LenDenClub, a Peer-to-peer (P2P) lending platform, recently launched a Fixed-Maturity P2P Plan (FMPP). It allows members registered with the platform to lend money for a fixed tenure of 1 to 5 years and earn interest at a rate of 10-12 percent per annum.

Although the products are not comparable, the return is higher than interest rates offered by bank Fixed Deposits (FDs). Should you invest or lend via this P2P platform?

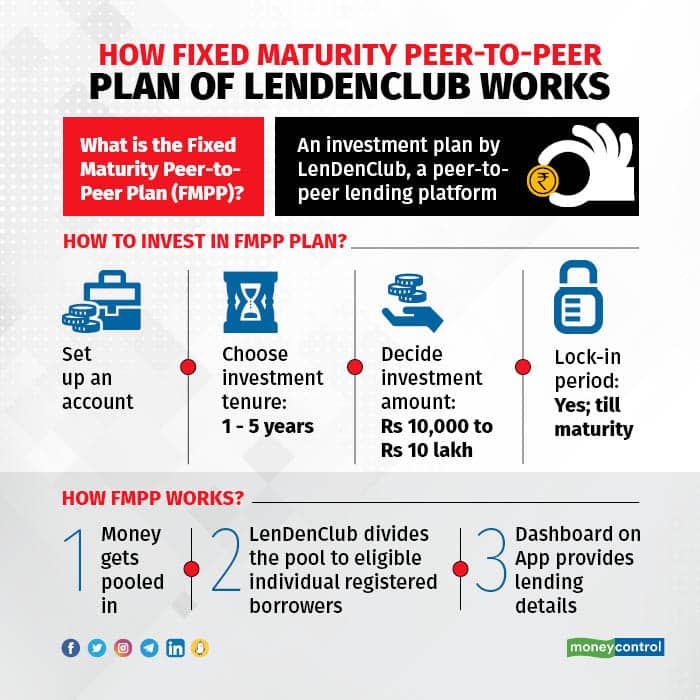

What is LenDenClub’s FMPP?FMPP is a term-based investment plan launched by LenDenClub, a Reserve Bank of India (RBI)-registered P2P non-banking finance company. It offers flexible tenures of 1, 2, 3, 4 or 5 years. Investors, who, in reality are lenders, can earn returns of up to 10-12% per annum.

Investing in FMPP doesn’t entail a registration cost. You can invest from Rs 10,000 to Rs 10 lakh or Rs 50 lakh by submitting a net-worth certificate

Investing in FMPP doesn’t entail a registration cost. You can invest from Rs 10,000 to Rs 10 lakh or Rs 50 lakh by submitting a net-worth certificateIt’s important to note that the return rate is not guaranteed or fixed, like in the case of bank FDs.

For instance, HDFC Bank offers 5.5 percent fixed interest on one-year fixed deposits. While investing (lending) in an FMPP, the interest rate can be higher by at least 5 to 6 percentage points compared to HDFC bank’s FD, but it's not guaranteed.

“A P2P platform is an online space where borrowers with lower credit scores or those with little or no credit history can avail of loans from individuals willing to lend,” says Parijat Garg, a digital lending consultant. “For investors (lenders), higher returns come with more risk.”

Investing in FMPP doesn’t entail a registration cost. You can invest from Rs 10,000 to Rs 10 lakh or Rs 50 lakh by submitting a net-worth certificate. The investment amount has a lock-in period for the full investment tenure as FMPP is not a liquid investment avenue.

Bhavin Patel, co-founder and CEO of LenDenClub, suggests: “Investors should park part of the savings in bank FDs, mutual funds, and stocks for liquidity so that they can be diluted at any point in time, and around 10 per cent of overall portfolio exposure can be in a P2P investment scheme.”

LenDenClub is a regulated entity and has been in the market for the past seven years. “So, there is more credibility to the operator, and it’s not a fly-by-night operator in the P2P lending space,” says Garg.

“The investment amount is hyper-diversified into a vast pool of borrowers. People could borrow as little as one rupee, owing to which we’ve drastically minimised the default rate (in the last quarter, the default rate was 2.45 percent at the portfolio level), thus offering investors systematically risk-mitigated returns. This has been possible with new artificial intelligence and machine learning-based algorithms,” says Patel of LenDenClub.

The algorithms automatically reshuffle the capital allocation to borrowers in a portfolio from time to time to achieve the estimated returns of 10-12% per annum.

There is transparency in transactions, and information disclosures are maintained. “Investors get to see the number of borrowers and their profiles on the dashboard after logging in,” says Patel. Other details available on the dashboard are the amount linked to a particular borrower, upcoming monthly installments, and defaults by borrowers.

Lenders can check the values of their investments in annual statements on the web and mobile app. The real-time account statements help you understand your inflows and outflows of funds.

What doesn’t work?The lender doesn’t get to see the credit rating of the borrower that the LenDenClub has allotted your money to. Patel says the credit rating is not the more important thing to focus here.

“The plan requires a maturity time and holding period from investors to achieve the estimated returns on investment,” he says.

An investor with a liquidity mindset should not opt to invest in this scheme.

Also read | Why P2P lending is a risky proposition, and not an investment

And there is a significant risk here, warn experts. “The credit risk is significantly high; you do not know the risk involved in the borrower nor an understanding of how borrower defaults and delays are handled or the impact of them,” says Bhavana Acharya, co-founder of PrimeInvestor.in.

She adds that the information provided shows a default rate of 2.45 percent in the latest quarter, and it has been much higher at 4.45 percent as well in the past. There also appears to be a rapid rise in the number of loan disbursals of late, so managing payments/delays becomes important.

Ultimately, although P2P platforms tend to equate or compare their products to traditional investments like bank FDs, thereby harping more on the guaranteed returns, P2P lending and borrowing come with far fewer safeguards.

For instance, the Deposit Insurance and Credit Guarantee Corporation (DICGC), a subsidiary of the central bank, guarantees investments in bank fixed deposits of up to Rs 5 lakh.

There is no such guarantee in case of defaults in a P2P scheme.

In this scheme, credit risk is involved. “The money is being given to multiple borrowers, and even if a part of it doesn’t come back, then there is a risk that the return may not match what the algorithm estimated,” says Garg. “In FMPP, due to hyper-diversification, the risk is mitigated to a minimum since the disbursal of loans can be as low as Re 1 per borrower,” Patel says.

“The 10-12 percent annual returns are indicative only and not guaranteed. It can change and be misleading to go by the stated expected returns,” cautions Acharya.

Should you invest?Credit and default risks and a lock-in period make FMPP an unattractive proposition for many investors.

The name of the scheme is also ominous; it sounds eerily similar to fixed maturity plan; a closed-end debt mutual fund scheme that gives you nearly the returns that it indicates at the time of investing.

Acharya adds, “Only high-risk investors who want to experiment with new products, who otherwise have enough investments built up in better-regulated and more transparent products, and who are looking for diversification can consider investing in the FMPP scheme.”

If you still wish to invest, then it’s best to start start with the base amount of Rs 10,000 for a minimum tenure of one year and depending on the returns you earn, you can think of opting for FMPP as a regular option in your portfolio. Consider it a diversifier or a high-risk emerging investment opportunity. “Don’t mark it for important or near-term goals; it’s best to allocate money that won’t hurt if there is any adverse event or if returns turn out to be lower than estimated,” says Acharya.

Garg suggests, “You should invest only that much money in this scheme which you are very comfortable to lock into without having to worry about the withdrawal.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.