The winners’ club: Here’s the list of the top performing equity mutual funds across categories in 2023-24

Equity mutual fund schemes that had relatively higher exposures to select PSU, finance, power, construction, defence, and automobiles stocks delivered better returns in FY24

1/8

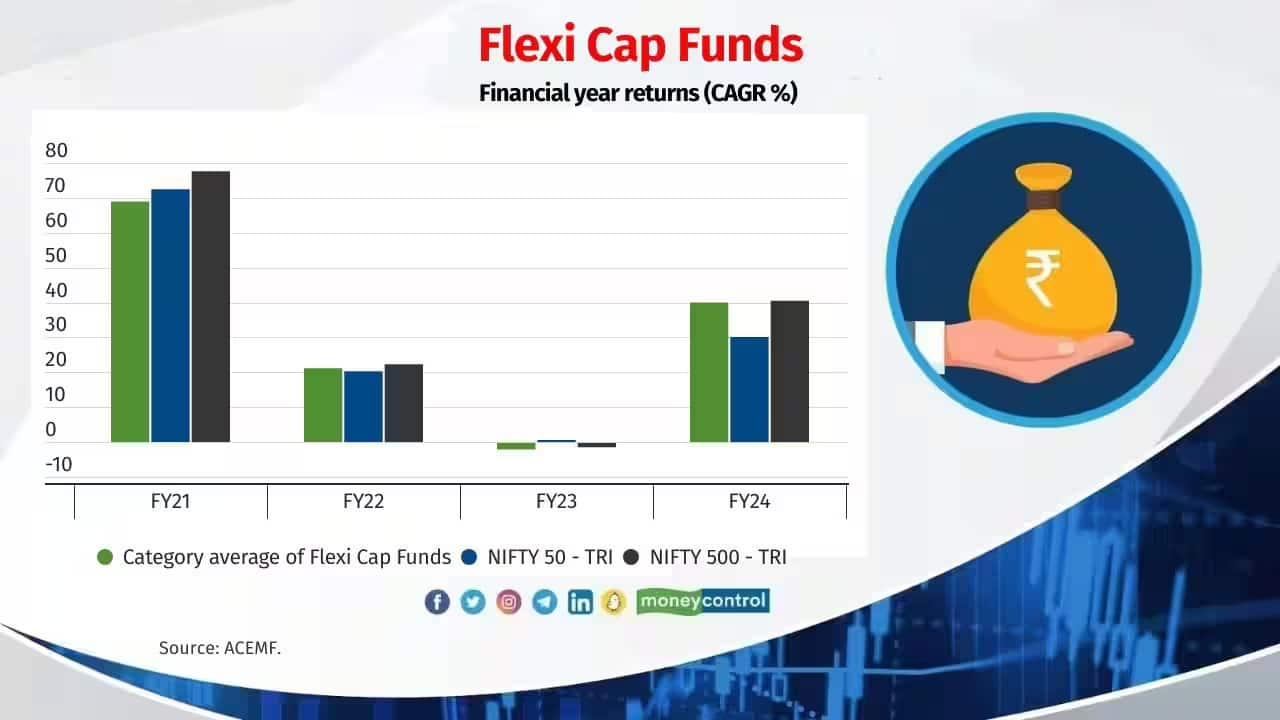

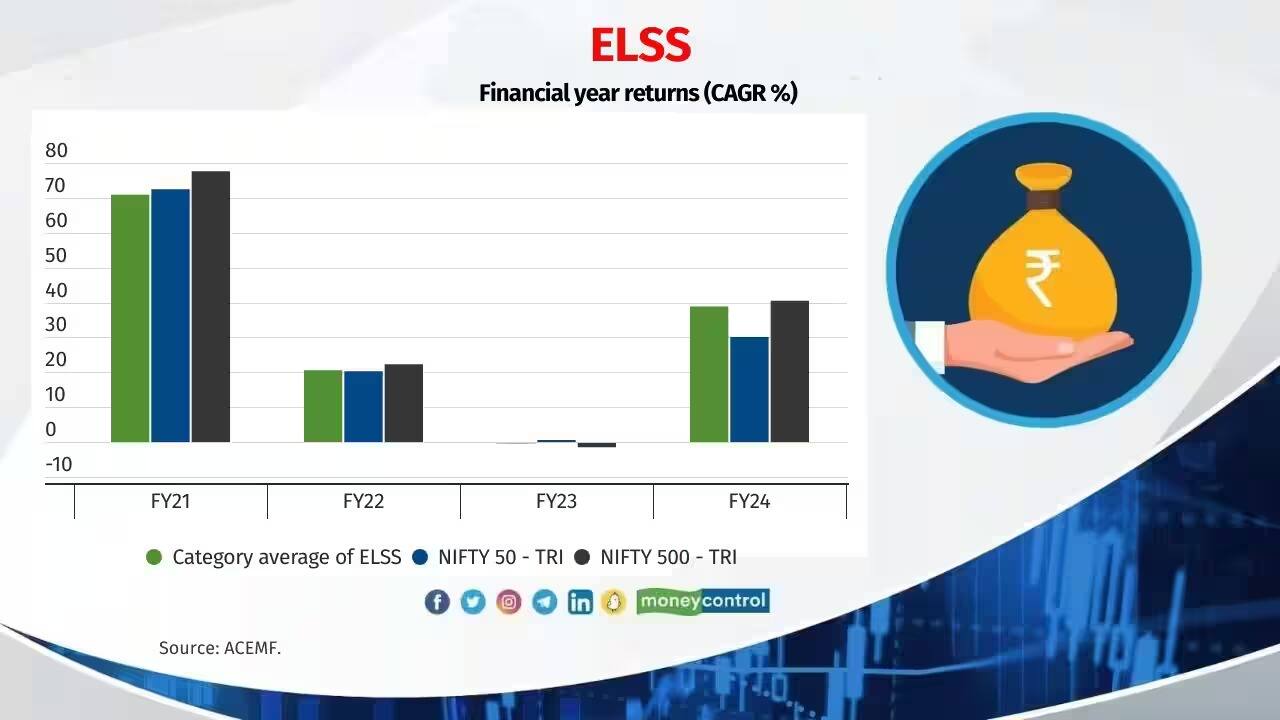

Indian equity markets have had an outstanding financial year 2023-24. The major indices achieved remarkable milestones as the S&P BSE Sensex reached 74,000 points, and the Nifty 50 index surged past 22,000 points. The Nifty 50 – TRI (total returns index), Nifty Midcap 150 – TRI, Nifty Smallcap 250 – TRI, and Nifty Microcap 250 – TRI delivered 30 , 57, 64, and 86 percent returns, respectively, during the period. Mutual funds that invest in equity also followed suit. All the equity-oriented mutual fund categories managed to register positive returns. Equity mutual fund schemes that had relatively higher exposures to select PSUs (public sector undertakings), finance, power, construction, defence, and automobiles stocks delivered better returns. In the market capitalisation-based fund categories, large , mid, smallcap and flexi-cap funds delivered 37, 50, 48, and 40 returns, respectively in FY24. Below, we look at how the major equity diversified categories fared, and the top performers in each category in FY24. Source: ACEMF.

