Dussehra is considered an auspicious time to make new investments, and gold is seen as a symbol of wealth and prosperity. Many Indians believe that buying gold during this time can bring good fortune and wealth in the coming year.

However, just like any investment, the decision to buy gold should be based on sound rationale. So, does it make sense to buy gold this Dussehra as the prices have gained close to 20 percent on a one-year basis?

Factors at play

Gold prices in India have gone up marginally in the recent past largely due to the current geopolitical tensions in the Middle East.

Further, factors such as higher inflation and buying by global central banks have been the key drivers of gold over the past few months. As far as local factors are concerned, robust consumer demand, depreciation of local currency and buying of the Reserve Bank of India are the major factors.

Also read | Smallcap stocks for long-term growth that category III AIFs like

As per Vikram Dhawan, Head Commodities and Fund Manager at Nippon India Mutual Fund, central bank buying and steady physical demand have been strong drivers of gold prices.

In 2022, central banks purchased over 1,300 tonnes of gold, which is a 55-year record. In the first half of 2023, central banks bought around 400 tonnes, another 20-year record.

“Factors such as de-dollarisation, re-globalisation, and geopolitics may be contributing to this trend. However, the increasing US debt and volatile US Treasuries could potentially lead central banks to reduce their US dollar holdings in favour of other currencies and gold,” said Dhawan.

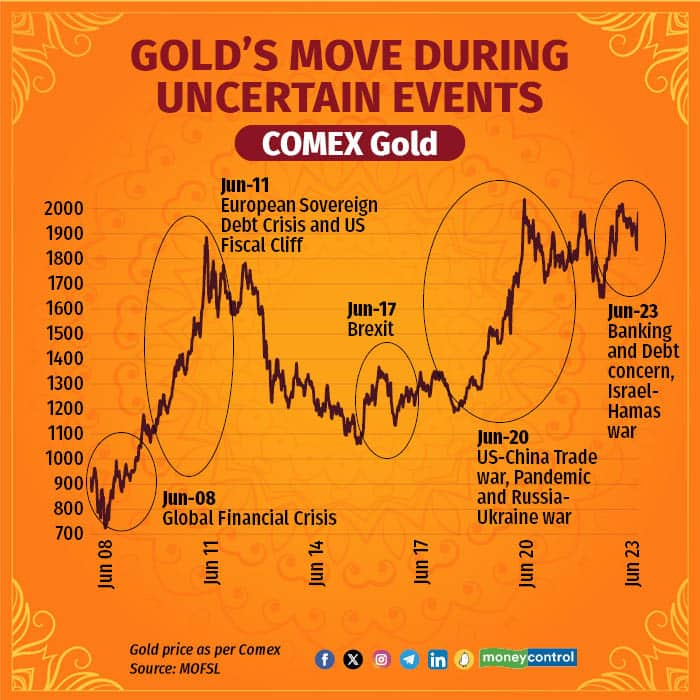

Manav Modi, Analyst, Commodity Research at Motilal Oswal Financial Services, believes that there's a risk premium built into the market due to the Israel-Hamas war. “Also, there are some comments from the US Federal Reserve officials where there is a cautious tone on inflation. These two factors could take gold prices higher. On the other hand, if the war premium eases off, we could see a fall, or if the interest rate hike expectations further increase, we could see a capping in gains for gold,” he said.

Should you invest?

As per, Manoj Kumar Jain, director of Prithvi Finmart, in November 2018 gold was trading at Rs 30,200 per 10 gram levels and currently trading at Rs 60,500 levels. In US dollar terms, the metal has moved from $1,240 per troy ounce to $1,980 per troy ounce during the period and in percentage terms returns are a bit lower as compared to rupee terms.

Also read | Samir Arora-backed Helios AMC’s first equity fund: All you need to know

Notably, gold and silver prices have recently surged due to the deteriorating geopolitical situation in the Middle East. Despite this, gold exchange-traded fund (ETF) holdings worldwide are at a three-year low, but at pre-pandemic levels.

“This suggests that investors may be underweight in gold and not adequately hedged against event or macro risks,” said Dhawan.

Commodity experts believe that in the next couple of years, gold prices will move majorly once global central banks start easing their monetary policies as the dollar index is at 11-month highs and the US 10-year bond yields are at 16-year highs, which is a major hurdle for restricting prices of gold.

“Buying gold always looks costly, but over a period of time, it gives better returns to the investors. Even this Dussehra, buying gold is a good option as we are targeting gold to hit $2,200 per troy ounce in the next one year and $2,500 by 2026. Even in rupee terms, we are expecting that the precious metal could test Rs 70,000 per 10 gram by next Diwali and Rs 85,000 by 2026,” said Prithvi Finmart’s Jain.

Gold’s historical performance

Gold is consistently performing well in the international as well as local markets. In dollar terms, gold prices moved from $1,230 per troy ounce in November 2013 to almost $2,000 per troy ounce in 2023.

Also read | How Long Should You Keep Your Tax Documents, Income Proof?

“It has given 63 percent returns in dollar terms in the last decade but in rupee terms it moved from Rs 29,550 to Rs 60,500, delivering 105 percent returns in the last decade. Performance was slightly lacklustre due to the Covid-19 period and higher interest rates but in the next one decade we are expecting better returns in gold as compared to the previous decade,” said Prithvi Finmart’s Jain.

Nippon India MF’s Dhawan also acknowledges that gold has recently emerged from a two-three-year consolidation period, so it may be risky to rely too heavily on historical data.

“Historically, gold has been one of the best-performing commodities during recessions and has served as a hedge during times of extreme volatility in risk assets like equities and Black-Swan events,” he said.

Investment strategy

While gold prices have run up quite a bit, especially since the Hamas-Israel war broke out, experts say that prospects for one year, or in the medium term, look good.

“This is mainly because, despite the one or two more 25-basis point interest rate hikes that can come from the US central bank, the monetary tightening is coming to an end. This monetary tightening by the Fed has been weighing on gold prices over the last year or so. Once this moves out of the picture, we can definitely expect an upmove in gold prices,” said Ghazal Jain, fund manager- alternative investments, Quantum Mutual Fund.

Also read | Stranded in war zone: Travel insurance to cover hospitalisation for illness, but not evacuation to India

The fund manager suggests a buy-on-dips strategy in gold. “If the US Fed hikes interest rates in November or December, there could be some correction in gold, which could be a better opportunity to enter gold,” she said.

Irrespective of gold’s fundamental or technical factors, financial experts suggest having around 5-10 percent of one portfolio in the yellow metal as it acts as a cushion in times of economic crisis in comparison to equity.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.