In 2014, peer-to-peer (P2P) lending commenced and final regulation on the same was announced by the Reserve Bank of India (RBI) in October 2017. They came with complete guidelines on how P2P lending will operate. Basically, the platform connects a borrower with a lender. They provide an end-to-end digital platform to execute, manage and completely close the loan life cycle.

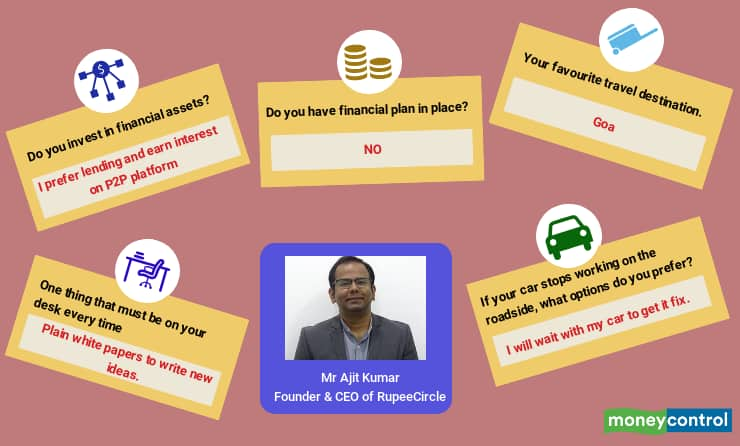

Ajit Kumar, Founder and CEO of P2P lending firm, RupeeCircle, talks about securing an NBFC-P2P licence from RBI, its guidelines and regulations, risks of lending on P2P platforms, the key factors lenders must check before registering on a P2P lending platforms and more.

Edited excerptsQ: RBI has recently issued a non-banking financial company (NBFC)-P2P licence to RupeeCircle. According to RBI, how many lenders are registered in the NBFC-P2P category? Also, how does it benefit your organisation, borrowers and lenders?A: As of now over 10 NBFC-P2P companies have received a licence from RBI. We are the first company in 2019 to receive this licence. The licence plays an important role as it builds credibility of the company, and gives lenders and borrowers the confidence that we are RBI compliant. A regulatory licence brings in more trust for lenders on the platform since the process will be audited quarterly by RBI to make sure that the entire system is transparent.

After the RBI notification, which came on October 4, 2017, it was mandatory for all P2P companies existing then to apply for licence to continue as a P2P platform. All new entrants had to get a provisional NBFC-P2P licence from RBI to start operations in this space. This has made sure that all operational P2P players are either regulated or are awaiting a licence from the regulator.

Q. Briefly explain RBI guidelines on capping to lenders and borrowers A: RBI has maintained a cap on lenders and borrowers on the P2P platform. Any lender cannot invest more than Rs 10 lakh across all P2P platforms. Similarly, a borrower cannot borrow more than Rs 10 lakh across P2P platforms. A lender cannot lend more than Rs 50,000 to a borrower. With these guidelines, RBI wants lenders to diversify their risk. We expect RBI to relook at the Rs 10 lakh capping for lenders and hope the limit will be raised in future after it gains confidence and as more investors envisage interest in participating in P2P lending. It’s important to note that RBI has kept this capping so that investors don’t take high investing risks at one go. These are new investment avenues for investors, so awareness is important before they decide to invest (lending) into it. The regulator wants this market to develop slowly. The capping limit hampers exponential growth for the company at the moment, but it also creates the right environment and sets the right tone for lenders and borrowers.

------

Q. RBI regulation has a requirement to have net owned funds of at least Rs 2 crore. How has this condition impacted P2P lending platforms?A: This requirement has acted as a deterrent for non-serious P2P lenders to enter the market. We are backed by Mahindra & Mahindra Financial Services and are the only P2P player on the Oracle global startup ecosystem, which works with startups from an early stage to scale-up and build a thriving global startup community to drive the digital economy.

Earlier, around 40-50 companies were into P2P lending, but stringent guidelines and mandatory licence from the regulator has streamlined P2P lending companies, forcing several P2P companies to shut their operations.

A: Typically, young adults are borrowing from the platform to meet requirements like home improvement, travel, medical emergency, personal reasons and pay-off outstanding credit card bills, business loan, consumer durable loan, etc. We have lenders across India in their 30s to 50s and most borrowers are millennials in the age group 25 to 35 years.

Q. How are interest rates decided on P2P platforms for borrowers?A: We basically decide on the interest rate for borrowers after screening them. We access more than 200-250 data points of the borrower, which includes social, economic, financial and educational to come up with a credit score.

On our platform, some borrowers are new to P2P lending. So, they come from the under-banked or unbanked category. They may not have access to formal channels of credit and don’t have a CIBIL score but they can still apply on our platform. We undertake the credit assessment of such borrowers.

So, while we do the credit modelling, we assign them a credit score, an interest rate, the amount and the tenure for which they can borrow. The interest rate thus assigned ranges from 12 percent to 30 percent. We also do a lot of physical verification of all documents such as where they stay, job, etc. Once we are completely satisfied, only then do borrowers get listed on our platform. After they are listed, any registered lender on our platform can lend to them.

Q. What are the key challenges for P2P firms and how does your organisation tackle them?A: Currently, the major challenge is awareness. P2P lending is still a nascent concept given the huge demand for consumer credit in India. Off late unsecured loans have been growing the fastest in line with millennial consumer behaviour. With increasing user acceptance, we are confident of reaching out to the under-banked segments faster.

A: Our credit rating score model is based on a credit underwriting algorithm that categorises borrowers across multiple risk grades from A to F. A grade being the category with the strongest credit profile and F grade being the weakest. We assign an interest rate as per these risk grades along with a report for each of the loans listed on our platform for lenders.

Q. What measures are taken by your P2P platform to prevent defaults and frauds?A: We have complied and aligned all our processes as per RBI requirements. To mitigate credit risk and fraud, we have developed our proprietary machine learning-based credit underwriting algorithm, backed by in house tele calling, field verification and collection team. We have created an in-house fraud and risk repositories/databases to minimise defaults.

We have managed to keep our default rate at 1.94 percent. In case a borrower defaults on an EMI even after adequate reminders, the case is taken up by our collection team. If required, legal proceedings are also initiated against the borrower.

Q. What is revenue model for P2P lenders?A: Since we provide a service to both borrowers and lenders and help them to connect, we take a processing fee for facilitating the borrower. We have lenders to whom we provide the opportunity to lend on our platform and earn a service fee.

Normally, the processing fee for borrowers is 3-5 percent. We don’t charge anything upfront to lenders. We charge only a percent of the investment amount after last EMI is received successfully from the borrower.

This fees are generally decided by P2P platforms and is not regulated by RBI. However, RBI is clear in its guidelines that we cannot earn interest as we are not providing loans from our pockets. We are just service providers and can charge for that.

Q. What are the key factors lenders must check before registering on a P2P lending platform? And how to mitigate risks while lending on P2P platforms?A: The key factors lenders must check while registering on P2P lending platforms are credibility of P2P lending platforms, understanding of the risk and return trade-off, ease and simplicity of lending on the specific platform.

Diversification is key and is something that we recommend to all our lenders. Spreading the credit risk across multiple risk grades and tenures provides an opportunity of earning better returns while minimising risks.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.