2/8

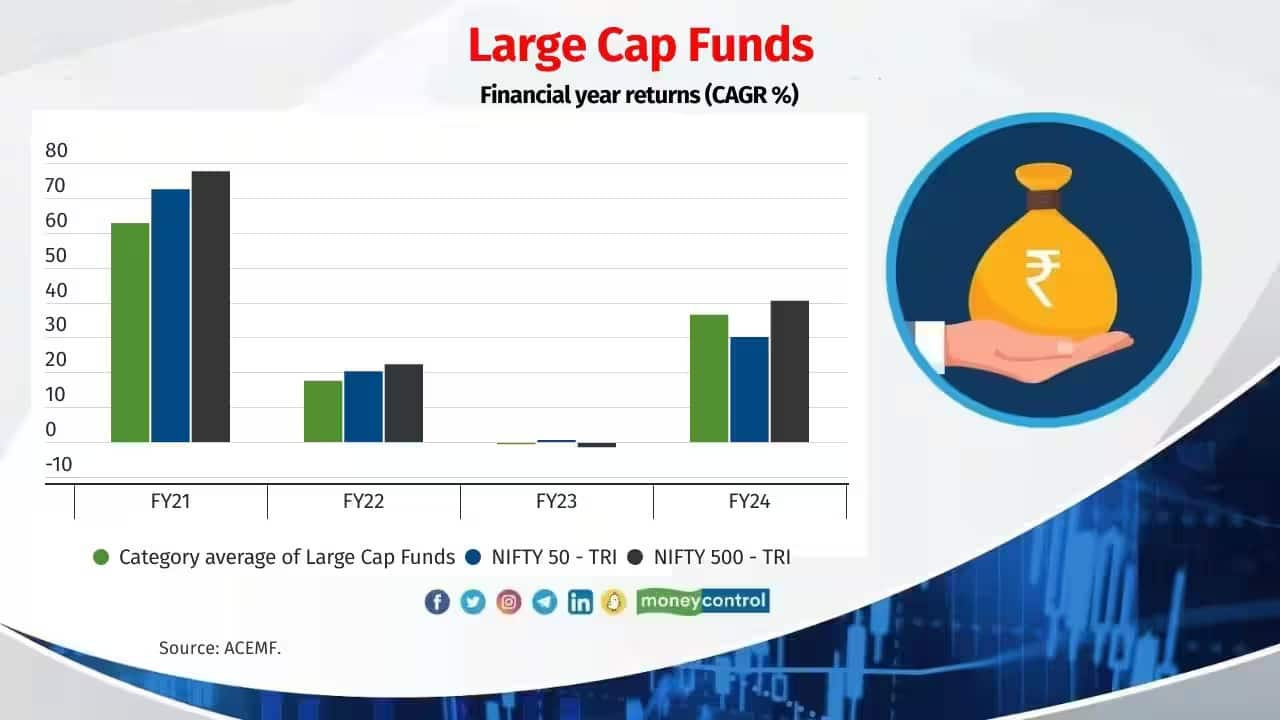

Large Cap Funds

Top 5 funds:

Quant Large Cap (52 percent)

Bank of India Bluechip (47 percent)

JM Large Cap (45 percent)

Nippon India Large Cap (44 percent)

Taurus Large Cap (44 percent)

Note: One-year returns in brackets; data as on March 28, 2024

Top 5 funds:

Quant Large Cap (52 percent)

Bank of India Bluechip (47 percent)

JM Large Cap (45 percent)

Nippon India Large Cap (44 percent)

Taurus Large Cap (44 percent)

