When insured makes well-thought-out decisions, OPD cover not only reduces out-of- pocket expenditure but also deepens engagement with preventive and wellness services

More than 80 percent of insured people polled in s survey feel unsure about the efficacy of their health insurance cover because of rising hospitalisation and medical costs in India, a survey by Future Generali India Insurance has found.

This alarming statistics brings to the fore the importance of having proper healthcare coverage.

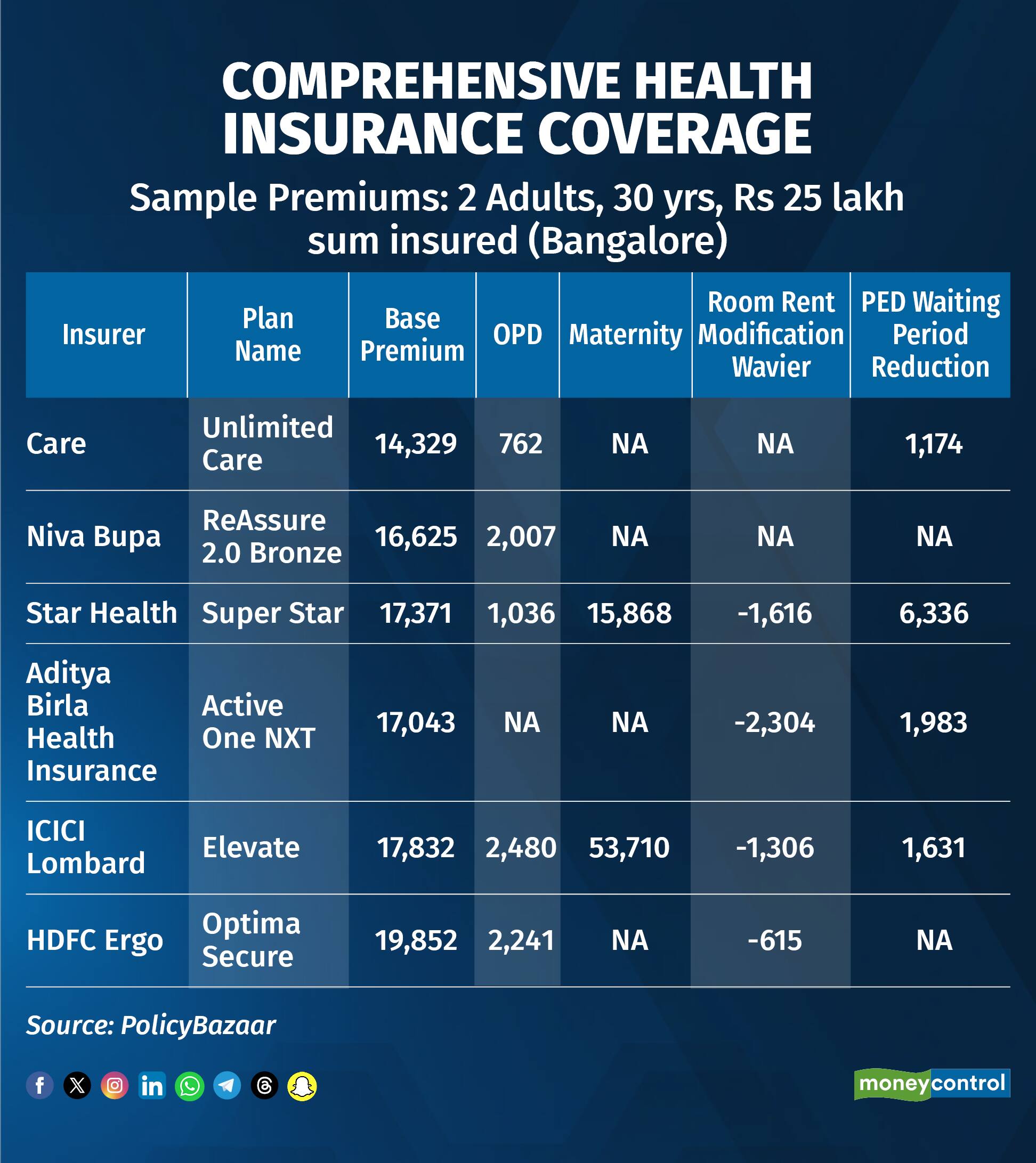

“For individuals living in metro cities, where healthcare costs are significantly higher, we recommend opting for a minimum sum insured of Rs 25 lakh,” says Siddharth Singhal, Head of Health Insurance at Policybazaar.

