Say, you have a property that you have rented out. Let’s assume you earn a rental income of Rs 70,000 a month. That is Rs 8.40 lakh a year. How high or low is this amount?

Many individuals or couples take it easy if they have a rental income. Plus, property prices appreciate, or so they expect. But, in the long run, real estate has given only average returns. For close to a decade now, keeping exceptions aside, there has been negligible increase in property prices across the country. In reality, looking at just the absolute figure of your rental income, Rs 70,000 in this case, is not the right way. You could earn that much even from a bank fixed deposit.

Confused? Here’s an analysis to give you greater clarity.

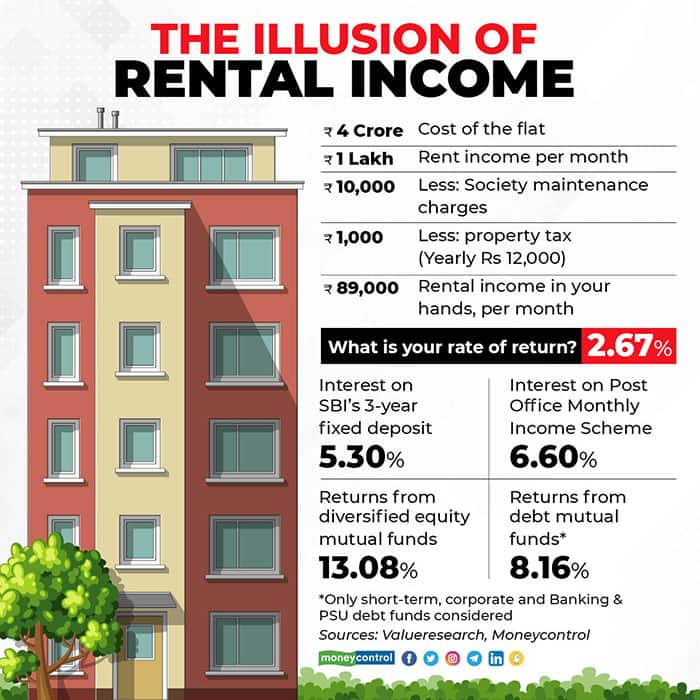

Many of us make the mistake of considering just the absolute cash that comes in as our rental income. Instead, we must check the rental yield.

Take the case of a 3-BHK apartment in Lower Parel, Mumbai. It will cost you at least Rs 5 crore. And it will fetch you a rent of approximately Rs 1.25 lakh a month or Rs 15 lakh a year. Similarly, a 200-square yard builder floor in Green Park, Delhi will cost you Rs 3.5-4 crore; the rental income would not be more than Rs 1 lakh a month.

Now a rental income of Rs 1.25 lakh or Rs 1 lakh per month looks good and may be sufficient for a house owner to meet his or her monthly expenses. But if you compare this income to the amount you spent to buy the apartment, it is only around 3 percent a year. And you still have to pay property maintenance charges and taxes on income.

What remains in your hand is the net rental yield. “After accounting for society charges, repairs, property taxes and income tax on rent, what remains is about half of the rent amount. Hence, the returns from property are rather low and there are hassles associated as well,” says Suresh Sadagopan, founder, Ladder7 Financial Advisories.

Not only is the return low, it is not fixed and the risk of vacancy always remains. “There could be periods of vacancy, which is a real risk. Rents do not always increase; they can decrease as well, like it has happened in the COVID-19 situation. There is a chance that the tenant does not pay the rent on time,” says Sadagopan.

There are various other risks as well for the owner to deal with. “Unstable rental income, property frauds and damages done by tenants, changes in tenancy laws and rental income taxation, rental reprising risk when the tenant leaves, and inflation risk (general inflation vs rental income inflation) are some of the risks that investors need to keep in mind,” says Rohit Shah, founder, Getting You Rich.

A property can remain illiquid for longOne of the other major issues with real estate is that it is highly illiquid. In most cases, you cannot sell your property in parts; you have to sell it in its entirety. Besides that, under normal market conditions, finding the right buyer and selling the property can easily take six months to a year. In difficult market conditions such as now, it can take even longer and you may still not get the right price.

Don’t rely only on rental incomeIf you are want investment avenues to generate regular income, financial planners suggest options other than real estate. “It may be a better idea to simply invest in other avenues for income generation,” says Sadagopan. The other option could be investing the money in financial assets such as mutual funds, equity and small savings schemes. This is because net yield from residential property is about 1.5-2 percent in India, whereas financial assets, even in this low interest rate scenario, can give 5-8 percent post-tax returns.

Even if you already a property investment, “it is better to dispose the property and simply invest in financial assets, and enjoy returns and a hassle-free life,” says Sadagopan.

In general, “real estate rental yield tends to be lower than the financial portfolio’s growth rate. It may be a good idea for aggressive and balanced profile investors to seriously explore if divesting to a financial portfolio is a better idea – especially if they are heavy on real estate,” says Shah. “A conservative, 40-60 equity-bond portfolio may generate a real return of 2-3 percent and hence nominal returns are likely to be far higher than the 3 percent rental yield,” he adds.

If investors want to keep a portion of investment in real estate, financial planners suggest they consider Real Estate Investment Trusts (REITs). “With REITs slowly becoming available now, investors will have far better choices for non-correlated investments such as real estate in times to come. The case for physical property for rental income continues to get weaker as we move forward,” says Shah.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.