As adoption of passive investing among retail investors rises, there is greater appetite for looking beyond plain-vanilla index funds investing in large-cap equities. Sectoral/thematic index funds and ETFs allow investors to invest in benchmarks tracking high-conviction ideas that have structural or cyclical tailwinds in their favour. Investors can thus gain from promising strategies, along with benefits of passive investing such as low expense ratios and no fund manager bias.

Consumption has been one such secular growing theme that has been getting a lot of interest as the post-pandemic Indian economy reopens. Nifty has two indices mapping the consumption theme – Nifty India Consumption, which maps the broader universe of discretionary consumption, and Nifty Fast Moving Consumer Goods (FMCG), which tracks the specific FMCG sector. We study both indices to understand how you can choose between the two.

Stock composition & diversification

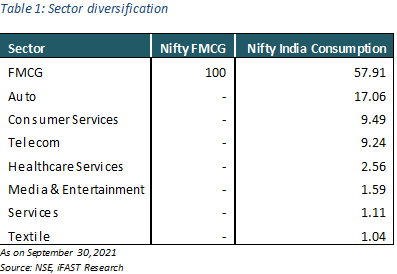

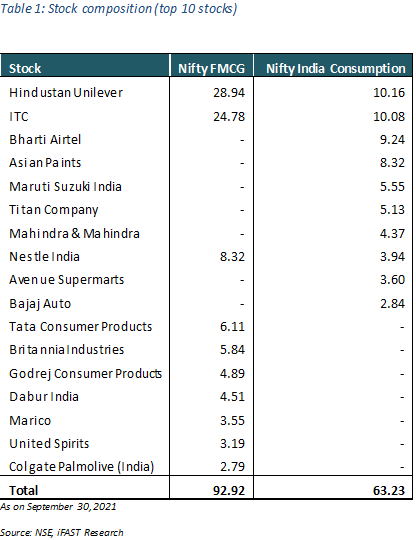

The Nifty India Consumption index includes a spectrum of sectors covering the ‘discretionary consumption’ theme. This makes it more diversified than the Nifty FMCG Index, which is focused on the FMCG sector alone.

The stock composition of the two indices further illustrates a stark difference in diversification (Table 2). Now, the top ten stocks of Nifty FMCG account for over 90 percent of the index, whereas in Nifty India Consumption, the top ten stocks only constitute 63.23 percent of the index. The Nifty FMCG index includes 15 stocks, whereas the Nifty India Consumption index includes 30 stocks.

Long-term performance

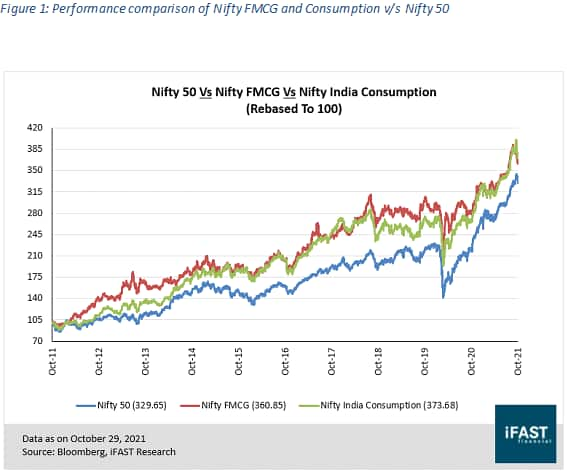

Over a 10-year period, both Nifty FMCG and India Consumption indices have managed to outperform the Nifty 50 index convincingly (Figure 1). This comparison effectively highlights how themes with good revenue visibility can help derive an alpha over a period of time.

Nifty India Consumption v/s Nifty FMCG

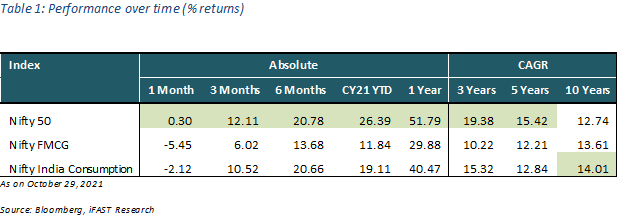

Historical trends show that the Nifty India Consumption index has managed to consistently outperform the Nifty FMCG index over different periods of time (Table 3). One way to view this is that most FMCG stocks are already well-discovered and command premium valuations over other stocks.

In contrast, stocks in the broader market (Nifty India Consumption, Nifty 50) not only offer comparatively better value, but also tend to rally when sentiments are positive and the economy is on a rebound (as seen in H2 CY20 and CY21).

Year-wise performance

In the last 7-8 years, the Nifty India Consumption index outperformed the Nifty FMCG index (Table 4) on most instances. Higher discretionary spends, growing penetration of e-commerce channels, revenue traction in tier 2 and 3 cities, and a valuation discount of non- consumer stocks versus the richly valued FMCG shares have aided re-rating.

The Nifty India Consumption index has also managed to beat the Nifty 50 index in most years in the last 14 years. That said, whenever the Indian markets have staged a comeback from the lows and the appetite for equities increases (in 2009, 2014, 2021 YTD), the Nifty 50 index did better.

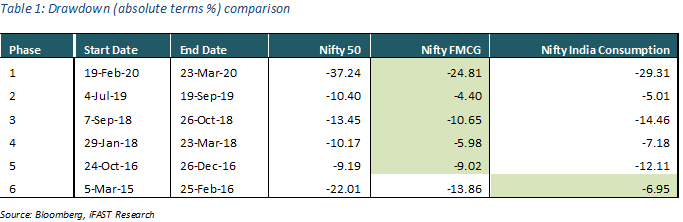

Drawdowns

On this front, the Nifty FMCG index has been able to effectively counter phases of downfalls versus the Nifty India Consumption and Nifty 50 indices. As seen in Table 5, when the Indian markets faced sharp falls (2008, 2011), Nifty FMCG declined by a considerably lower degree because of its defensive characteristics.

Sectoral strategies complement core equity investments

Complementing core equities (large, mid and small caps) with sectoral equity index funds/ETFs can help investors in several ways: a) maximising returns over and above the headline indices (especially when the sectoral upcycle is underway); b) investing in themes with immense potential at a low cost; and c) investing with considerably lower capital requirements as opposed to buying individual stocks of each index.

The Nifty India Consumption index scores better on most performance-related parameters versus the Nifty FMCG index. However, it has also shown to have steeper drawdowns in bear phases. Therefore, index funds and ETFs based on the Nifty India Consumption index are well suited for investors with a risk appetite and those who wish to invest across a wide range of sector leaders across staple and discretionary sub-segments.

Passive funds tracking the Nifty FMCG index, on the other hand, would be apt for risk averse investors who prefer the defensive characteristics of the staples space and seek steady compounding of returns over the long term.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!