These private sector banks offer the highest interest rates on tax-saving fixed deposits

A host of smaller and new private sector banks are offering higher interest rates on tax-saving FDs to garner new deposits

1/9

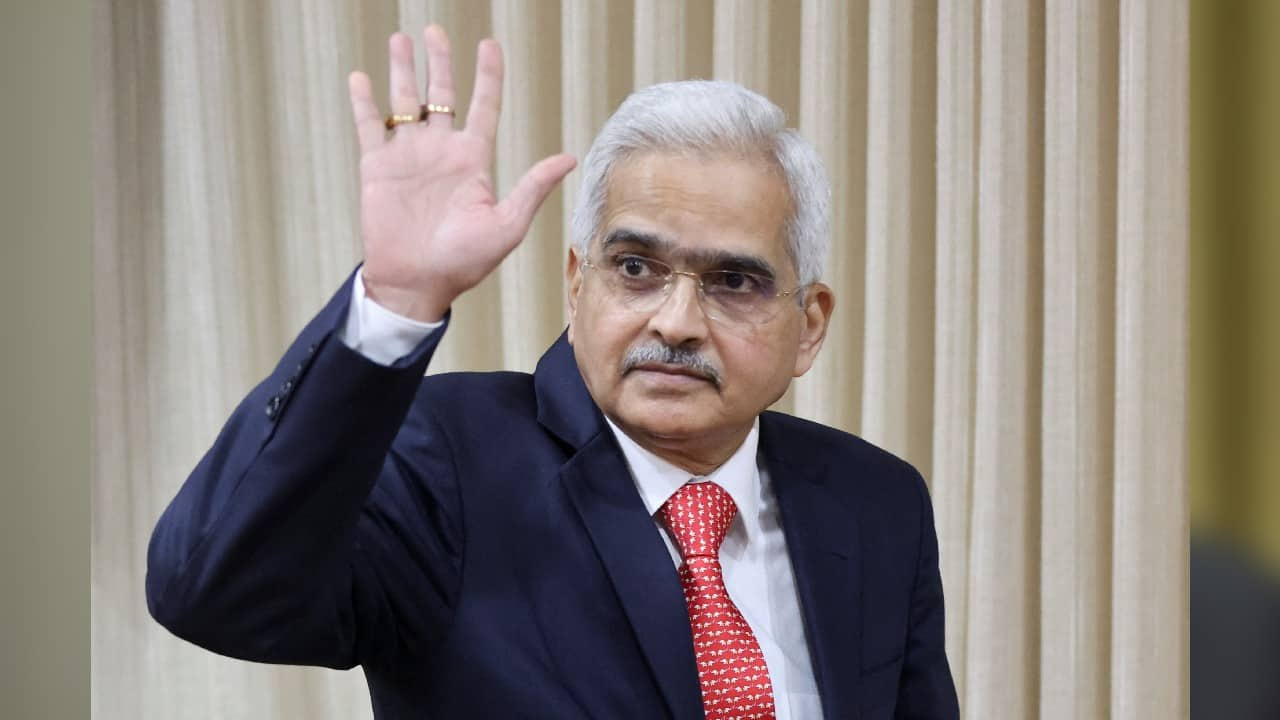

Several private sector banks have raised interest rates on tax-saving fixed deposits (FDs) after the Reserve Bank of India raised the repo rate to 5.4 percent in three tranches. Recently, ICICI Bank raised the interest rate on tax-saving FD by 40 basis points, from 5.70 to 6.10 percent. Smaller and new private sector banks now offer rates up to 6.75 percent on tax-saving FDs, data compiled by BankBazaar shows.

2/9

Investments of up to Rs 1.5 lakh can be claimed for tax deduction under Section 80C of the Income Tax Act but don’t just invest to save tax. Your tax–saving FDs must fit into your financial plan. Tax-saving FDs have a lock-in period of five years and premature withdrawals are not allowed.

3/9

IndusInd Bank and Yes Bank offer interest rates of up to 6.75 percent on tax-saving FDs. Among private sector banks, these offer the best interest rates. A sum of Rs 1.5 lakh invested grows to Rs 2.10 lakh in five years.

4/9

DCB Bank is offering interest rate of up to 6.6 percent on tax-saving FD. A sum of Rs 1.5 lakh grows to Rs 2.08 lakh in five years.

5/9

RBL Bank is offering interest rate of up to 6.55 percent on tax-saving FD. A sum of Rs 1.5 lakh grows to Rs 2.08 lakh in five years.

6/9

IDFC First Bank is offering interest rate of up to 6.5 percent on tax-saving FD. A sum of Rs 1.5 lakh grows to Rs 2.07 lakh in five years.

7/9

HDFC Bank and ICICI Bank are offering interest rates of up to 6.1 percent on tax-saving FDs. A sum of Rs 1.5 lakh grows to Rs 2.03 lakh in five years.

8/9

A host of smaller and new private banks are offering higher interest rates to garner new deposits. The Deposit Insurance and Credit Guarantee Corporation, a subsidiary of the central bank, guarantees investments in FDs of up to Rs 5 lakh.

9/9

The data as of 19 August 2022 has been compiled from websites of the banks. BankBazaar has accounted for FDs belonging to only those private sector banks that are listed on the BSE. Banks for which data is not available on their websites were not considered. The rates are for tax-saving five-year FDs for non-senior citizens.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!