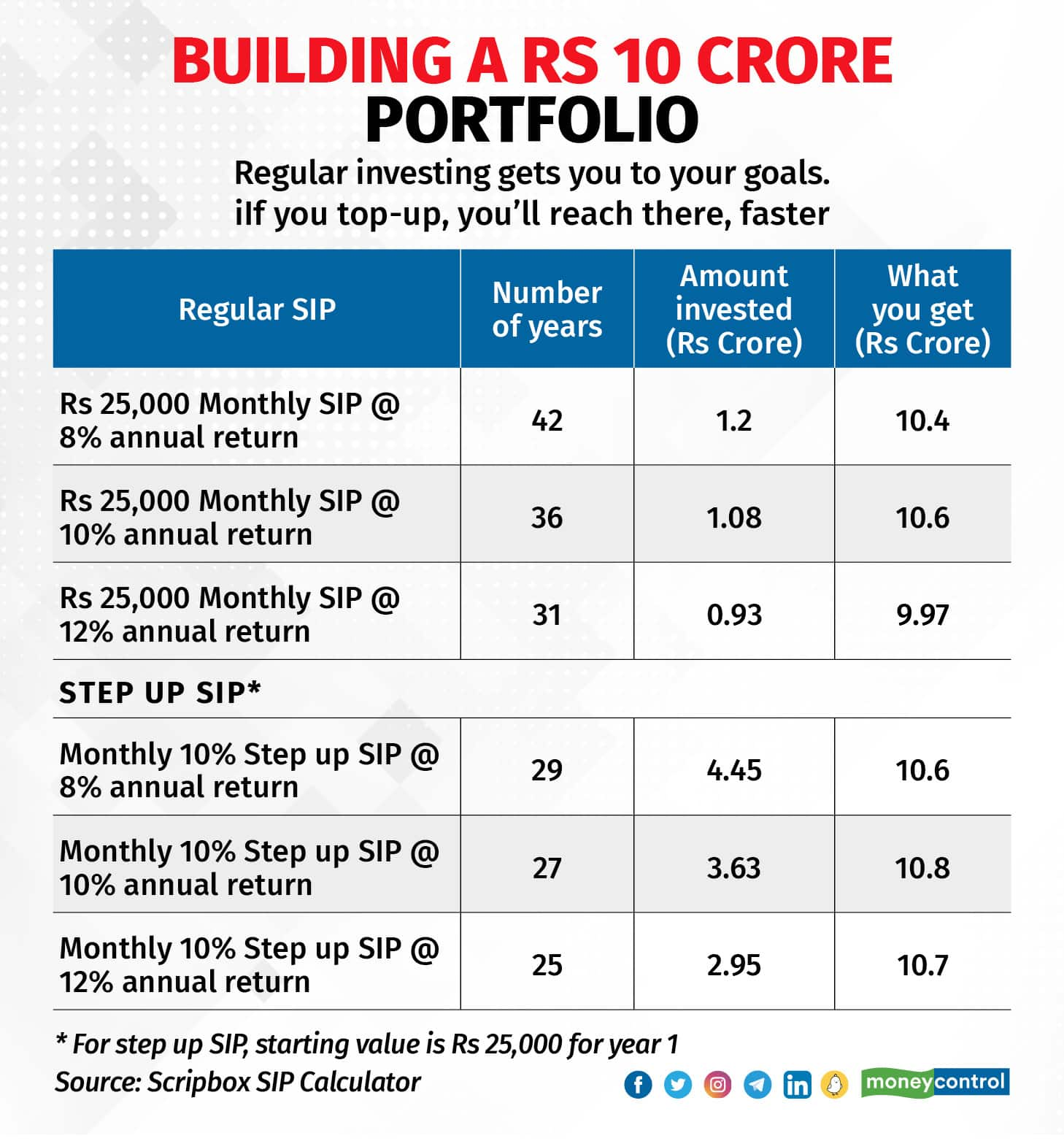

To understand the impact of regular, disciplined investing with annual increments, we tried to answer the question: How long will it take to build Rs 10 crore of wealth purely by investing?

We assumed a starting point of Rs 25,000 monthly SIP and have taken three return scenarios of 8 percent, 10 percent and 12 percent a year. For a conservative investor, there is a great likelihood that investment choices will be made carefully and not more than 8 percent returns can be generated.

