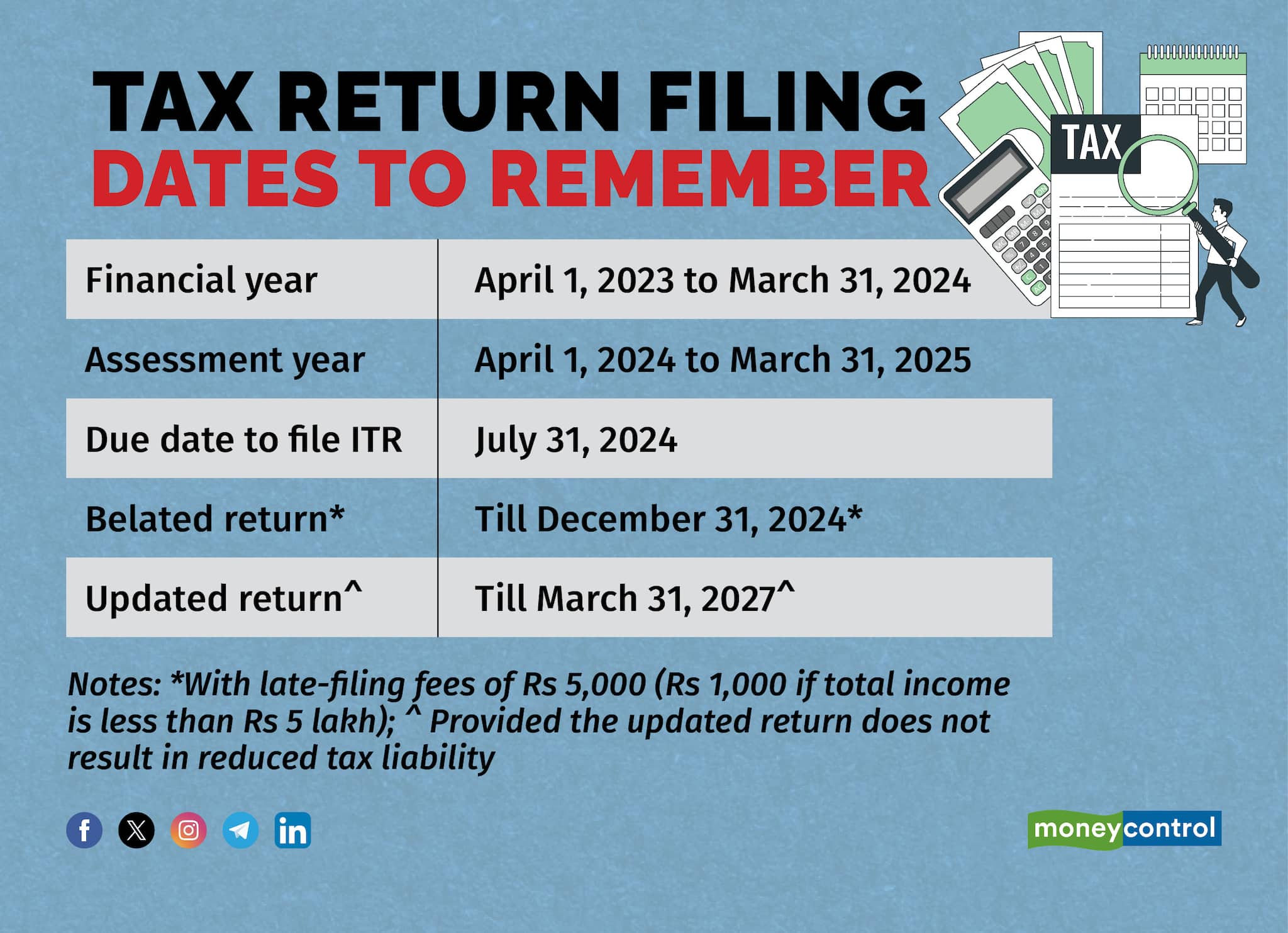

It is July, an important month for individual taxpayers. For the financial year 2023-24, which corresponds to the assessment year 2024-25, the last date to file income tax returns is July 31.