Note: One-year returns in brackets; data as on March 28, 2024

3/8

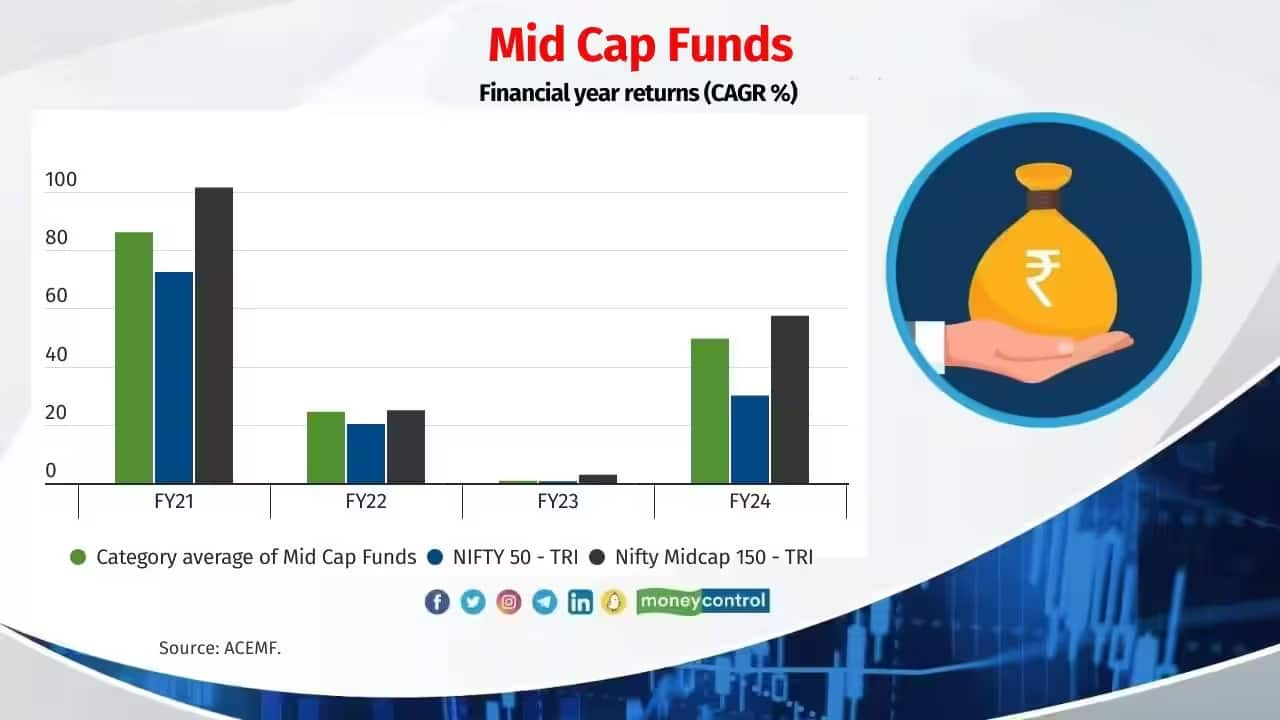

Mid Cap Funds

Top 5 funds:

Quant Mid Cap (65 percent)

ITI Mid Cap (62 percent)

Motilal Oswal Midcap (60 percent)

Mahindra Manulife Mid Cap (59 percent)

HDFC Mid-Cap Opportunities (57 percent)

Also see: 10 mid-cap gems that children-oriented MFs love to hold for the long term

Top 5 funds:

Quant Mid Cap (65 percent)

ITI Mid Cap (62 percent)

Motilal Oswal Midcap (60 percent)

Mahindra Manulife Mid Cap (59 percent)

HDFC Mid-Cap Opportunities (57 percent)

Also see: 10 mid-cap gems that children-oriented MFs love to hold for the long term

4/8

Small cap Funds

Top 5 funds:

Bandhan Small Cap (69 percent)

Quant Small Cap (66 percent)

Mahindra Manulife Small Cap (65 percent)

ITI Small Cap (62 percent)

Nippon India Small Cap (55 percent)

Top 5 funds:

Bandhan Small Cap (69 percent)

Quant Small Cap (66 percent)

Mahindra Manulife Small Cap (65 percent)

ITI Small Cap (62 percent)

Nippon India Small Cap (55 percent)

