Buying gold during Dhanteras and Diwali is considered auspicious in Indian households. But, you may not want to venture out to a nearby jeweller to buy gold, as COVID-19 continues to remain a potential health risk.

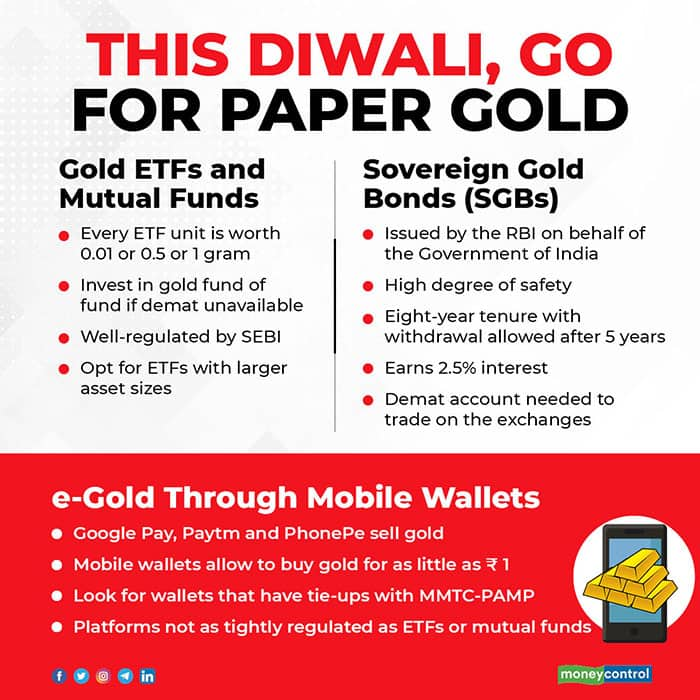

Instead, you can purchase gold through digital modes, sitting at home. You can also save on additional costs such as making charges, which you otherwise need to bear when you buy gold from your jeweller. Paper gold is easier to store and there is no risk of theft. Here are a few ways to buy gold in electronic or paper form.

Gold exchange traded funds

Gold ETFs (exchange traded funds) offered by various mutual funds (MFs) allocate units that represent physical gold. Depending on the mutual fund scheme, each unit of the gold ETF is equivalent to 0.01 gram of gold (Nippon India ETF Gold BeES, ICICI Prudential MF), or 0.5 gram (Quantum Gold ETF) or 1 gram of gold. You can buy even one unit of a gold ETF on the exchange.

If you go for a scheme with one unit being equal to 0.01 gram of gold, your minimum investment would be around Rs 45 at current prices. You can buy ETFs from stocks exchanges. A demat account is mandatory.

The best part of ETFs is that they are regulated by the Securities and Exchange Board of India (SEBI). This should give you some assurance that when you buy a gold ETF, a certain level of compliance is being followed by all parties involved in the process.

While you get units when you purchase a gold ETF, at the back-end, the mutual fund purchases an equivalent amount of gold and stores it in a vault. “The inflow into a gold ETF is matched by the purchase of gold from authorised gold distributors such as banks or entities registered for gold distribution,” explains Chintan Haria, head-product development and strategy at ICICI Prudential MF.

This gold is then stored in approved vaults and also insured by the vault providers. The gold needs to be in-line with the good delivery norms of London Bullion Market Association (LBMA), which sets standards for how precious metals are refined and traded around the world. This gold should have 99.5 percent purity.

A gold with 99.5 percent or above purity is 24 karat gold, which is considered as the purest form of gold.

Gold Fund of Funds

If you do not have a demat account, you can buy gold through a fund of funds (FoF). They invest their entire corpuses in gold ETFs. Minimum invest in gold FOFs – also popularly known as gold mutual funds – is Rs 1,000; some FOFs also come with minimal investment amounts of Rs 100 or Rs 500.

The best part of gold FoF is that you can invest through the systematic investment plan (SIP) route and build your allocation to gold in a gradual manner.

Keep in mind that expense ratio in a FoF can be a few basis points higher than that of an ETF.

Mobile wallets

Digital wallet provides such as Google Pay, Paytm and PhonePe also give you options to buy gold on their platforms. Google Pay and Paytm have tied-up with MMTC-PAMP, which sells and stores the gold in its vaults, which are insured.

MMTC-PAMP is India’s only refiner that is LBMA-accredited. The company is a joint venture between Government-backed Metals and Minerals Trading Corporation and Swiss company PAMP SA, which is one of the leading bullion brands in the world.

You can buy gold from any of the wallet providers for as little as Re 1. This gold comes with 99.9 percent or 99.5 percent purity.

PhonePe has a tie-up with Safegold, which works with vault provider Brinks India and IDBI Trusteeship to secure the gold. The role of a trustee is to check if the quality of gold is certified and ensure equivalent amount of physical gold (sold digitally) is made available in the vaults.

While these new-age wallet providers are not as regulated as MFs, experts say investors need not be worried. “These wallet providers offer gold from credible gold vendors,” says Sharad Ingule, founder and chief executive officer of GoldUno.

Sovereign gold bonds

If you don’t mind locking your money in a gold investment, then you can look at sovereign gold bonds (SGBs). As the Reserve Bank of India (RBI) issues them, on behalf of the Government of India, they are completely safe. The best part is that they offer 2.5 percent fixed interest rate per annum (on the issue price), which are paid half-yearly. This is an eight-year instrument, but premature withdrawal is allowed after five years.

While you don’t need a demat account to apply for these bonds (you can get them from your bank or post office), you will need a demat account to sell these bonds on the exchanges, if you want an early exit. Liquidity is low, though.

If you do not mind the lock-in of eight years, go for SGBs. If you prefer liquidity, then stick to Gold ETFs which are well-regulated. Large ETFs are typically more liquid than others.

Depending on your investment capacity, you can go for a scheme where a unit is equal to 0.01 gram, 0.5 gram or 1 gram of gold.

If you do not have a demat account or if you wish to start an SIP in gold, opt for gold FoF.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.