The other important thing to consider is whether your health plan has the necessary features. While some features are inbuilt, some need to be taken as an add on.

Let us take a look.

OPD Cover

Medical needs are no longer confined to hospitalisation alone which makes OPD coverage increasingly an important component of a comprehensive health plan.

“Coverage for doctor consultations, diagnostics, and medicines ensures these day-to-day costs are also brought under the insurance umbrella because there is a rise in the number of families spending a significant amount of their healthcare budget on these services,” says ArtiMulik, Chief Technical Officer, Universal SompoGeneral Insurance.

“Early access to these medical services promotes preventive care, which can lead to the early detection of diseases, significantly reducing the risk of conditions escalating into severe or costly health issues,” says SurinderBhagat, Head- Employee Benefits, Large Account Practices, Prudent Insurance Brokers.

When insured makes well-thought-out decisions, OPD cover not only reduces out-of- pocket expenditure but also deepens engagement with preventive and wellness services, making insurance feel relevant in everyday life rather than only at time of crisis.

“It is also advisable to enquire whether the insurer provides a cashless OPD network or if they work only on reimbursement-based claims, as the ease of claim procedure has a great influence on utilization,” says Surender Tonk, Vice-President, Insurance Brokers Association of India (IBAI).

Maternity Cover

Maternity riders are invaluable for young couples planning a family, as they ease the financial burden of delivery and new born care.

Maternity cover is worthwhile only if the same is not covered through their employer. “Also, these riders come with waiting periods and sub-limits. So do check these details before buying it,” says Abhishek Kumar, a Securities and Exchange Board of India (Sebi)-registered investment advisor (RIA), and founder and chief investment advisor of SahajMoney, a financial planning firm.

Most maternity covers have a waiting period of 24-48 months from the policy start date. Also there are sublimits- for example, Rs 40,000–Rs60,000 for a noroutmal delivery and Rs 60,000–Rs 1,00,000 for a C-section, depending on the plan.

“The right way to look at riders is not as optional frills but as enablers of a more tailored, relevant policy. A well-selected rider strengthens the base plan and ensures that insurance responds to the very real every day and long-term needs of a household,” says Mulik.

Room Rent Modification Waiver

Your room rent limit plays an important role in deciding how much of your hospital bill is covered by insurance. Most policies have a cap, say Rs 10,000 per day per room. If you choose a room with a higher rent, the cost limits of other aspects like doctor’s fees, nursing and ICU charges are proportionately reduced. This leaves you with hefty out of pocket expenses.

This waiver removes that restriction. When you opt for this, you can select a room of any category, single, private, suite or deluxe and not worry about proportionate deduction on claims. In metro cities where room charges are higher this can come in handy.

You need to pay some extra premium, but it ensures that your hospital stay and overall quality of treatment is not compromised.

PED Waiting Period Deduction

Last year IRDAI reduced the waiting period on pre-existing diseases (PEDs) from four years to three years. However, if you already have a pre-existing condition, a long waiting period may be risky. So, some policies now allow you to reduce your waiting period even further or even start coverage from Day 1, for pre-existing diseases.

The day one coverage actually starts after 30 days from the inception of the policy. But if you have PEDs, you can pay a slightly higher premium to reduce your waiting period. This can be a wise decision because otherwise you may end up paying money out of your pocket.

Do evaluate your health insurance policy to avoid last minute surprises. The above-mentioned features can cost you a bit extra but provide comprehensive coverage to you and your family.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!