5/8

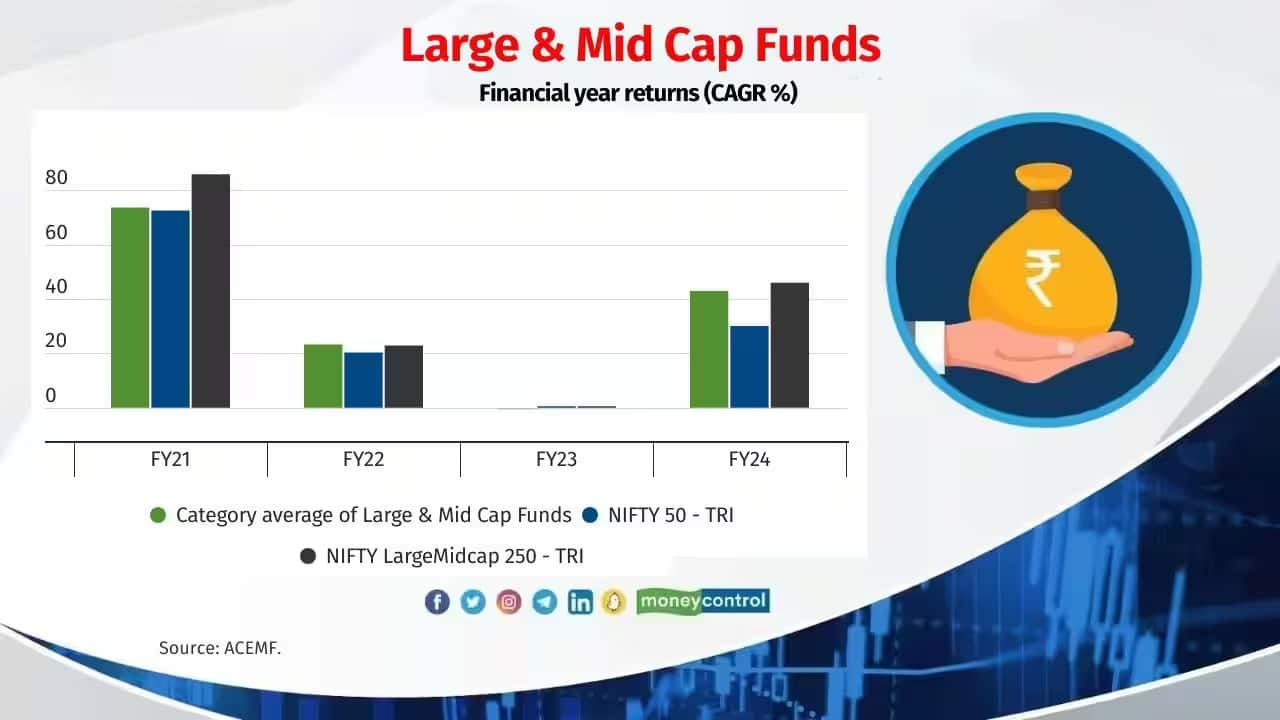

Large & Mid Cap Funds

Top 5 funds:

Quant Large & Mid Cap (61 percent)

Bandhan Core Equity (52 percent)

Motilal Oswal Large & Midcap (51 percent)

Mahindra Manulife Large & Mid Cap (50 percent)

Invesco India Large & Mid Cap (50 percent)

Also see: These large-cap multibaggers rewarded MF investors up to 400% in last one year

Top 5 funds:

Quant Large & Mid Cap (61 percent)

Bandhan Core Equity (52 percent)

Motilal Oswal Large & Midcap (51 percent)

Mahindra Manulife Large & Mid Cap (50 percent)

Invesco India Large & Mid Cap (50 percent)

Also see: These large-cap multibaggers rewarded MF investors up to 400% in last one year

