13 February, 2025 | 13:24 IST

The new-age digital lending apps and websites are gaining popularity due to access to multiple loan offers, quick approval and disbursements. Instant Loan Apps have changed the entire process of applying for loans and disbursements by eliminating the lengthy document verification and approval.

However, alongside the benefits of quick loan apps, comes a significant risk — differentiating between legitimate loan apps and potential scams.

So, it’s crucial to understand how to identify which apps are safe compared to the potential fraudulent online lenders.

Let’s delve into how you can distinguish between trustworthy loan apps and potentially dangerous ones, for your financial security.

Table of Contents

Before diving into identifying safe instant loan apps, it’s important to understand why caution is necessary. While legitimate apps offer benefits like quick disbursements, paperless process and flexible repayment options, fraudulent apps could lead to identity theft, exorbitant fees or even harassment for repayments.

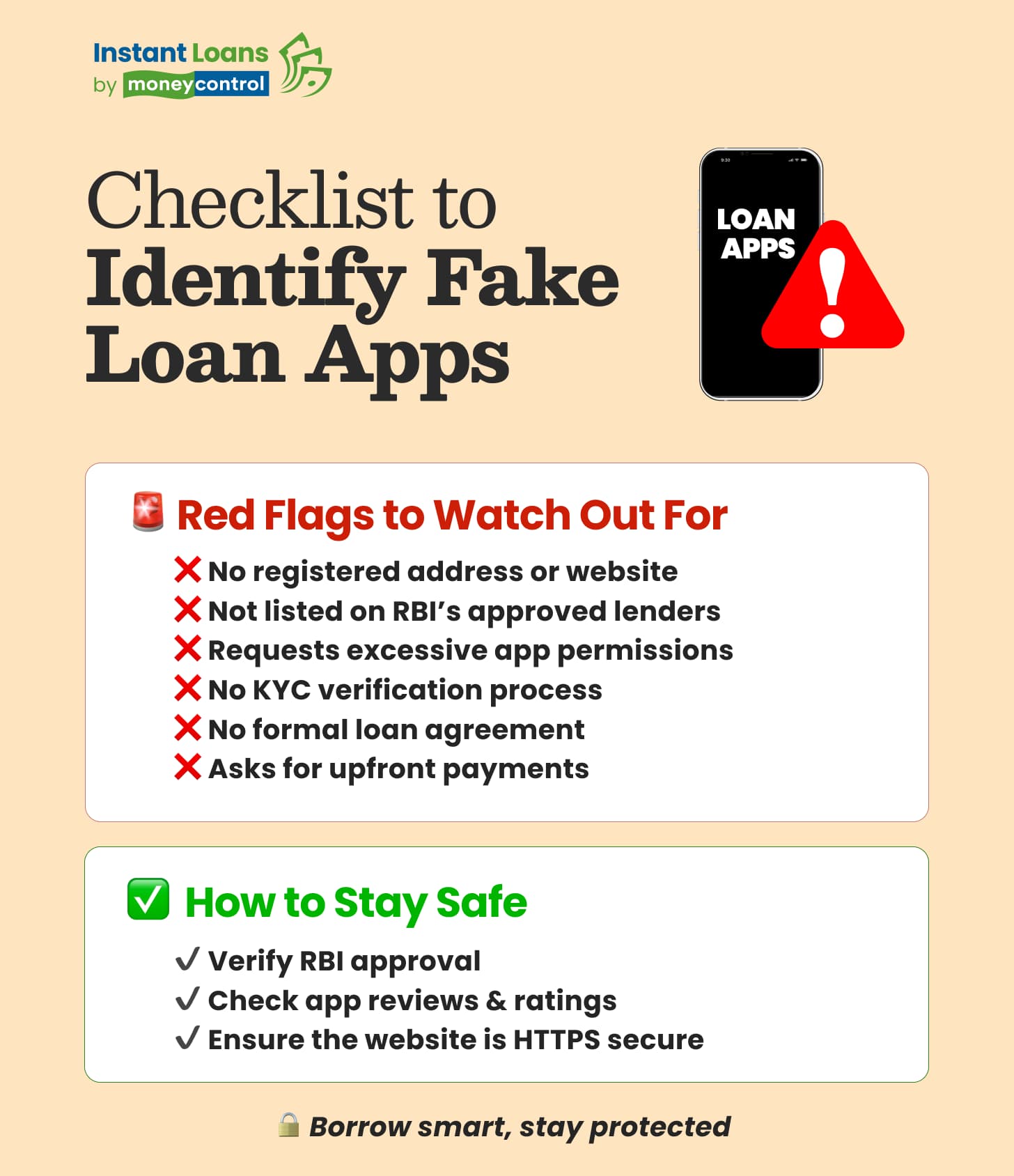

To ensure a safe borrowing experience, here are a few quick ways to identify legitimate instant loan apps:

Check the contact details

One of the first steps in assessing whether an app is legitimate is to check whether the lender has a verifiable offline address and a proper website. Approved instant loan apps and companies associated with them will always have a registered office address, phone number and email for customer service. Lenders that operate without any physical presence or official website could be fraudulent. In contrast, instant loan apps by RBI approved lenders tend to be transparent about their operations, providing detailed contact information on their websites and app store listings.

Ensure the lender is registered with RBI

As a diligent borrower, you should always verify the legality of the lender. The instant loan app operators are mandated to be regulated and authorised by the RBI in order to offer loans. Instant loan apps that are RBI-approved are usually listed on the official RBI website. Fraudulent apps often operate without proper regulatory approvals, and borrowing from such platforms can expose you to significant instant loan risks, including data theft, fraud and harassment.

Pay attention to reviews and ratings of apps

A quick way to determine the credibility of an app is by checking reviews and ratings on app stores like Google Play Store or the Apple App Store. Watch out for any negative reviews, particularly those that highlight high-interest rates, hidden charges or aggressive recovery tactics, should raise red flags. Instant loan apps that are safe generally have a good reputation across multiple platforms, as they ensure transparency in loan terms, interest rates and repayment policies.

Evaluate the app’s data access permissions

When you download an instant loan app, it may request access to various data on your smartphone, including your contacts, photos and location. While this is sometimes done for security purposes, legitimate apps will clearly state why they need access to the data. However, excessive permissions, especially those that seem unnecessary, could signal a fraudulent app. Some fraudulent apps may use your contacts to harass your family members and acquaintances in case of repayment issues. Always read the permissions the app asks for, and avoid any instant loan apps that seem to request access to more information than necessary.

ALSO READ: How to get a quick personal loan: Your essential guide for instant loan approval

Look for secure websites

When applying for loans online, it’s vital to check if the lender’s website is secure. A secure website will have a lock icon next to the URL and begin with “https://” rather than “http://”. The additional ‘s’ signifies that the website encrypts your data, protecting it from hackers and malicious actors. Fraudulent apps may not use encryption, leaving your sensitive financial and personal information exposed to cyber frauds.

Lack of KYC process

Legitimate instant loan apps will always require you to complete a Know Your Customer (KYC) process. If an app doesn’t ask for KYC, it’s likely not safe. The KYC process verifies your identity and ensures regulatory compliance. Avoid apps that bypass this essential step.

No loan agreement

A reliable loan app will always provide you with a formal loan agreement, detailing the interest rate, processing fees, repayment schedule and other terms. If the app does not offer such an agreement, it could be a fraudulent platform.

Requests for upfront payments

Legitimate lenders do not ask for advance payments before loan approval. If an app requires you to pay a fee before processing your loan, it’s probably a scam.

If you’re looking for safe options, you can explore Moneycontrol that offers a 100% paperless process to access instant personal loans from top lenders. Through the Moneycontrol app and website, you can apply for loans up to Rs 15 lakhs.

While the ease of instant loan apps can be appealing, it’s essential to prioritise safety over convenience. With a surge in fraudulent loan apps, borrowers must remain vigilant. Always stick to approved instant loan apps and verify the lender’s legitimacy through official channels.

For a secure borrowing experience, consider trusted platforms like Moneycontrol, which provide safe, transparent and digital loan solutions. Always remember that protecting your money starts with the power of knowledge and due diligence.

Share it in your circle

Table of Contents

Explore Top Lenders for Instant Loan upto

Get Instant Loan up to ₹50 Lakhs with Zero Paperwork from Top Lenders

100% Digital

100% Digital Quick Disbursal

Quick Disbursal Low Interest Rates

Low Interest Rates