All-time high (ATH) is an oft-used term in capital markets. There is some fascination with this term- some get excited, and some fearful. There’s advice floating around voting for both the camps. Some take the decision to stay on and some move to the fences and wait for the right time. However, stock markets are for believers and those who stay put in the market are the ones who eventually win. The rule of compounding works when not disturbed intermittently.

Correlate ATH with how much one saves. If your income is currently at your lifetime high, shouldn’t your monthly savings, rather investing, be at a lifetime high too?

In my career span of more than two decades, I have observed a few things which have stayed consistent. One, the belief in the India story. Second, the concept of investing regularly. Third, that investing any amount is ‘enough’. Many investors started their investing journey with a minimum amount, without thinking about what should be the right amount for them. Somehow, doing an SIP (systematic investment plan) in mutual funds of Rs 1,000-2,000 gave them a feeling of satisfaction that he/she had started saving in equity.

But most Indians who started investing 20 years back have seen their incomes grow many folds. However, many of them may not have increased their SIPs from what they started with. Why? As I said, they may have thought that they were doing the right thing by investing Rs 2,000-3,000 every month. Is that enough?

With income growth, haven’t lifestyles improved? Haven’t expenses gone up? Haven’t aspirations gone up? So, why not your SIP amount?

Also read: Is Rahul Gandhi a wise investor?

At the industry level, over the last couple of years, we have seen exponential growth of the SIP book, thanks to the lakhs of new investors who started their investing journey and, thanks to the distribution partners we work with.

For most of the time, the average ticket size of SIPs in India has been in the range of Rs 2,000 or thereabout. Even now the average ticket size is Rs 2,400 only despite crores of investors doing SIPs. Why? Because our monthly savings are still not at ATHs.

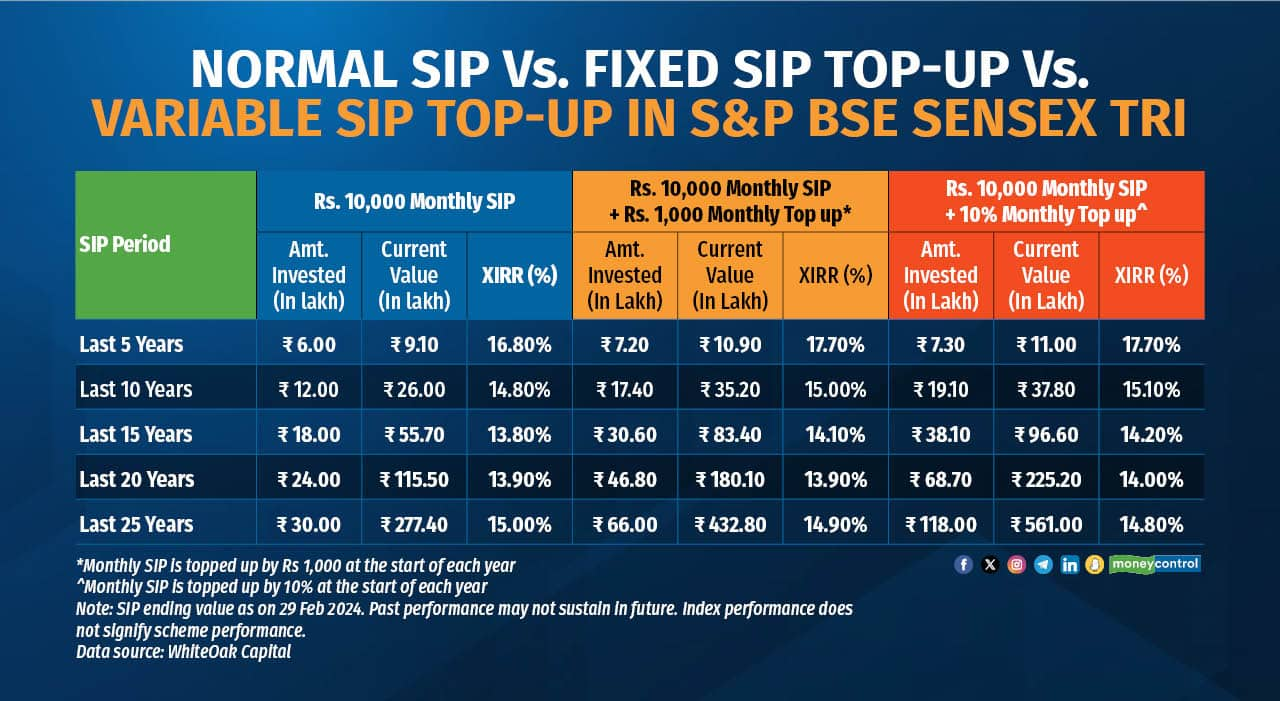

Here’s some interesting data from WhiteOak Capital which highlights that had investors increased their monthly investing as much as their incomes had grown, they could have met their financial goals much faster.

Also read: Confused about which mutual funds to invest in? Check out MC30

The data shows that over the last 25 years, if one had increased their monthly SIPs by just Rs 1,000 every year, their wealth accumulation would have been Rs 4.33 crore, compared to Rs 2.77 crore if they had continued with the same amount. Take another example, if someone had increased his monthly SIP by 10 percent each year, he would have accumulated Rs 5.61 crore.

Was there any magic? - Yes, the compounding magic works and opting for a top-up can make all the difference.

Also read: This mutual fund facility gives you regular income. Here’s how

If Indians save approximately 30 percent of their income, shouldn’t the SIP amounts also go up in relation to income? Why have an obsession with lifetime highs of the market alone? Keep taking your savings to lifetime highs and that will take care of your financial freedom. We experience inflation day in and out, and we need to prepare for it.

You may think that you have started another SIP in another fund. Well, that’s also perfectly fine. Just ensure that you increase your investments in proportion to your income growth. However, also be aware that a top-up SIP is another convenient option if you don’t want to keep adding to your list of funds. Just a small tick opting for a top-up can help you in the long term.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.