6/8

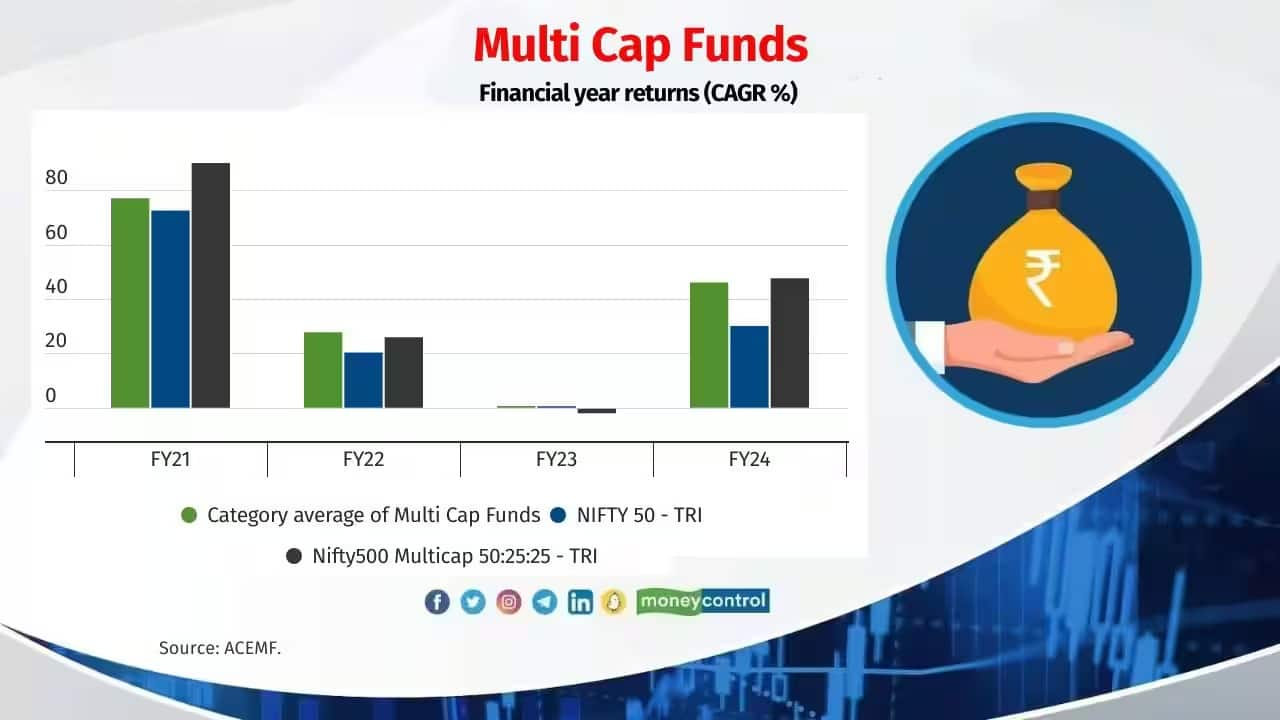

Multi Cap Funds

Top 5 funds:

Kotak Multicap (61 percent)

HSBC Multi Cap (56 percent)

ITI Multi-Cap (54 percent)

Axis Multicap (51 percent)

Bank of India Multi Cap (51 percent)

Top 5 funds:

Kotak Multicap (61 percent)

HSBC Multi Cap (56 percent)

ITI Multi-Cap (54 percent)

Axis Multicap (51 percent)

Bank of India Multi Cap (51 percent)

7/8

Flexi Cap Funds

Top 5 funds:

Bank of India Flexi Cap (59 percent)

Quant Flexi Cap (57 percent)

JM Flexicap (57 percent)

Motilal Oswal Flexi Cap (54 percent)

ITI Flexi Cap (52 percent)

Top 5 funds:

Bank of India Flexi Cap (59 percent)

Quant Flexi Cap (57 percent)

JM Flexicap (57 percent)

Motilal Oswal Flexi Cap (54 percent)

ITI Flexi Cap (52 percent)

8/8

ELSS

Top 5 funds:

SBI Long Term Equity (59 percent)

Quant ELSS Tax Saver (55 percent)

Bank of India ELSS Tax Saver(54 percent)

Motilal Oswal ELSS Tax Saver (54 percent)

ITI ELSS Tax Saver (51 percent)

Note: One-year returns in brackets; data as on March 28, 2024

Also see: Mutual funds call for easing RBI's limit on overseas investments amid growing opportunities

Top 5 funds:

SBI Long Term Equity (59 percent)

Quant ELSS Tax Saver (55 percent)

Bank of India ELSS Tax Saver(54 percent)

Motilal Oswal ELSS Tax Saver (54 percent)

ITI ELSS Tax Saver (51 percent)

Note: One-year returns in brackets; data as on March 28, 2024

Also see: Mutual funds call for easing RBI's limit on overseas investments amid growing opportunities

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!