With a simple step-up of the SIP you can reduce the time taken to achieve the wealth goal – in this case, Rs 10 crore – by six to 13 years. If the step-up proportion is higher, then the time taken can get reduced further.

With a simple step-up of the SIP you can reduce the time taken to achieve the wealth goal – in this case, Rs 10 crore – by six to 13 years. If the step-up proportion is higher, then the time taken can get reduced further.

Similarly, the other end of the spectrum assumes that you have the ability to absorb market volatility and can take on higher equity risk, thus assuming an average return of 12 percent a year.

Also read | The Moneycontrol - CRISIL SIP study: The secret behind maximising SIP returns

The same return scenarios are also played out with a step-up SIP, where you increase the amount invested by 10 percent each year. So, in year one you begin with a monthly SIP of Rs 25,000 and in year two this amount becomes Rs 27,500 and so on for the duration of your SIP.

The first basic finding is that one doesn’t need large capital to begin – yes, it would be useful, but not necessary. If you are starting small, you need the advantage of time on your side. The more you are willing to invest each month, the less time you take to achieve your financial goal. Similarly, the more conservative you are with your portfolio, the longer it will take to achieve your goal.

Why top-up SIPs help

Secondly, with a simple step-up of the SIP you can reduce the time taken to achieve the wealth goal – in this case, Rs 10 crore – by six to 13 years. If the step-up proportion is higher, then the time taken can get reduced further. For example, if you were to step up your SIP by 20 percent each year, you will need 19 years instead of 25 to achieve your return goal at 12 percent returns per year.

Also read | Top-up, trigger-based and an insurance cover...SIPs now come with a twist

The point is that systematic investing with an eye on increasing the value as income increases can help you transform small amounts of money into a large, accumulated pool of wealth.

It’s not that easy: what the numbers don’t tell you

When you see numbers compounding, it’s a very exciting prospect and seems simple enough.

However, being disciplined is not an easy attribute for all. Investing regularly, come rain or shine, can be a tough ask. Moreover, disciplined investing with small amounts requires one key ingredient and that is an early start. When one is young, it’s just not as fashionable to invest as it is to spend.

It gets very tricky to wait for 2-3 decades for wealth creation, especially when markets are unsupportive. Moreover, if there are other short-term goals, you may be tempted to break the portfolio and fund those instead.

According to Vivek Rege, founder of VR Wealth Advisors, “There are three critical aspects – ability and willingness to take risk plus tolerance. Unless all these three are in sync with each other, it will be hard to show any discipline or patience in investing. You may be willing to take on equity risk, but may not be able to tolerate a sharp 40-50 percent decline in price. An exit thanks to market volatility can be seen as impatience, but really it’s about risk tolerance.”

The opposite can happen when the markets do well. According to Khyati Mashru Vasani, founder of Plantrich Consultancy, “When the market peaks, returns are looking good and the portfolio value rises, clients come back to us seeking redemption to, let’s say, upgrade the house they live in or shift to another asset. In doing that, the retirement goal which they are working towards will get disturbed and in some cases, enough to need to stretch the retirement timeline by another 5-7 years. It’s best to keep the end goal in mind, rather than get too excited or impatient.”

Lastly, for steady and stable long-term wealth creation, you must be prepared to get bored.

Rege says, “The feeling of missing out comes in and what one is already invested in, which is working towards their financial objective, just gets taken for granted. Investors want to keep looking for something new, whether needed or not.”

Where to invest?

Seeking change and excitement in your portfolio can inadvertently increase risk and let you down when the tide turns. Instead, it’s important to stick to simple products with the benefit of high quality rather than chase quick returns and a new investment opportunity every few months or years. The latter can often lead you to the temptation of taking on higher risk and that can be a double-edged sword, especially if you weren’t ready to witness capital loss.

Vasani says, “Clients often ask for what else is ‘new’. We like to keep it boring and show clients, with data and details, how overdiversification can kill returns. In fact, what we tell clients is that one’s entire portfolio, physical and financial assets, should fit in an A4 size page, you don’t need more than that.”

Whether you are working to create Rs 1 crore of wealth or Rs 10 crore, looking at the numbers and understanding how returns compound is step one. However, the second step around managing behaviour is the key. Wealth creation is as much about seeking relevant returns as it is about inculcating the relevant behaviour.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.