It is crucial for taxpayers to understand the importance of the due date and timely filing of tax returns. Here are some key aspects of filing the income tax return (ITR), the importance of adhering to the deadline, and the potential consequences of missing it.

What is the difference between financial year and assessment year?

Financial year is the period in which you earn income, running from April 1 to March 31—your tax return pertains to this year. The assessment year, on the other hand, is the year immediately following the financial year, during which the income earned in the financial year is assessed and taxed. For instance, for income earned between April 1, 2023, and March 31, 2024 (FY 2023-24), the assessment will be done in AY 2024-25.

Also read: Moneycontrol's income tax calculator

What is the ITR?

An income tax return is a declaration form that taxpayers submit to the income tax (I-T) department, detailing their income, expenses and other relevant financial information for a particular financial year. Filing an ITR allows the government to assess your tax liability and ensure that you have disclosed your earnings and paid the correct amount of taxes.

What is the last date for filing ITR for FY 2023-24 or AY 2024-25?

For FY 2023-24 (AY 2024-25), the due date for filing your income tax return is July 31, 2024. It is essential to file your ITR before this deadline to avoid penalties and interest on delayed payments.

Why must you file your ITR before July 31?

Filing your ITR before the due date is crucial for several reasons:

Avoid penalties and interest: Missing the deadline can result in penalties and interest on the outstanding tax amount. “Taxpayer would be liable to pay simple interest under Section 234A of the I-T (Income-tax) Act at the rate of 1 percent for every month or part of a month, commencing from the date immediately following the due date, i.e., July 31, to the actual date of furnishing of the return; or in case no return has been furnished,” said Suresh Surana, a practicing chartered accountant.

Avoid late-filing fee: If you file the return after the due date, you will not only have to pay additional interest on due taxes but also a late filing fee. “Taxpayer would be additionally liable to pay late fees of Rs 5,000 under Section 234F if the return is furnished after the due date specified under Section 139(1). However, if the total income of the person does not exceed Rs 5 lakh, then such late filing fee shall be restricted to Rs 1,000,” said Surana.

Timely refunds: During the financial year, you may have received income from multiple sources, and tax may have been deducted at source by the payer as stipulated by tax laws. However, if you are eligible for a tax refund, filing early ensures that you receive it promptly.

No carry-forward of losses: Another crucial point to remember is that if you miss the deadline to file your ITR, you may not be able to carry forward losses (for instance, incurred on sale of stocks or mutual fund units) to future years. In other words, if you file a belated or updated return, you will not be allowed to carry forward losses for set-off against income in subsequent years.

Also read: Salaried taxpayer? Know how to pick the right ITR form, avoid common errors

Facilitate loan approvals: Timely ITR filing is often a requirement for loan approvals, as it serves as proof of your income.

Belated tax return

If you miss filing your return by July 31, you can still file a belated return. This can be filed up to three months before the end of the relevant assessment year.

So, if you miss filing the ITR for FY 2023-24 by July 31, 2024, you can file a belated return until December 31, 2024. However, as mentioned above, filing a belated return attracts a penalty, and the taxpayer may lose certain benefits, such as the ability to carry forward losses.

Updated ITR

An updated return is a revised ITR filed by a taxpayer to correct any mistakes or omissions in the original or belated return. This option allows taxpayers to rectify errors or include additional information that were initially missed. Updated returns can usually be filed within two years from the end of the relevant assessment year.

So, for the financial year 2023-24, the relevant assessment year is 2024-25. Therefore, an updated return for FY 2023-24 can be filed until March 31, 2027.

However, the catch is that an updated return should not result in a reduction of tax liability—in other words, you cannot reduce the income disclosed in the original return and thereby end up with a lower tax liability by filing an updated return. Filing an updated return can help avoid penalties or legal consequences for inaccurate or incomplete original filings or when you have missed disclosing certain income in the original ITR.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.