“Which is the best ELSS scheme to invest in this year?” That’s the question thrust at many financial planners and distributors as each calendar year begins and the financial year winds down. ELSS stands for Equity-Linked Saving Schemes. These tax-saving mutual fund (MF) schemes get you income-tax deduction under Section 80C, up to a maximum limit of Rs 1.5 lakh.

As a result, each year, a new ELSS scheme gets added to portfolios. Over the years, this leads to the buildup of a plethora of these tax-saving schemes in many equity mutual fund portfolios, making it necessary to consolidate them.

But if the main objective is to save taxes, the question is: just how many tax-saving schemes do you need?

ELSS: The tax saverFor beginners, ELSS competes against other instruments such as the public provident fund, employees’ provident fund, children’s tuition fee, home loan repayment, life insurance premium, Sukanya Samriddhi Yojana and National Savings Certificate, which are also eligible for a deduction under section 80C.

While small saving schemes with their tax deductions are the forte of most conservative investors, the aggressive ones prefer ELSS, which offers a diversified portfolio of stocks and comes with a lock-in of three years. In the long term, ELSS tends to do better than most other tax-saving avenues. For example, on average, tax saving schemes have given 9.88 percent returns in the five years ended 18 April 2023, as per Value Research.

Often, first-time investors keen on tax deductions enter the mutual fund space through an investment in ELSS. Since it is an equity scheme, they prefer to diversify across schemes. Consequently, many investors only have investments in tax saving schemes in their initial years but some investors end up with too many of them as the years go by.

ALSO READ: Four tax-saving tools for your investment portfolio

Says Amol Joshi, founder of Mumbai-based Plan Rupee Investment Services, “If you are choosing an ELSS based on recent performance, say, the last one year, then most likely you will have too many ELSS in your portfolio.”

Chasing short-term performance in most cases lands investors in trouble.

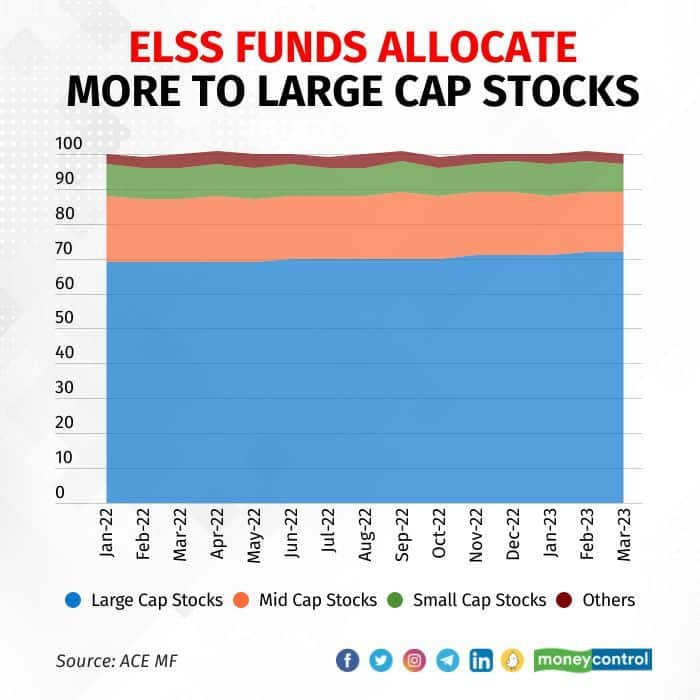

Choose one and stick to itMost financial planners advocate investing in one ELSS scheme and keep adding to it each year. “If the investor buys multiple funds under the same ELSS category, it would only result in duplication as most ELSS funds have on an average 60-70 percent money parked in large caps,” says Roshni Nayak, a SEBI-registered investment advisor and founder of Goalbridge, an investment advisory outfit.

ALSO READ: New tax regime vs old tax regime - deductions and exemptions allowed under both the regimes

Joshi prefers to pick schemes on the basis of long-term performance, along with other factors such as fund positioning and market cap bias. Fans of passively managed portfolios can look at passively managed ELSS as well.

Take a look at our curated list of well-managed ELSS schemes

Says Pankaj Mathpal, founder of Mumbai-based Optima Money Managers, “Investors ideally should pick a scheme that is actively managed since there is ample scope for outperformance in the long term. However, new investors, who may not have access to research, or investors who are keen on passive investing, should look for passively managed tax saving funds.”

Should you consolidate?If you have too much ELSS in your portfolio, then the thought of consolidation may creep into your mind. But do not jump the gun. Conduct a portfolio review. Seek professional help if necessary. Treat all your ELSS investments like any other equity fund. If the scheme is doing well, then let it compound money. There is no need to sell an ELSS just because the units are out of the lock-in period. Sell only those that have been underperforming.

“Identify funds that have been underperforming the benchmark and peers for at least three years. If an investor is not comfortable with a fund that is volatile and has fallen more during downturns compared to the benchmark, it can be chosen as well. Immediately stop SIPs after these funds are identified,” says Nayak. Sell if the units are out of lock-in.

After you account for taxation, reinvest the sale proceeds into other equity funds in your portfolio. This step is very important. If you have too many small folios and you sell the holdings under the garb of consolidation, then a large chunk of your equity portfolio will be redeemed. If you do not reinvest, then you lose out on the opportunity to compound your money.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.